FameEX Weekly Market Trend | March 13, 2025

2025-03-13 17:29:20

1. Key Insights on Crypto Market Trends

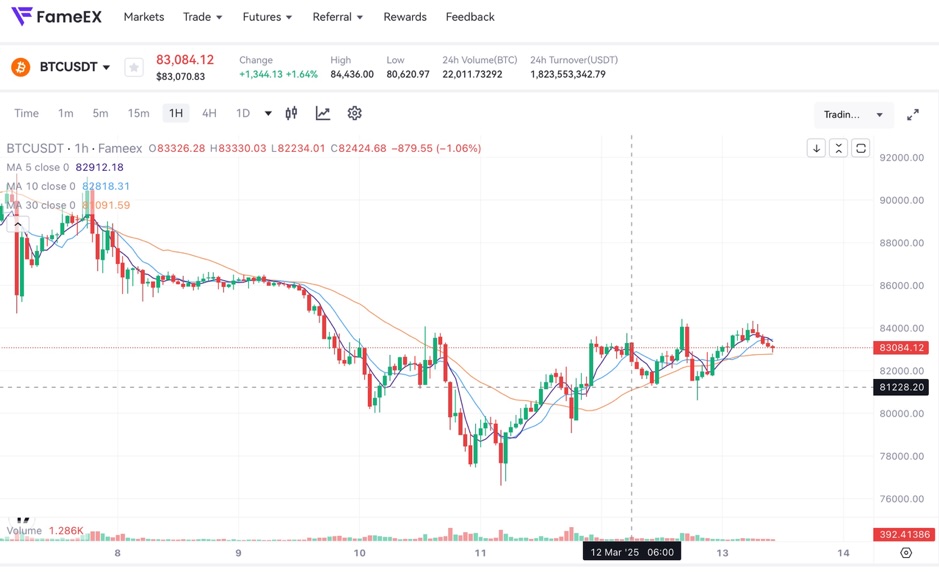

From March 10 to March 12, the BTC spot price swung from $76,553.92 to $84,373.4, a 10.21% range.

Over the past three days, key statements from the Federal Reserve(Fed) and the European Central Bank (ECB) were as follows:

1) On March 10, Fed Chair Powell stated that there is no rush to cut interest rates until the impact of Trump’s policies becomes clearer.

2) On March 11, the New York Fed noted that expectations for financial conditions to deteriorate over the next year are the strongest since November 2023.

3) On March 10, ECB President Lagarde announced plans to launch the digital euro (CBDC) in October this year.

4) On March 11, ECB Governing Council Member Rehn stated that if data supports it, there will be no rate cut in April, opting for a wait-and-see approach. Governing Council Member Kažimír emphasized the need to remain open to either cutting rates or pausing, as inflation risks still lean upward. Governing Council Member Nagel stressed that Germany needs reforms, not just increased spending.

5) On March 12, ECB President Lagarde stated that higher U.S. tariffs could reduce inflation in the Eurozone and that the region faces “exceptionally high” uncertainty.

Overall, the Fed’s stance remains cautious, while statements from ECB officials indicate a greater degree of uncertainty.

The SlowMist security team has issued a security alert, warning of a recent surge in social engineering attacks involving malware.

Hackers use fake video call links to lure victims into downloading malicious scripts, thereby stealing sensitive information.

In the latest cases, attackers first hacked the Telegram accounts of victims’ friends and then used these accounts to initiate fake video calls to lower the target’s vigilance.

The SlowMist team reminds users to take the following measures if attacked:

1) Protect assets: If a wallet’s private key/mnemonic phrase has been stored on a computer, transfer funds as soon as possible.

2) Change passwords & enable 2FA: Immediately update passwords for Telegram, X, email, exchanges, and other accounts, and check for abnormal login records.

3) Run a full system scan: Use well-known antivirus software such as AVG, Bitdefender, or Kaspersky to scan the system.

4) Reset the system (if necessary): Back up important files, reinstall the system, and ensure the virus is completely removed before restoring data.

