How to Start Grid Trading

2021/09/16 19:18:55

Our tutorial video provides quick access to solutions to common problems and information regarding related topics: https://www.youtube.com/watch?v=qZ26pXhnpXE&t=27s

More details are available in the whole article below.

1. What is Grid Trading?

Grid trading is a strategy which allows users to make profits with price fluctuations, without needing to time the market or bet on ups and downs. The strategy "buys low and sells high" within the specified range, obtaining stable returns.

2. Grid Trading Parameters

These determine the price level of each “grid”: when the price moves between specific intervals within the price range, the strategy will divide your funds into several parts to automatically execute a low buy order and create a corresponding high sell order. This strategy tool allows you to make stable returns by placing a series of buy and sell orders at set intervals around a set price. The orders will be placed round the clock automatically by the bot.

The Lower Boundary of the Price Range: buy low and sell high above this price. No orders will be opened lower than this price.

The Upper Boundary of the Price Range: buy low and sell high under this price. No orders will be opened higher than this price.

Stop-Loss Price range: When the asset’s price reaches the given stop price, the stop-limit order is executed to buy or sell the asset at the given limit price or better. If you feel that the market will move beyond your strategy range you can set up the stop price at any time to avoid and reduce your losses.

Here are 2 grid trading strategies that you can try:

Entry Price: When the spot price is in uptrend and might exceed the resistance, set up an upper stop-loss price in order to keep your profit opportunity during the uptrend in the market. While the market price reaches your upper stop-loss price, the grid bot will market buy the coin to let you profit from the rise in price.

Stop-Loss Price: When the spot price is in a bearish trend and might draw down the support, set up a stop-loss price in order to reduce your losses in grid trading. When the market price drops to your stop-loss price, the grid bot will sell all of your coins at the market price to reduce your loss.

Grid Number: This is the number of separate prices the strategy will divide the range into. In this way, it constructs a grid of trades. When the price is more volatile, set up fewer grids, and vice versa. Too many grids will cause the profit to be insufficient to cover the transaction fees, and too few grids will cause the grid spread to be too wide and difficult to execute.

Transaction Amount of Each Grid: fixes the order amount of each grid trade

Profit of Each Grid = (The Highest Price of the Order - The Lowest Price of the Order ) / Grid Numbers * Transaction Amount of Each Grid

Matched Order Quantity: The total number of orders bought low and sold high

Realized Yield = Matching Order Quantity * Profit of Each Grid + Loss Caused by the Higher or Lower Stop-Loss Triggering

Yield = Realized Profit / The Maximum Used Funds in the Strategies History * 100%

