FameEX Weekly Market Trend | February 23, 2025

2025-02-03 17:40:41

1. Key Updates on the Crypto Market

From January 23 to February 2, Bitcoin's spot price fluctuated between $96,244.86 and $106,984.51, with a price swing of approximately 11.16%. Below are the key statements from the Federal Reserve (Fed) and the European Central Bank (ECB) over the past 11 days:

1) On January 31, Fed Governor Michelle Bowman stated that she hopes to see further progress on inflation before adjusting interest rates.

2) On February 1, Fed Governor Goolsbee agreed with the view that there is no need to rush policy adjustments. He noted that, in theory, a one-time tariff hike is temporary and may not necessitate a policy response. Governor Bowman expressed a preference for a cautious and gradual approach to policy changes.

3) On January 27, ECB President Christine Lagarde expressed strong confidence that inflation will continue to slow. She confirmed that EU member states will not adopt Bitcoin as a reserve asset.

4) On January 31, the ECB unanimously agreed to cut interest rates by 25 basis points (bps). Inflation is expected to return to the medium-term target of 2% this year. Lagarde stated that there have been no discussions on a terminal rate or a 50 bps rate cut, adding that providing forward guidance is "not practically useful." Council Member Villeroy noted that inflation should sustainably hover around 2% by this summer, while MC Rehn expressed confidence that inflation will stabilize at the target level and that monetary policy will no longer be restrictive by spring or summer.

5) On February 1, ECB Commissioner Rehn observed further signs of slowing wage inflation and reaffirmed confidence that inflation will stabilize. He reiterated that monetary policy will cease to be restrictive by spring or summer. MC Villeroy confirmed that the ECB is confident in the decline of core inflation.

6) On February 2, ECB Council Member Knot stated that the need for restrictive policies is diminishing and asserted that no one wins in a trade war.

The Fed left interest rates unchanged. The statement removed references to progress on the inflation target but reiterated that inflation remains high. The labor market is still described as "strong," replacing the previous assessment that it had slowed. Fed Chair Powell stated in a press conference that there is no rush to adjust interest rates. He also expressed concerns about Trump’s policies but noted that he has not been in contact with Trump. Following the decision, institutional traders now expect the Fed to scale back policy easing this year.

From February 3 to February 5, traders can keep monitoring ETH spot trading opportunities. The sell order at $5,125, along with the buy orders at $2,040 and $1,730, should remain active. For the BTC spot, maintain the sell order at $169,400 and the buy orders at $73,970, $59,935, and $45,900.

