FameEX Weekly Market Trend | February 17, 2025

2025-02-17 19:02:20

1. BTC Market Trend

From February 13 to February 16, the BTC spot price swung from $95,018.25 to $98,963.94, a 4.15% range.

Important Statements from the Federal Reserve (Fed) and the European Central Bank (ECB) in the Last Four Days

1) On February 13, Fed’s Bostic indicated that the latest inflation data shows the need for cautious monitoring. The Fed will remain on hold until more clear information is obtained.

2) On February 13, Fed Chairman Powell stated that the dot plot does not serve as forward guidance. Even if U.S. President Trump asks, he will not resign.

3) On February 14, Fed Governor Waller stated that U.S. regulators should directly address the risks of stablecoins. He believed that stablecoin regulatory rules would be quickly passed.

4) On February 15, Fed’s Logan indicated that if the labor market remains strong, better inflation data does not necessarily mean the Fed can cut rates.

5) On February 13, ECB Governing Council member Nagel indicated that as the neutral interest rate approaches, gradual rate hikes are becoming increasingly appropriate.

Fed Chairman Powell’s testimony on the second day before Congress this year: The latest data shows that inflationary pressures have eased, but the target has not yet been reached. There are concerns about the liquidity of U.S. Treasury bonds. Quantitative tightening still has a long way to go. The Fed may have to adjust interest rates in response to tariff policies. Powell also mentioned that the Fed does not want to hinder banks from providing cryptocurrency services to legitimate clients.

According to the Wall Street Journal: On February 13, U.S. Vice President Vance stated that if Russian President Putin does not agree to a peace deal with Ukraine that guarantees Ukraine’s long-term independence, the U.S. will impose sanctions on Russia and may take military action. If Russia fails to engage in sincere negotiations, the option of sending U.S. troops to Ukraine remains “on the table”.

2. CMC 7D Statistics Indicators

Overall market cap and volume, source: https://coinmarketcap.com/charts/

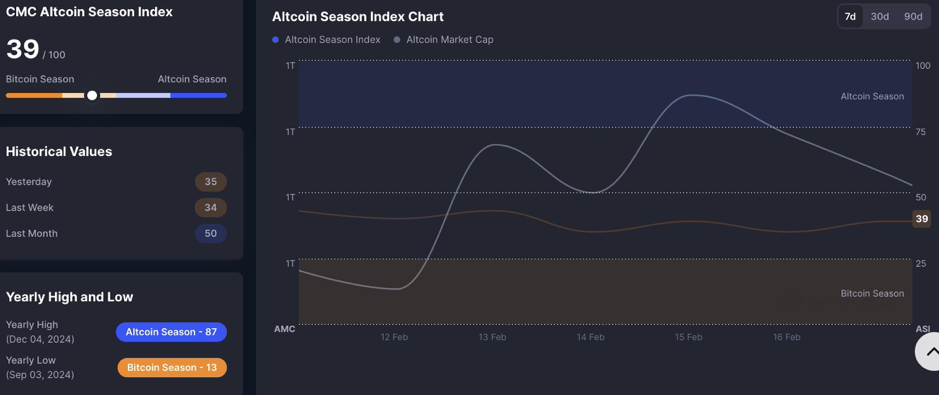

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

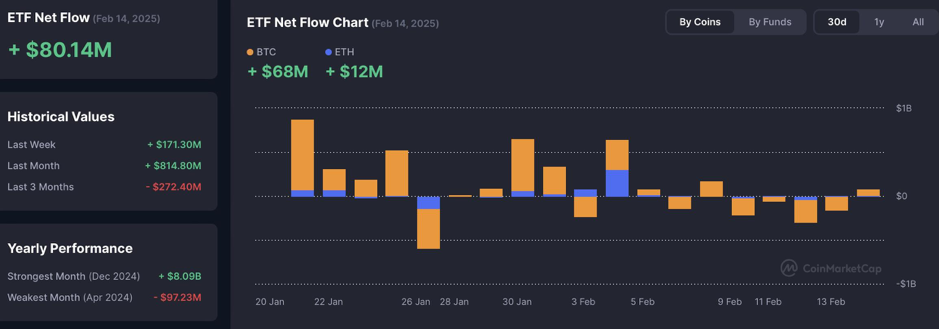

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

CoinMarketCap 100 Index: https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