3. How to start grid trading?

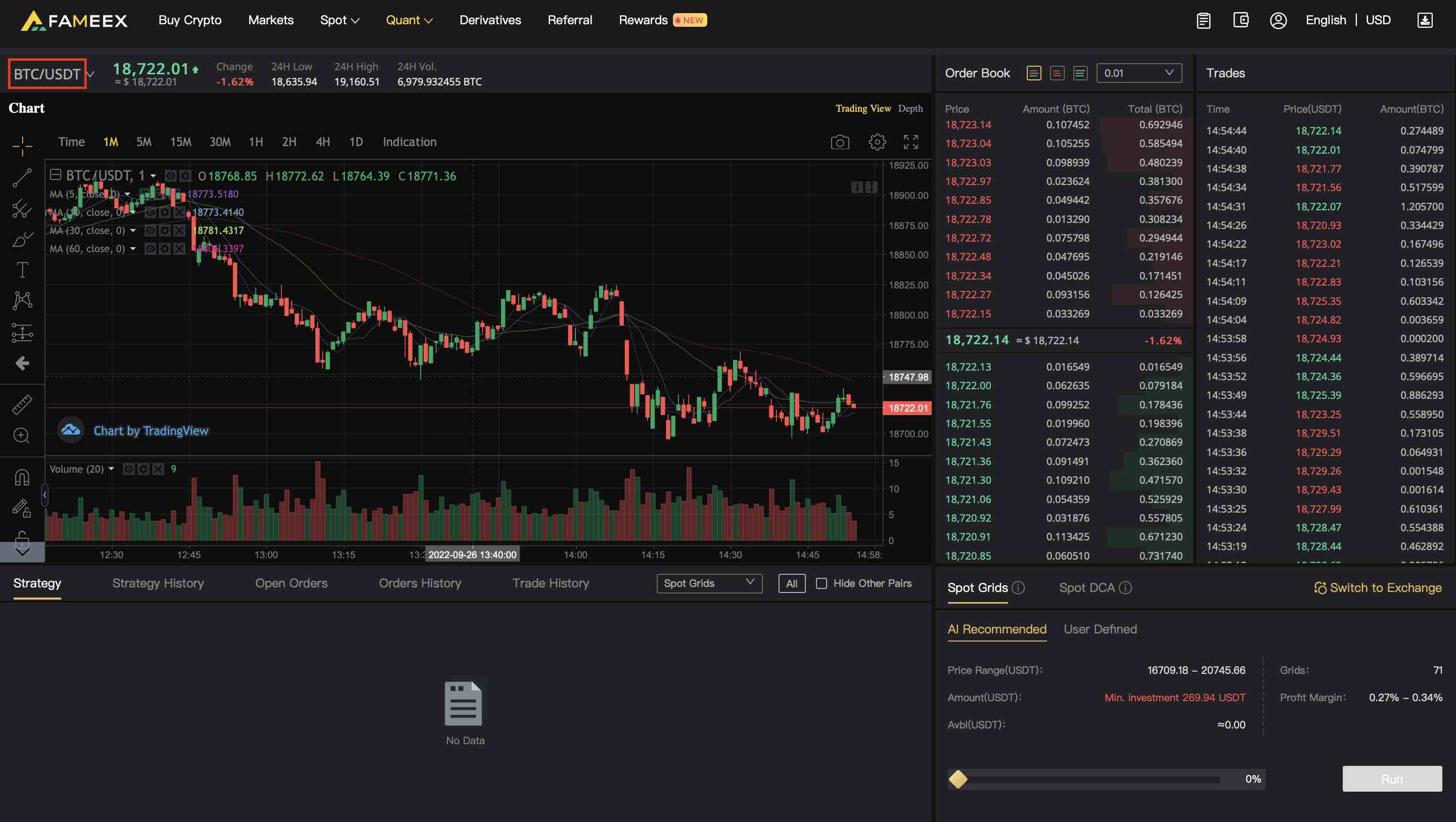

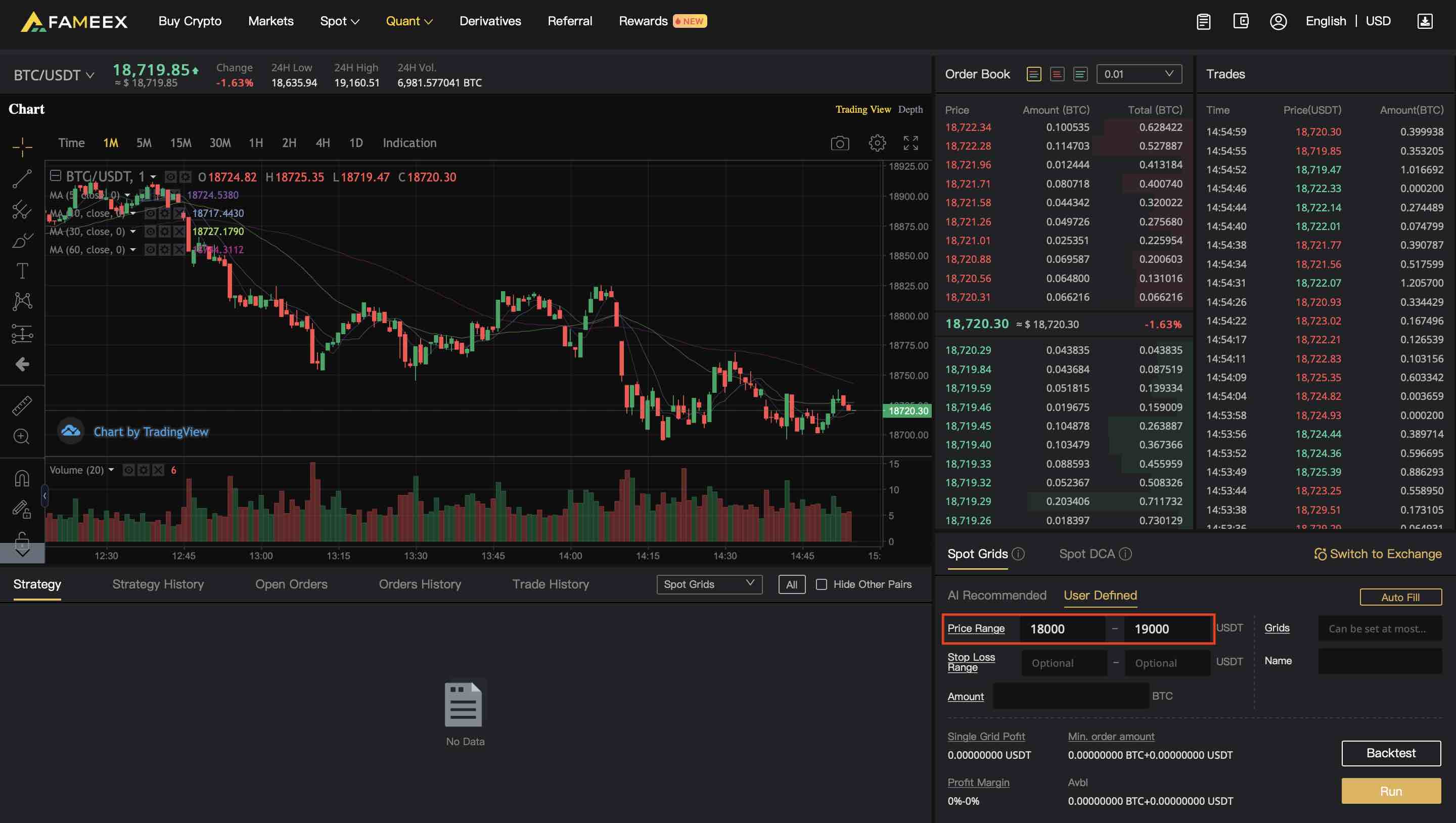

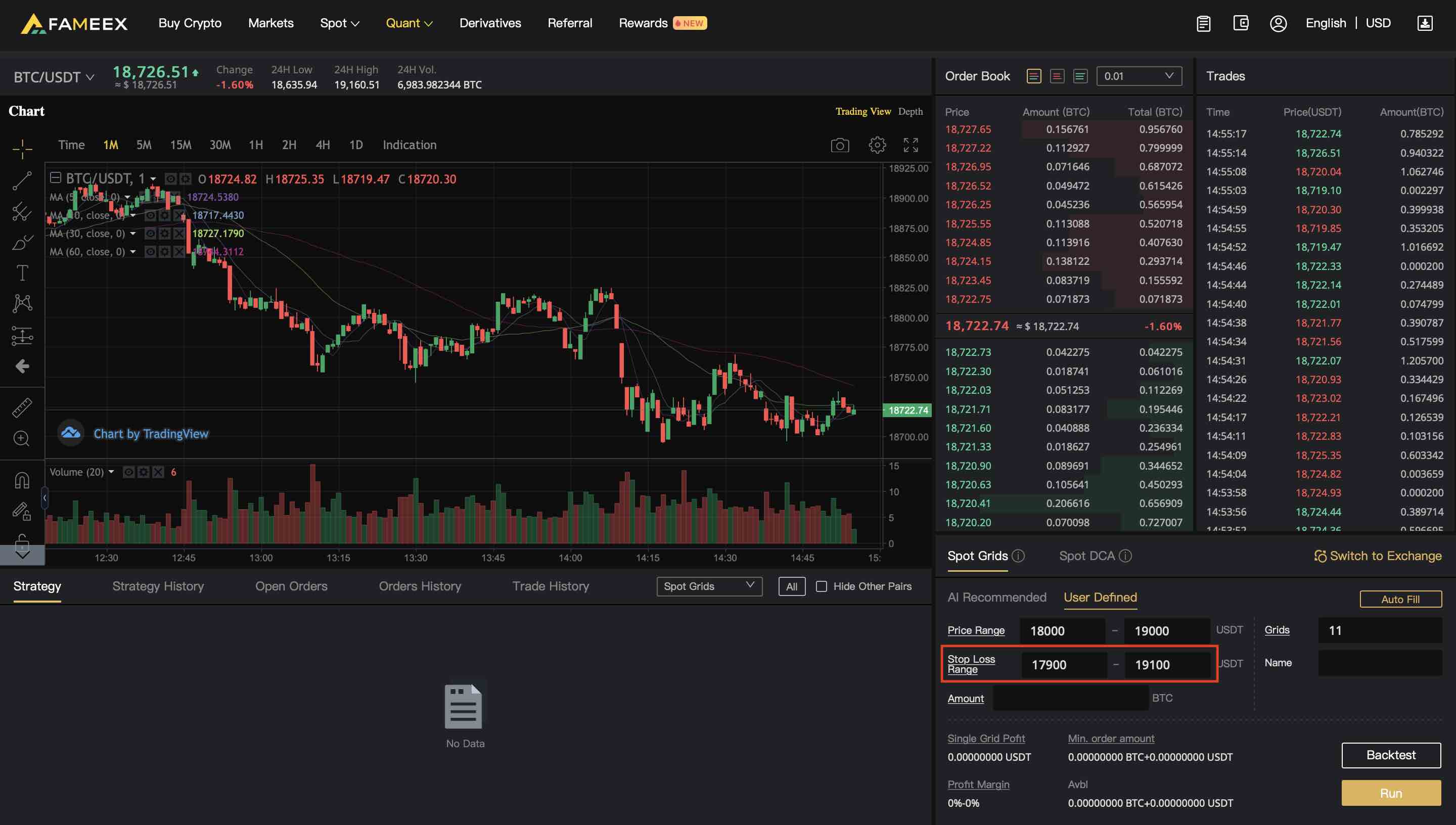

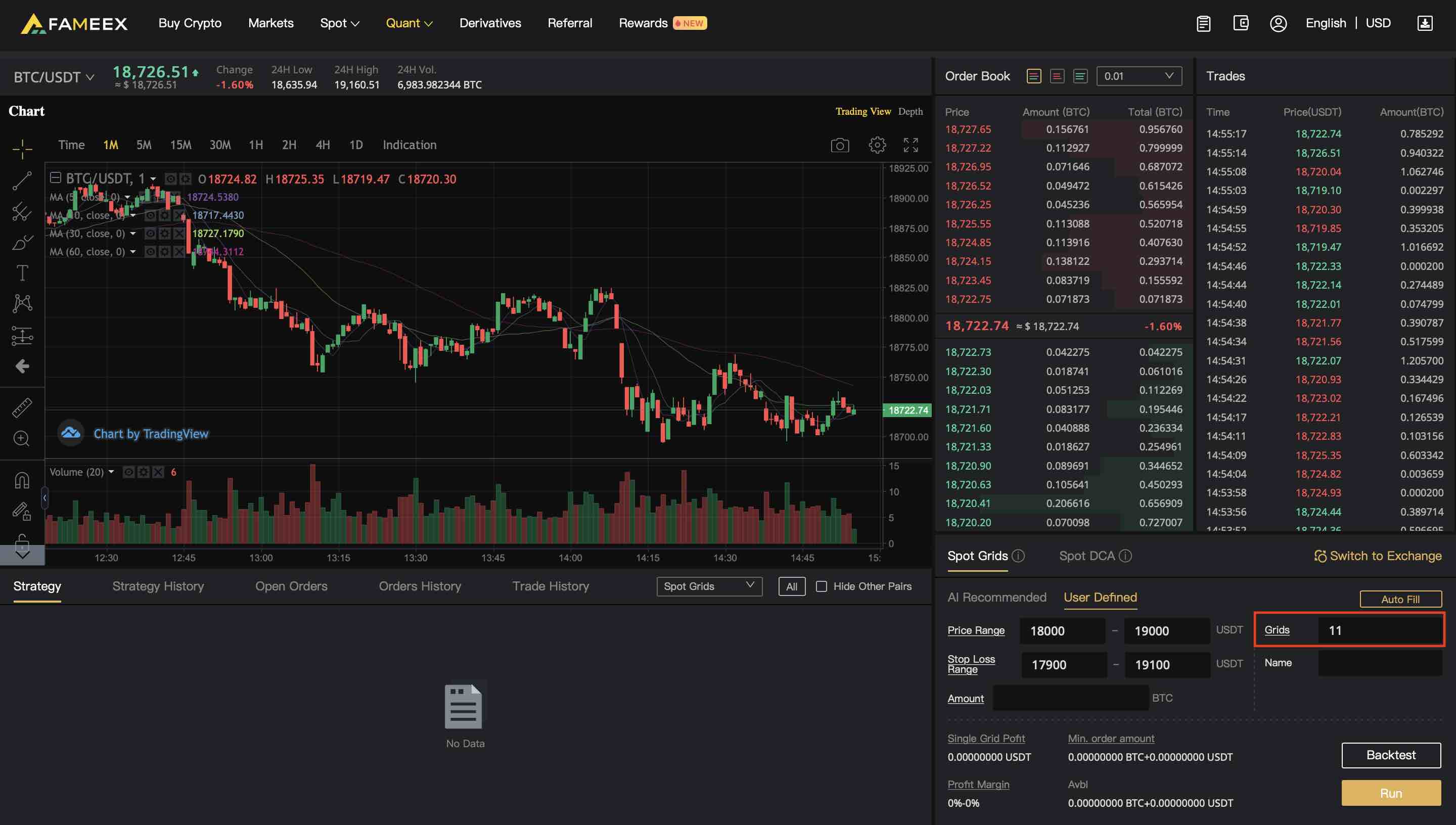

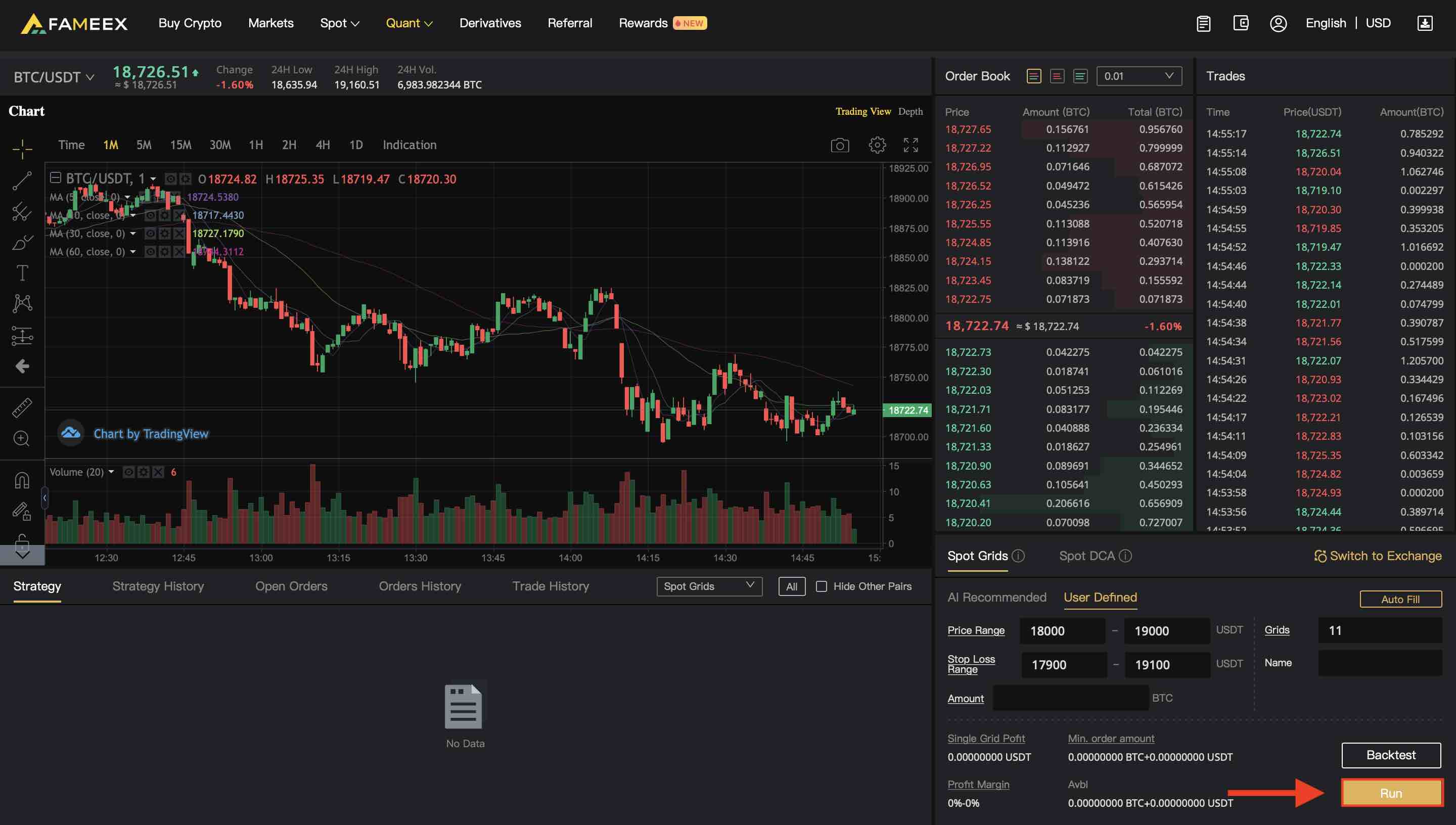

Web:

1) Choose a trading pair. FAMEEX supports any pairs on