2. CMC 7D Statistics Indicators

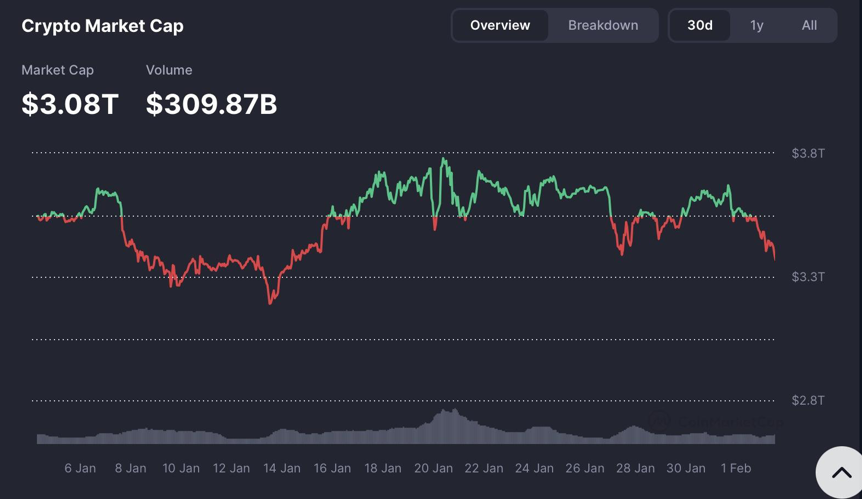

Overall market cap and volume, source: https://coinmarketcap.com/charts/

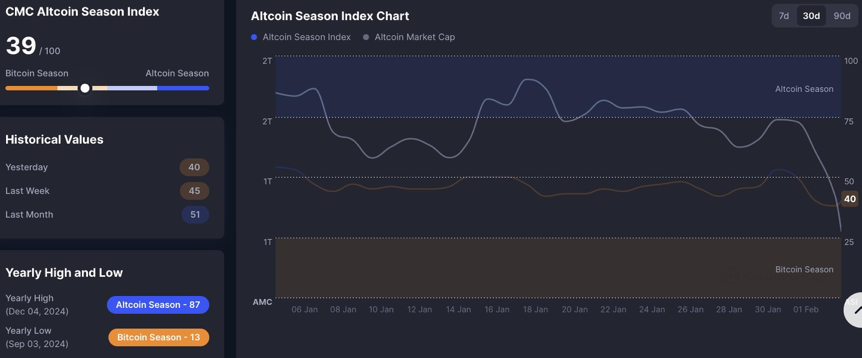

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

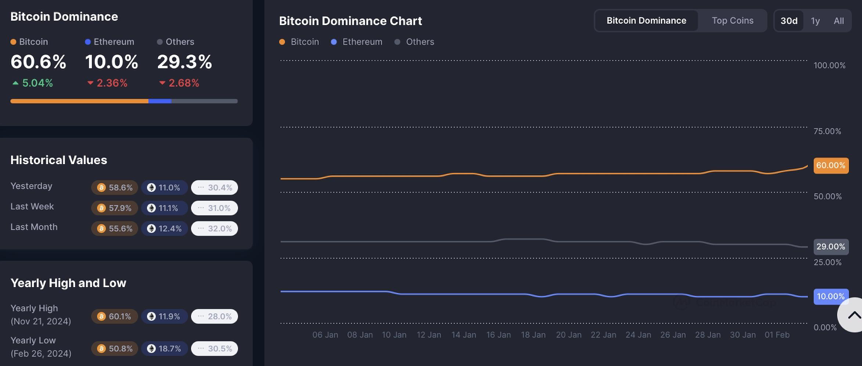

Bitcoin Dominance: https://coinmarketcap.com/charts/

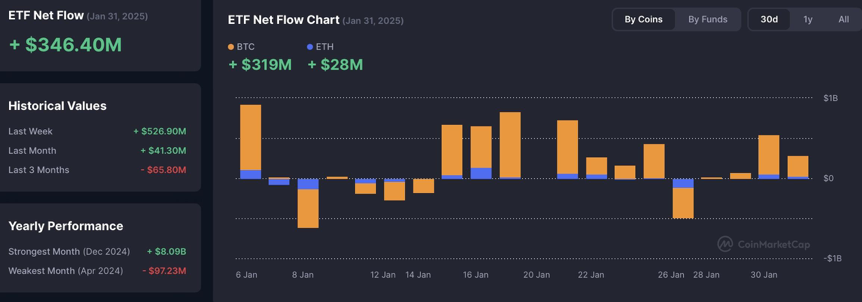

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

CoinMarketCap 100 Index: https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

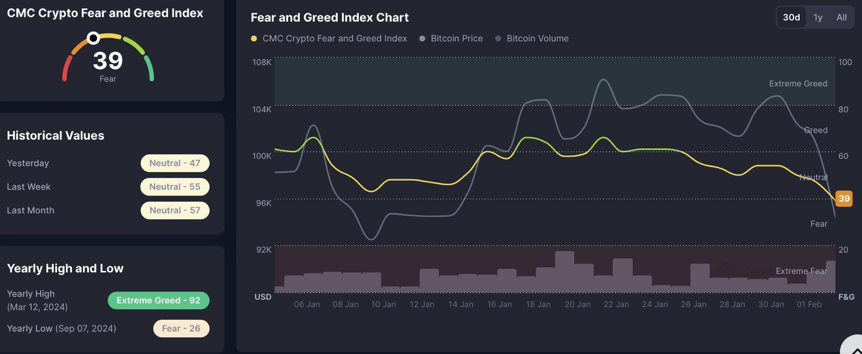

Fear & Greed Index, source: https://coinmarketcap.com/charts/

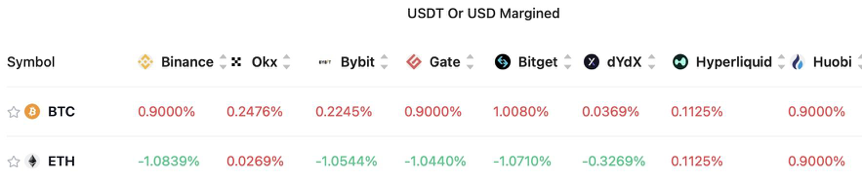

3. Perpetual Futures

The 30-day cumulative funding rates for major mainstream currencies are generally positive, indicating that long positions are currently more leveraged.