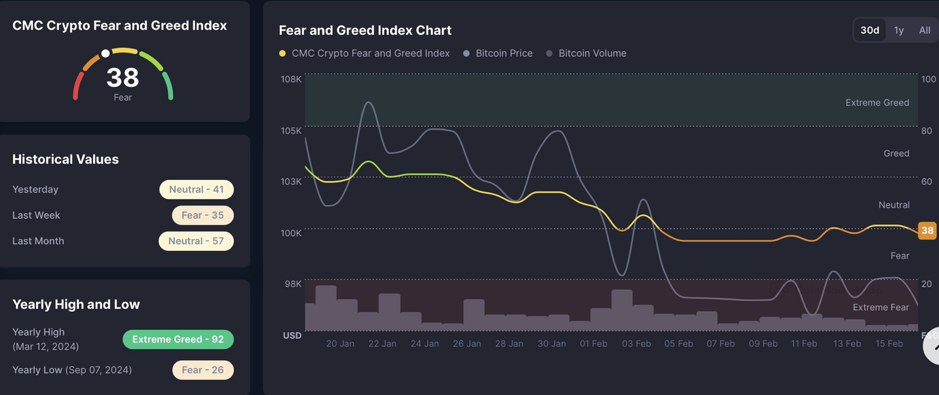

Fear & Greed Index, source: https://coinmarketcap.com/charts/

Based on various statistical indicators, the total market trading volume remains in a downward phase. Altcoin spot prices have started to decrease. ETF net inflows continue to decrease significantly. Large-cap mainstream coins’ spot prices have also begun to fall. Therefore, overall market sentiment is currently at a recent low point.

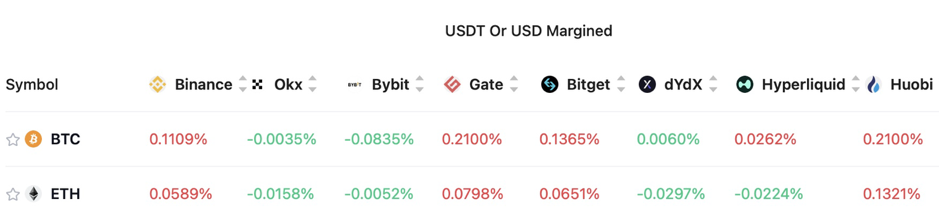

3. Perpetual Futures

The 7-day cumulative funding rates for major exchanges’ mainstream cryptocurrencies are generally positive, indicating that long leverage is relatively high, and the expectation of a continued bull market still exists in the minds of most market participants.

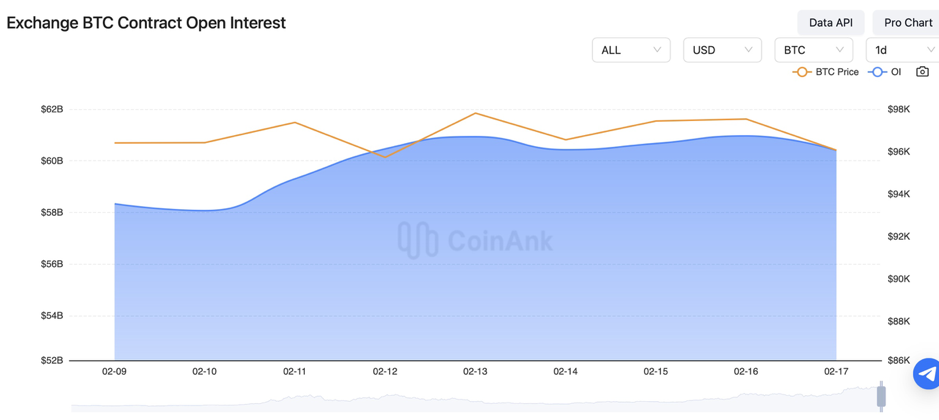

Exchange BTC Contract Open Interest:

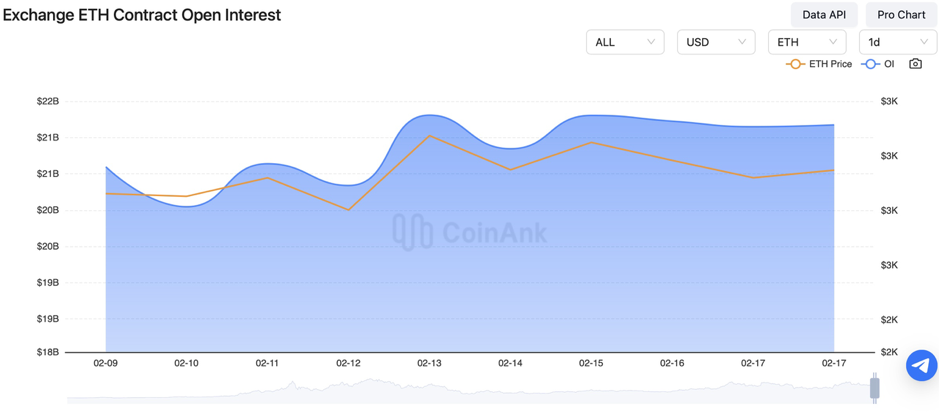

Exchange ETH Contract Open Interest:

Over the past three days, open interest in BTC and ETH contracts has remained relatively unchanged, with short-term market sentiment and overall risk appetite fluctuating within a narrow range.