grid trading, for example, you can choose BTC/USDT.

2) You can set up the lower and upper boundary of the price range in the bottom right panel.

3) Optionally select your stop loss price range. When the market is very bullish, you should set up a upper boundary price much higher than the current market price. On the contrary, when the market is bearish, you should set your lower boundary price much lower than the current market price.

4) Set up the Grids, which is the number of grids within your price range. Determine the reasonable number of grids, not too many or too little.

5) Set up the Amount of funds and Name for your grid trade. You can decide the amount based on your account balance to ensure that the funds required for the first order is lower than the account balance.

6) Check all the parameters and click “run” to start trading.

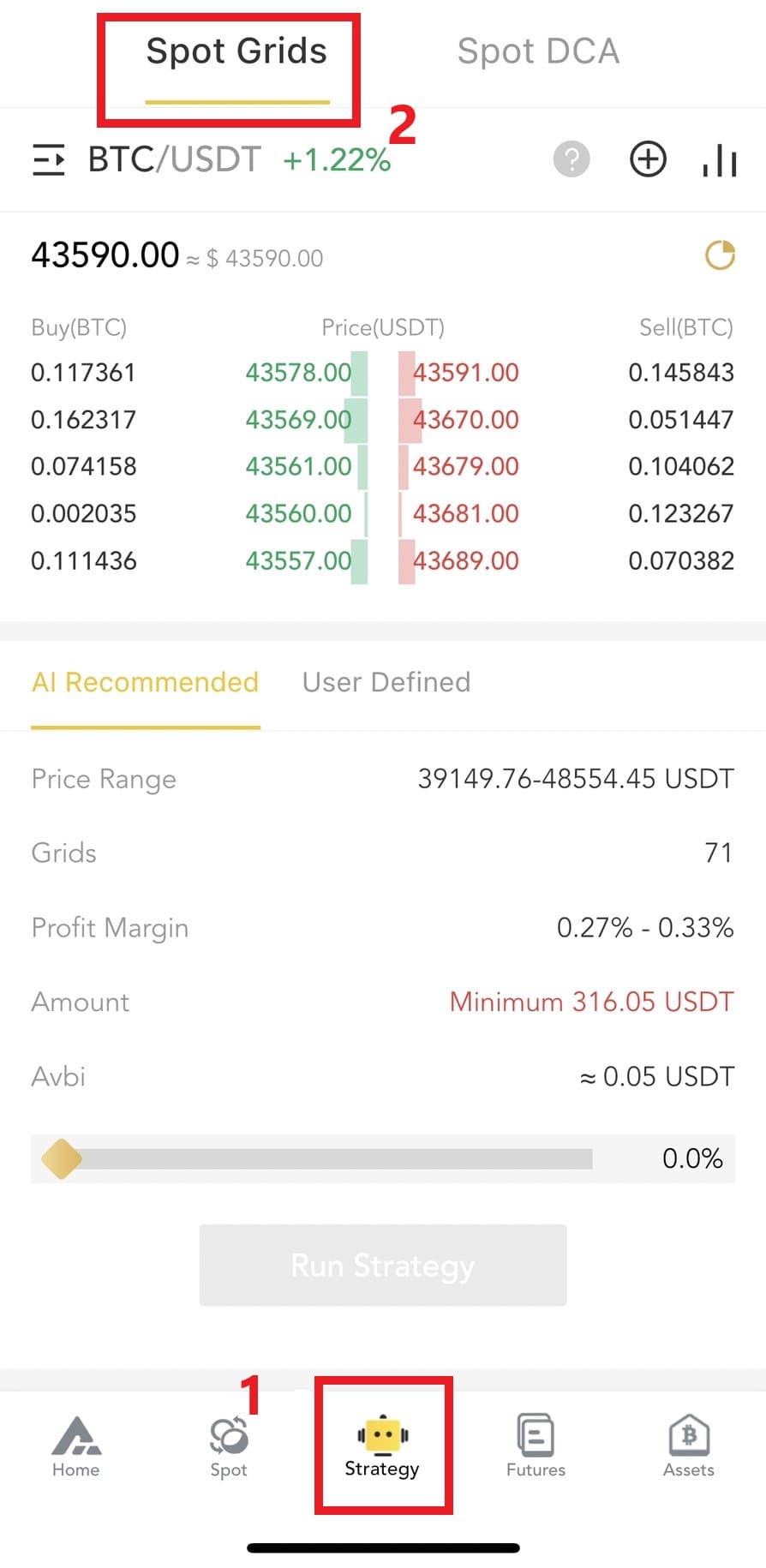

Mobile:

