Ondo(ONDO)

Ondo(ONDO)

ONDO (Ondo) Token Price & Latest Live Chart

2024-03-05 16:05:15

Discover the latest ONDO price with FameEX's ONDO/USD Price Index and Live Chart. Keep up-to-date with the current market value and 24-hour changes, as well as delve into Ondo's price history. Start tracking ONDO price today!

What is ONDO (Ondo)?

Ondo Finance emerges as a pioneering platform in the fusion of traditional finance and blockchain technology, striving to democratize access to institutional-grade financial products for a global audience. Ondo Finance originally launched a DeFi protocol on the Ethereum blockchain, offering liquidity solutions across different protocols. With the release of version 2, the company pivoted towards the tokenization of real-world assets (RWA), rolling out fund management offerings that cater to a range of underlying assets, including US government bonds, notes, and US money market funds. For its services, the platform levies a management fee of 0.15%. Rooted in the ethos of enhancing market efficiency, transparency, and inclusivity, Ondo stands at the forefront of the next-generation financial infrastructure revolution.

Founded by Nathan Allman, an alumnus of Stanford University with a rich background in economics and business, Ondo Finance was conceived out of a vision to integrate the dynamism of cryptocurrency with the stability of traditional financial markets. Allman's experience at prestigious firms like Goldman Sachs and ChainStreet Capital, coupled with his insights into the hedge fund industry, fueled his drive to innovate within the finance sector. Recognizing the untapped potential of crypto to revolutionize traditional financial paradigms, he launched Ondo with the aim of making U.S.–based, institutional-grade securities accessible through a decentralized framework. The initiative quickly gained traction, securing $24 million in funding from notable investors including Pantera, Wintermute, and Coinbase Ventures, which speaks volumes about its potential and the confidence vested in its mission.

Ondo Finance's ambition extends beyond merely offering tokenized securities; it aspires to overhaul the entire financial infrastructure by integrating blockchain technology with traditional financial instruments. This integration is designed to yield a more efficient, accessible, and transparent market. Ondo intends to make high-grade financial products more user-friendly and less reliant on intermediaries like hedge fund managers. Moreover, the decentralized nature of its operations aims to empower users, ensuring transparency and control through decentralized autonomous organizations (DAOs).

How does ONDO (Ondo) work?

At the heart of Ondo Finance's operations is the concept of tokenized assets, a novel mechanism that encapsulates traditional financial instruments within digital tokens on a blockchain. This innovative approach allows Ondo to collaborate with leading financial entities such as BlackRock and Pimco, tokenizing a wide array of securities that include everything from government money market funds to high-yield corporate bonds. By purchasing stakes in these conventional assets and representing them as digital tokens, Ondo facilitates a seamless and efficient platform for trading U.S.–based securities without the logistical and regulatory complexities typically associated with direct investments in exchange-traded funds (ETFs).

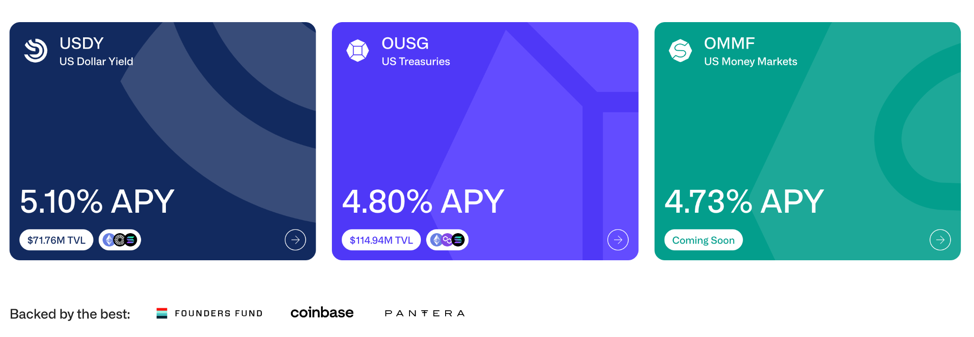

Ondo Finance's ecosystem announced in January 2023 the launch of a tokenized bond product. This offering allows holders of stable currencies to invest in U.S. Treasuries and investment-grade corporate bonds through its tokenized funds, catering to a diverse range of investment preferences and geographical locations. At the general-access level, products like the USD Yield (USDY) token offer a blend of stability and earning potential, backed by U.S. Treasury securities and yielding DeFi returns. For more experienced investors, qualified-access products provide exposure to short-term bonds and money market funds, exemplified by the OMMF and OUSG tokens, which are based on Ethereum and offer round-the-clock transferability and liquidity. According to Ondo's website, the OMMF fund, which invests in U.S. money markets, earns an annual return of 4.73%. The OUSG fund, focusing on U.S. Treasuries, yields 4.8% APY. Additionally, the US dollar yield token USDY offers a yield of 5.10% APY.