2. CMC 7D Statistics Indicators

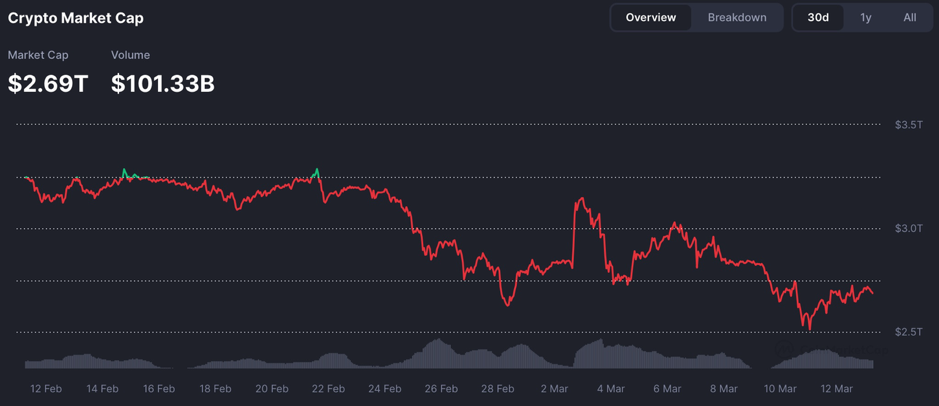

Overall market cap and volume, source: https://coinmarketcap.com/charts/

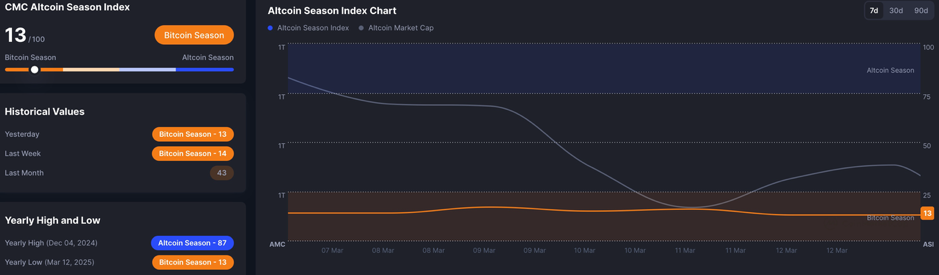

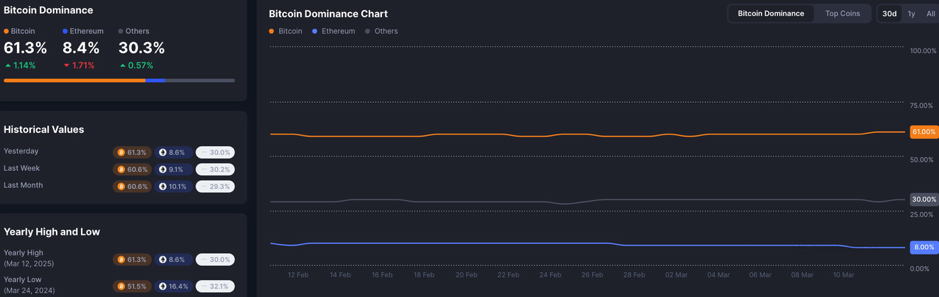

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

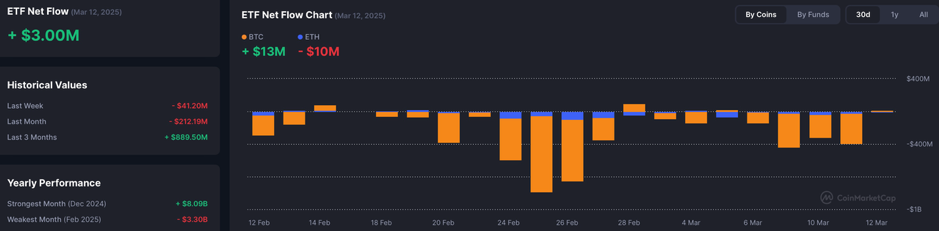

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

CoinMarketCap 100 Index: https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

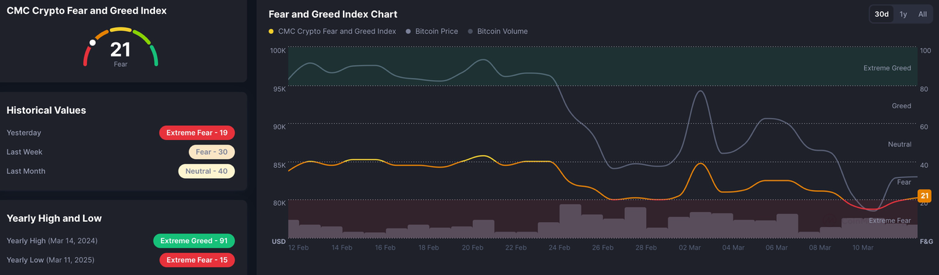

Fear & Greed Index, source: https://coinmarketcap.com/charts/

Over the past three days, the total cryptocurrency market capitalization, trading volume, and market activity have slightly rebounded, while the altcoin season index and Bitcoin dominance remain largely unchanged.