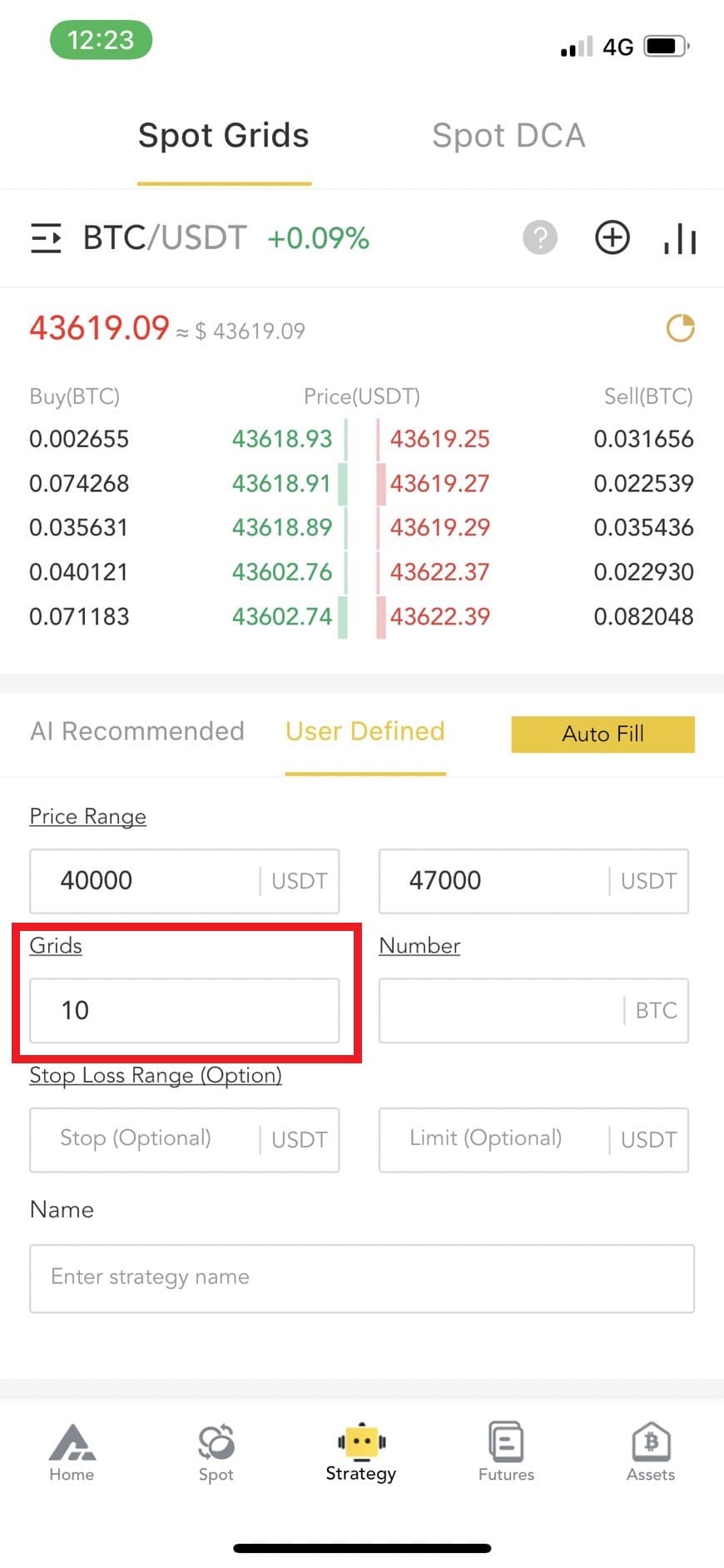

1) Go to “Strategy”, then choose “Spot Grids”.

2) Choose a trading pair. FAMEEX supports any pairs on grid trading, for example, you can choose BTC/USDT.