Different APY on ONDO ecosystem, source: ONDO website

Complementing these investment products, Ondo introduces auxiliary services such as Flux Finance, a decentralized lending protocol, and the Ondo Token Bridge, which enhances interoperability across blockchains. The Ondo Token Converter further simplifies the process of earning and managing yields from these tokenized assets, highlighting Ondo's commitment to user convenience and financial innovation.

ONDO (Ondo) market price & tokenomics

ONDO's tokenomics reveal a strategic approach to distribution and governance, centered around its native token, ONDO. With a total supply cap of 10 billion tokens, ONDO is meticulously designed to foster community engagement and decision-making through the Ondo DAO. Unlike conventional tokens, ONDO eschews a rigid distribution schedule in favor of a flexible, community-driven approach, allowing DAO members to vote on distribution strategies and adapt to evolving market conditions. This model allocated sixteen percent of the tokens to initial investors, with the remainder poised for future DAO-directed distributions, underscoring Ondo's commitment to decentralized governance and investor participation. As of now, ONDO (Ondo) is ranked #132 by CoinMarketCap with market capitalization of $491,714,073 USD. The current circulating supply of ONDO coins is 1,385,723,628.

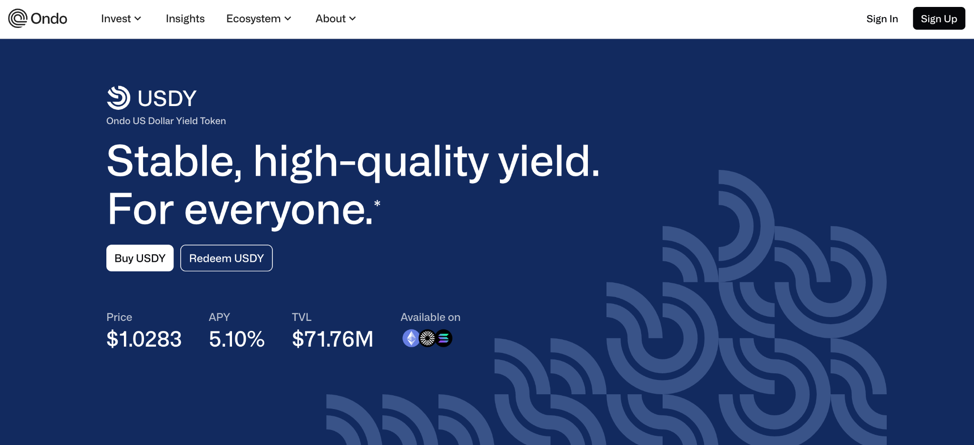

USDY is a digital note secured by short-term U.S. government bonds and deposits in banks, tailored for non-U.S. individuals and institutional investors who pass the platform’s KYC verification. The deposit process into the system concludes within 2-3 days of USDC deposit, earning interest income. The creation of USDY, which takes 40-50 days, results in the transfer of the newly minted digital notes to the investor’s account.

USDY from ONDO, source: ONDO website

Furthermore, Ondo Finance offers two tokenized fund products, OUSG and OMMF, accessible for purchase and trading on secondary markets by any interested party. OUSG grants token holders exposure to short-term government bonds, essentially representing an investment in such bonds. OMMF is envisaged as a tokenized version of a U.S. government money market fund, although it has not yet been released for trading.

Why do you invest in ONDO (Ondo)?

Investing in ONDO presents an opportunity to participate in a pioneering DeFi project that merges the traditional finance sector with the burgeoning potential of blockchain technology. Ondo Finance, the platform behind the ONDO token, aims to democratize access to institutional-grade financial products, making it a significant player in the next generation of financial infrastructure. Its commitment to market efficiency, transparency, and accessibility positions it as a compelling option for both retail and institutional investors.

The platform's innovative approach to tokenizing real-world assets, such as U.S. Treasury securities and corporate bonds, allows investors to engage with U.S.-based securities without the traditional barriers to entry. This tokenization process not only simplifies investment in these assets but also introduces a level of liquidity not typically found in the traditional finance sector. With products like USDY and OMMF tokens, investors gain exposure to stable assets with attractive yields, leveraging the security and potential of decentralized finance.

Is ONDO (Ondo) a good Investment?

Determining whether ONDO is a good investment requires a nuanced understanding of both its potential and the inherent risks associated with the crypto and DeFi markets. On one hand, Ondo Finance's unique proposition and its early successes in tokenizing securities indicate a strong market potential. The platform's ability to attract significant investment and its plans for future expansion reflect confidence in its model and technology.

On the other hand, the platform's focus on transparency, decentralized governance through the Ondo DAO, and its innovative approach to financial products could mitigate some of these investment risks. While ONDO presents an enticing investment opportunity due to its innovative approach and potential for growth, investors should approach with caution. As with any investment, the potential for high rewards comes with the risk of significant losses, making thorough research and risk assessment essential before committing capital to ONDO tokens.

Find out more about ONDO (Ondo):

Explorer: Etherscan