4. Industry Roundup

1) On February 13, 21 U.S. states planned to propose Bitcoin reserve bills, potentially driving $23 billion in buy orders.

2) On February 13, Shanghai Securities News reported that the People’s Bank of China’s balance sheet reduction does not indicate a tightening of monetary policy. China will implement a moderately accommodative monetary policy this year.

3) On February 13, the Bridgewater Fund founder warned that the U.S. fiscal deficit should be reduced to 3% of GDP, otherwise, leaders should resign.

4) On February 13, Coinbase’s subscription and services revenue grew to $2.3 billion in four years, with a compound annual growth rate (CAGR) of 167%.

5) On February 13, according to Bloomberg, Bitmain faces delays in shipments of mining machines to U.S. clients due to stricter scrutiny.

6) On February 13, SlowMist Security Alert reported that suspicious transactions were detected on the ETH and BSC chains. Attacked contracts may have a missing swap function parameter check.

7) On February 14, China’s M2 money supply in January grew by 7% YoY. New RMB loans totaled 5.13 trillion yuan, higher than expected.

8) On February 14, EU Commission President von der Leyen expressed a willingness to find a solution to the tariff issue that benefits all parties with the U.S.

9) On February 14, Eurozone Q4 seasonally adjusted employment grew by 0.1% QoQ, in line with expectations. Q4 GDP growth was revised to 0.9% YoY, also in line with expectations.

10) On February 14, Trump signed a memorandum on reciprocal tariffs, explaining: It means that regardless of how much tariffs other countries impose on the U.S., we will charge them the same amount—no more, no less.

11) On February 14, UAE’s Minister of Artificial Intelligence announced a collaboration with Elon Musk to build a Dubai Loop.

12) On February 14, U.S. initial jobless claims for the week ending February 8 were 213,000, slightly lower than the expected 215,000, with the previous figure revised from 219,000 to 220,000.

13) On February 15, former Shanghai Stock Exchange Party Committee member and Vice General Manager Dong Guoqun was expelled from the party and public office.

14) On February 15, the U.S. January PPI MoM increased by 0.4%, above the expected 0.3%; the YoY PPI rose by 3.5%, higher than the expected 3.2%.

15) On February 15, the UK’s 3-month GDP for December increased by 0.1% MoM, better than the expected -0.1%, with the previous value revised from 0% to -0.1%. The preliminary GDP growth for Q4 was 1.4% YoY, higher than the expected 1.1%, with the previous value revised from 0.9% to 1%.

16) On February 15, Bank of England Chief Economist Pill stated that the Bank of England needs to be cautious with rate cuts as the long process of curbing inflation is not yet complete.

17) On February 15, Trump nominated former Bitfury executive Jonathan Gould to lead the U.S. Office of the Comptroller of the Currency, which could enhance financial access for the crypto industry.

18) On February 15, Japan’s Financial Services Agency proposed a comprehensive reform plan for crypto assets and stablecoins. Russia’s Central Bank keeps the benchmark interest rate unchanged at 21.00%.

19) On February 16, China’s Foreign Minister Wang Yi on the principle stance of China-U.S. relations: China and the U.S. cannot afford conflict, or the world will suffer.

20) On February 16, Indian authorities seized $190 million in crypto linked to the BitConnect Ponzi scheme.

21) On February 16, the SEC and CFTC discussed a collaboration on crypto regulation, possibly reviving the Joint Advisory Committee.

22) On February 16, Mastercard revealed that 30% of its transactions would be tokenized by 2024. Institutional holdings in Ethereum ETFs will rise from 4.8% to 14.5% by Q4 2024.

23) On February 16, according to Token Unlocks data, MURA, MELANIA, FTN, QAI, MRS, IMX, APE, PIXEL, ID, and PRIME will see significant token unlocks next week.

24) On February 16, China’s domestic gold jewelry price dropped below 890 yuan/gram, a decline of 18 yuan/gram. WeChat Search integrates with DeepSeek-R1, currently in the grayscale testing phase.

25) On February 16, next Thursday, China will announce its one-year and five-year loan market quotation rates. The U.S. will release initial jobless claims for the week, and the Fed will also publish the minutes from its January monetary policy meeting on the same day.

5. Market Outlook

From February 17 to February 19, keep monitoring ETH spot trading opportunities. The sell order at $5,125, along with the buy orders at $2,040 and $1,730, should remain active. For the BTC spot, maintain the sell order at $169,400 and the buy orders at $73,970, $59,935, and $45,900.

Risk Reminder: Cryptocurrency investments are highly volatile, with significant price fluctuations and speculative risks. The above content is for reference only and does not constitute specific investment advice from this exchange.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.