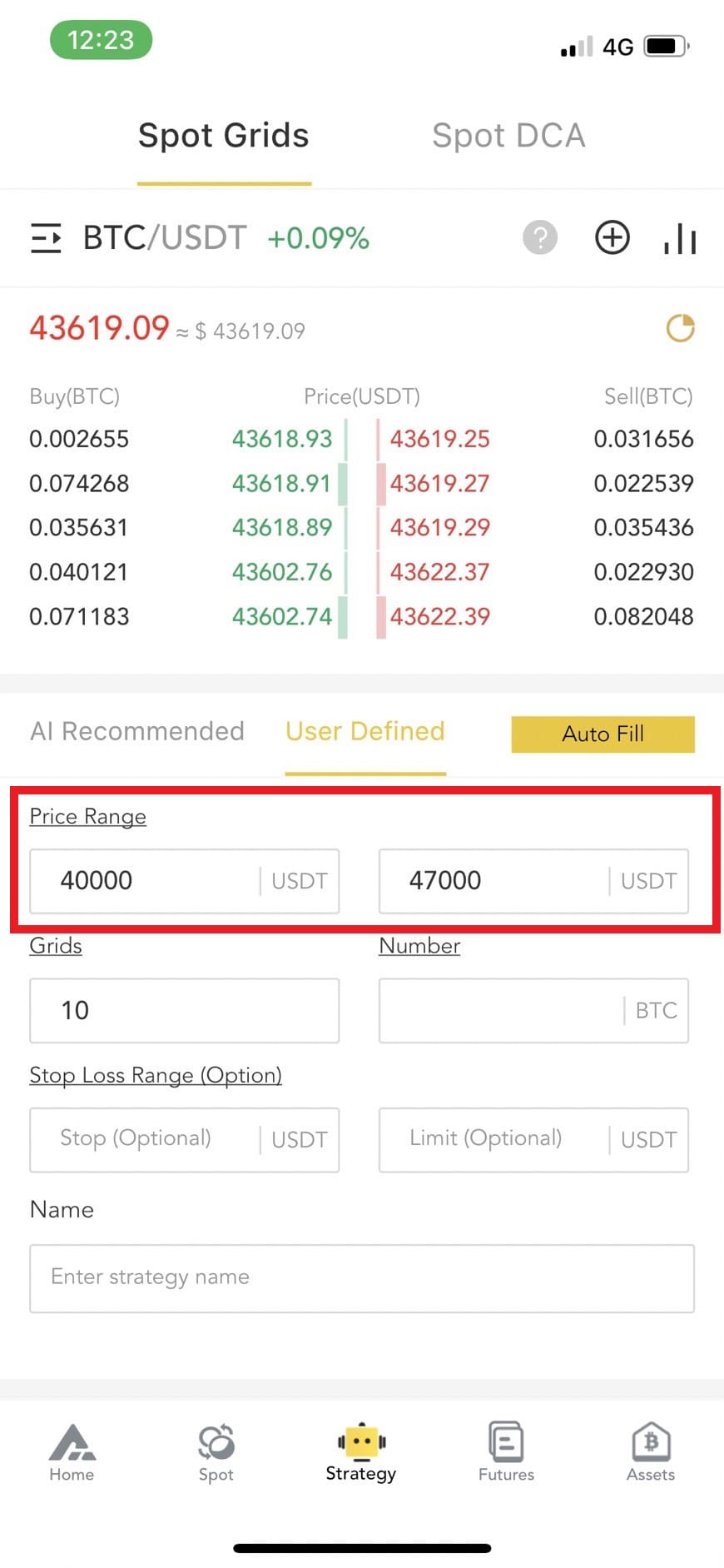

3) You can set up the lower and upper boundary of the price range in the bottom panel.