ETF funds continue to see outflows, and the prices of major cryptocurrencies and large-cap altcoins have slightly recovered. The current Fear & Greed Index stands at 21, still near its recent bottom.

3. Perpetual Futures

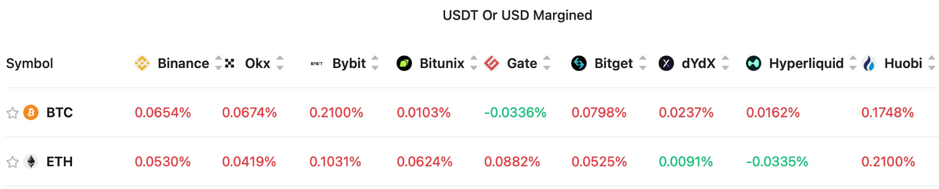

The 7-day cumulative funding rates for BTC and ETH on the top 8 exchanges are 0.614% and 0.5685%, respectively, indicating strong bullish sentiment in the market and sustained bullish expectations.

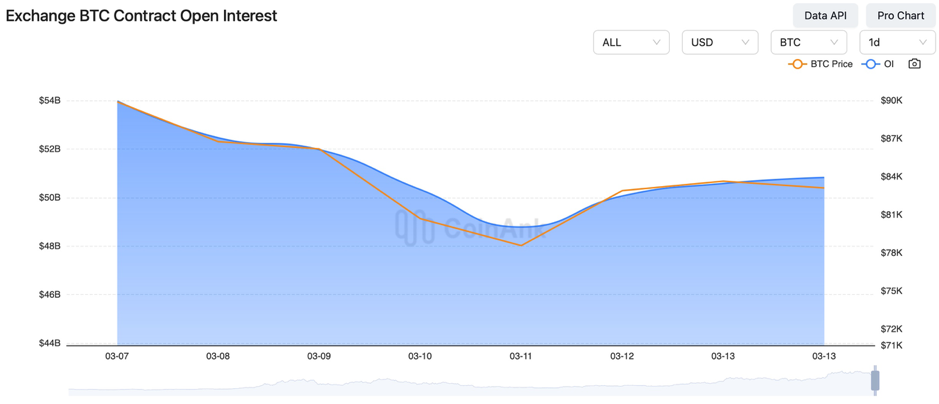

Exchange BTC Contract Open Interest:

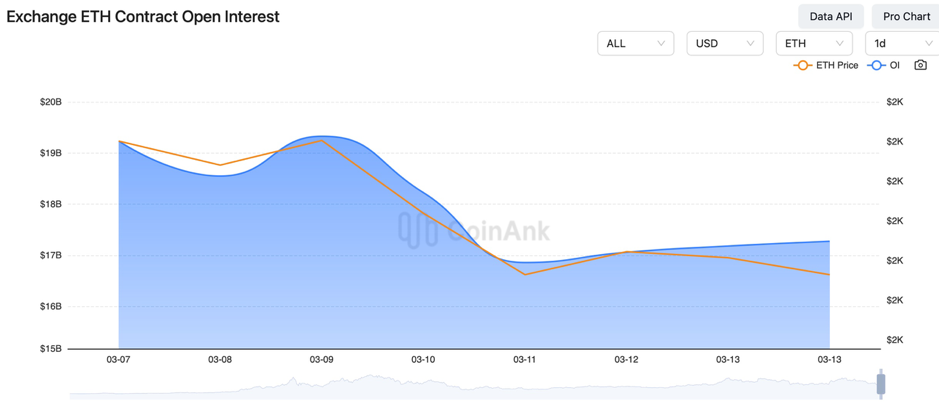

Exchange ETH Contract Open Interest:

Over the past three days, BTC contract open interest has remained largely unchanged, while ETH has seen a significant decline. This suggests that high-risk appetite market participants are relatively less optimistic about a broad altcoin rebound in the near term.

4. Global Economic and Crypto Sector Developments

Macroeconomy

1) On March 10, according to market news, the U.S. House of Representatives passed a spending bill to avoid a government shutdown, and the bill has been submitted to the Senate.

2) On March 10, Bank of Japan Governor Kazuo Ueda indicated that the central bank would conduct bond purchases if Japanese government bond yields rise abnormally.

3) On March 11, the Bank of Canada reduced its target for the overnight rate to 2.75%, in line with expectations (2.75%) but lower than the previous rate of 3.00%.