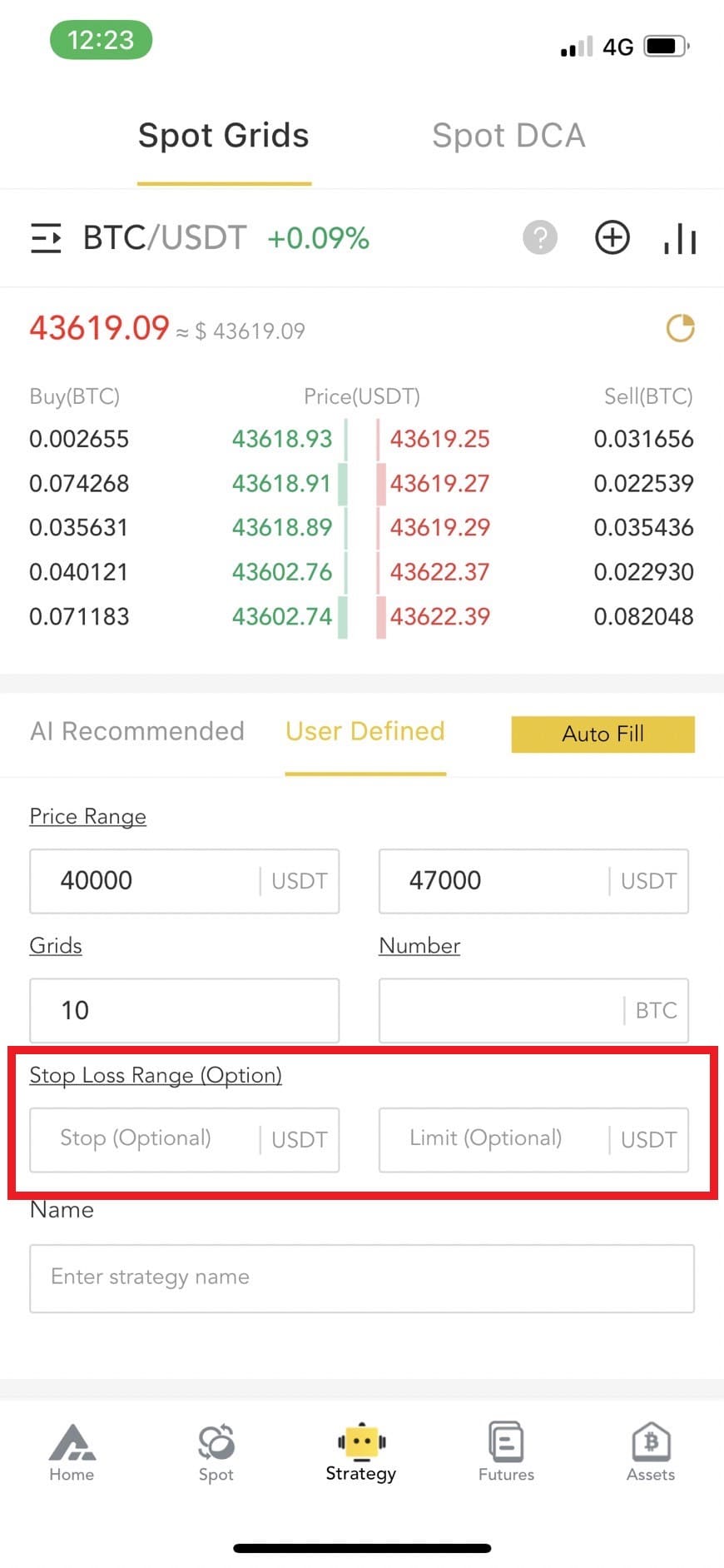

4) Optionally select your stop loss price range. When the market is very bullish, you should set up a upper boundary price much higher than the current market price. On the contrary, when the market is bearish, you should set your lower boundary price much lower than the current market price.

5) Set up the Grids, which is the number of grids within your price range. Determine the reasonable number of grids, not too many or too little.

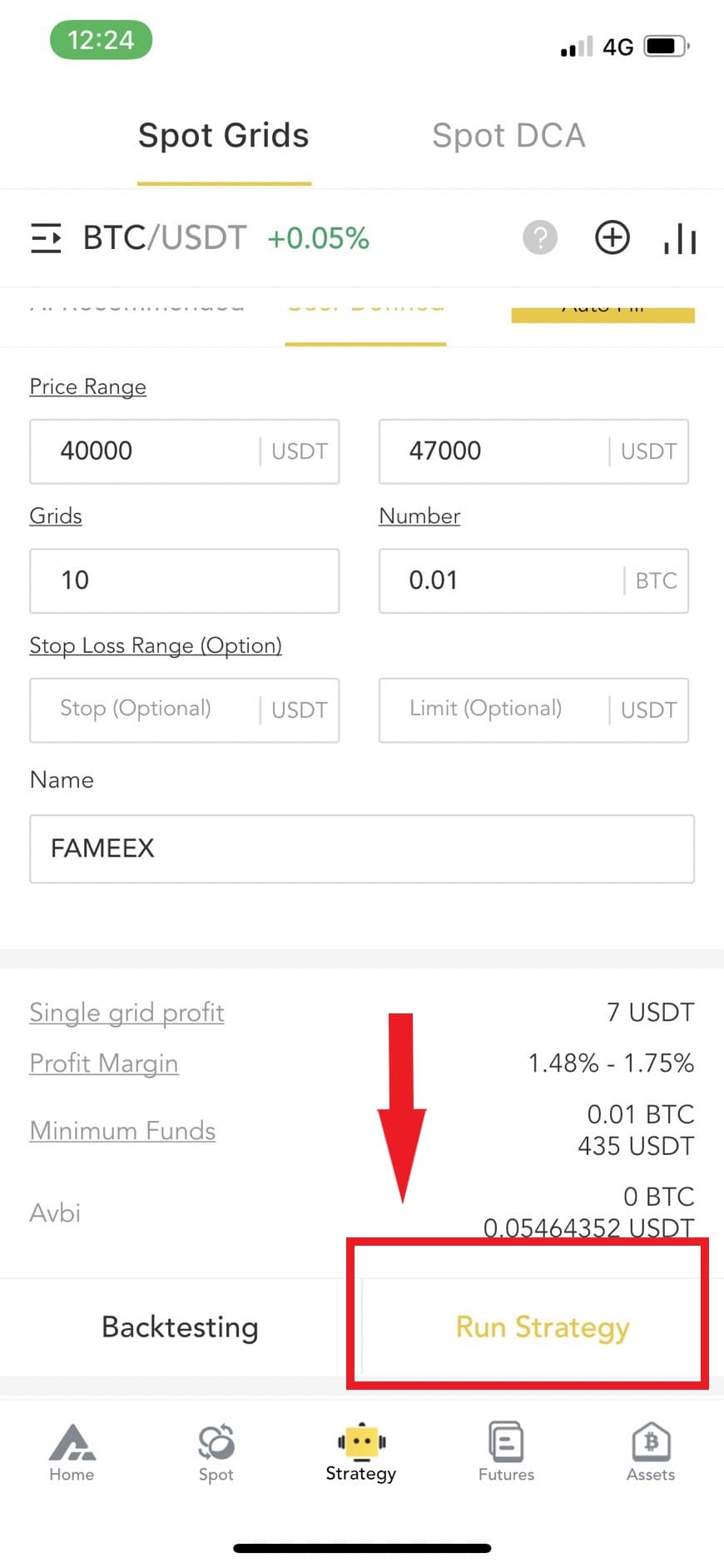

6) Set up the Amount of funds and Name for your grid trade. You can decide the amount based on your account balance to ensure that the funds required for the first order is lower than the account balance.

7) Check all the parameters and click “run” to start trading.

FAMEEX kindly reminds you that digital assets are a new asset with a volatile price. Please make your investments in digital assets very cautiously. Users should self-assess any possible losses to be within an affordable range before any trading decision.