4) On March 12, the U.S. February seasonally adjusted CPI MoM came in at 0.2% (expected: 0.3%, previous: 0.5%), while the unadjusted CPI YoY stood at 2.8% (expected: 2.9%, previous: 3.0%).

5) On March 12, the U.S. February seasonally adjusted core CPI MoM was 0.2% (expected: 0.30%, previous: 0.40%), while the U.S. February unadjusted core CPI YoY stood at 3.1% (expected: 3.20%, previous: 3.30%).

6) On March 12, as U.S. February CPI data came in below expectations across the board, traders increased their bets on the Fed cutting interest rates at least twice this year.

Cryptocurrency Industry Updates:

1) On March 10, the U.S. Bitcoin spot ETF market experienced capital outflows for four consecutive weeks.

2) On March 10, Grayscale’s Head of Research stated that Bitcoin’s further appreciation does not rely on the U.S. crypto strategic reserve.

3) On March 10, CryptoQuant’s Head of Research reported that Bitcoin spot demand growth is slowing.

4) On March 10, Luxury giant LVMH was sued over its watch NFT patent technology.

5) On March 11, Hacker group “Dark Storm” claimed responsibility for the DDoS attack on platform X.

6) On March 11, the U.S. housing department was considering using blockchain and stablecoins for subsidy payments and monitoring.

7) On March 11, Shen Yu’s “3/12” five-year survey revealed that 70.5% of investors are still recovering losses, while 48.8% consider “holding BTC and other cryptocurrencies” as their primary source of wealth.

8) On March 12, North Korean hacker group Lazarus embedded cryptocurrency-stealing malware in a new batch of JavaScript packages.

9) On March 12, Dragonfly’s report suggested that U.S. crypto users may have missed out on potential gains of $1.84 billion due to regional restrictions.

10) On March 12, Pakistan planned to leverage blockchain technology to streamline overseas remittance processes.

11) On March 12, South Korea’s opposition party and industry representatives were calling for Bitcoin to be included in the national reserves.

Regulation & Crypto Policy:

1) On March 10, it was reported that the Monetary Authority of Singapore and the Vietnam Securities Commission would enhance cooperation on the regulatory framework for digital assets.

2) On March 10, it was said that Texas’ “Bitcoin Reserve Fund” would be used to hold at least $500 billion in cryptocurrency.

3) On March 10, Thai regulators approved USDT as an accepted cryptocurrency.

4) On March 10, South Korea planned to introduce new guidelines in Q3 to lift the ban on institutional crypto investments.

5) On March 11, the Central Bank of Russia proposed a crypto investment pilot program for high-net-worth investors.

6) On March 11, California disclosed that it shut down 26 crypto scam websites, involving losses of up to $4.6 million.

7) On March 11, the Cayman Islands’ new crypto regulatory framework introduced licensing requirements, effective April 1.

8) On March 11, the U.S. SEC has delayed its decision on multiple crypto spot ETFs, including ADA, SOL, and XRP.

9) On March 12, the Cayman Islands updated its crypto regulatory framework, requiring virtual asset service providers to obtain a CIMA license.

10) On March 12, U.S. senators reintroduced a bill allowing the U.S. to hold over 1 million Bitcoin in reserves.

11) On March 12, the Hong Kong Securities and Futures Commission released a roadmap for regulating Hong Kong's virtual asset market.

12) On March 12, the Alberta Securities Commission in Canada warned that the CanCap project might be a crypto investment scam.

13) On March 12, U.S. Senator Bill Hagerty introduced a revised version of the stablecoin bill, the GENIUS Act, strengthening cross-border payment regulations.

Other News:

1) On March 10, Peking University and Huawei jointly released the full-stack open-source DeepSeek inference solution.

2) On March 11, Elon Musk presented his U.S. poll data, showing the Department of Government Efficiency (DOGE) with an approval rating of 81.1%.

3) On March 12, Interpol issued a red notice for former Philippine President Rodrigo Duterte.

5. Market Outlook

From March 13 to March 16, the medium-term trading strategy will still be applied: for the BTC spot, maintain the sell order at $169,400 and the buy orders at $73,970, $59,935, and $45,900, respectively.

For the ETH spot, sell orders are placed at $5,125, while dip-buy orders are set at $1,730.

The U.S. federal-level Bitcoin Strategic Reserve Act still requires congressional approval and will take some time. This bull market is not over yet, so there’s no need for excessive panic.

Risk Reminder: The cryptocurrency market is highly volatile, and investors are advised to control their positions and implement stop-loss strategies. The above content is for reference only and does not constitute specific investment advice from this exchange.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.