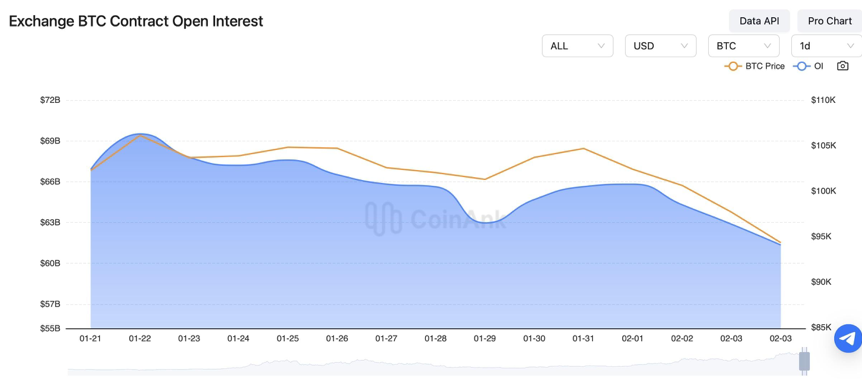

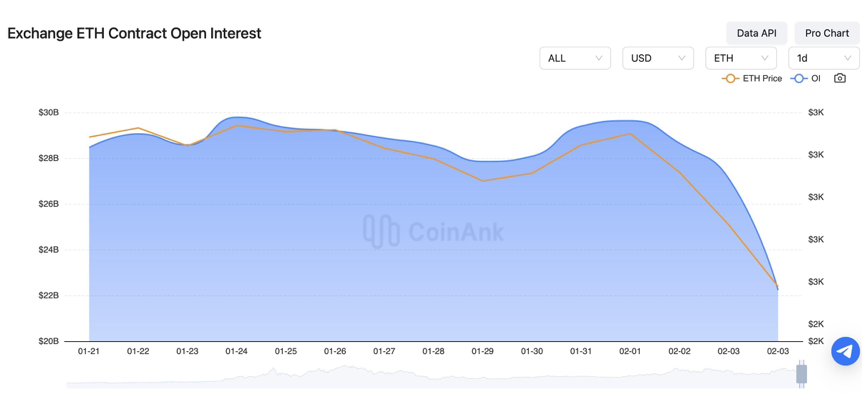

In the past 11 days, the contract open interest for both BTC and ETH has experienced slight decreases.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On January 23, 15 U.S. states pushed for a Bitcoin strategic reserve, with Arizona and Utah taking the lead.

2) On January 23, the French Senate passed the 2025 budget, which includes a tax on crypto, pending a vote in the National Assembly.

3) On January 23, the Acting Chairman of the CFTC launched a series of open roundtables to discuss digital assets and other financial topics.

4) On January 24, a survey found that more than one-fifth of its Russian respondents had traded or held memecoins.

5) On January 24, Bitwise stated that Trump's cryptocurrency executive order could disrupt Bitcoin's four-year cycle.

6) On January 24, the market value of the Trump family's crypto project WLFI's on-chain holdings surpassed $400 million for the first time, with ETH accounting for approximately 50% of the total.

7) On January 25, El Salvador revoked Bitcoin’s status as an official currency.

8) On January 25, Indian cryptocurrency holders faced a 70% tax penalty for failing to disclose earnings.

9) On January 25, the Bank of Japan raised interest rates by 25 basis points to 0.5%, the highest level since 2008, and increased its inflation forecast.

10) On January 26, U.S. President Donald Trump announced plans to ask Saudi Arabia and OPEC to lower oil prices and require Saudi Arabia to invest $1 trillion in the United States.

11) On January 26, the U.S. suspended most foreign aid, while Ukraine’s president stated that U.S. military assistance to Ukraine had not stopped.

12) On January 26, DeepSeek crashed again, failing to answer user queries and displaying the message: "The current operation cannot be completed at the moment. If you need help, please contact us." The login screen also showed "Login Failed."

13) On January 27, the eurozone's December unemployment rate was 6.3%, in line with expectations, with the previous value revised from 6.3% to 6.2%. The eurozone's Q4 GDP annualized growth rate was 0.9%, below the expected 1%, with the previous value at 0.9%.

14) On January 27, ahead of the ECB's January 30 decision, the main refinancing rate stood at 2.9%, as expected, down from the previous 3.15%. The deposit facility rate was 2.75%, also as expected, down from the prior 3.00%.

15) On January 27, the U.S. weekly initial jobless claims for the period ending January 25 with a total of 207,000, below the expected 220,000 and down from the previous 223,000.

16) On January 28, U.S. Q4 real GDP annualized quarterly preliminary growth came in at 2.3%, below the expected 2.6% and down from the previous 3.1%.

17) On January 28, Japan's unemployment rate for December stood at 2.4%, below the expected 2.5%, with the previous value also at 2.5%.

18) On January 28, Bank of Japan Governor Kazuo Ueda stated that if economic trends align with expectations, the bank will continue raising interest rates. He also noted that exchange rate fluctuations have broad economic impacts, and the central bank does not target a specific forex level.

19) On January 29, several Trump-branded merchandise websites began accepting Trump-themed tokens $TRUMP as payment.

20) On January 29, minutes from the Bank of Japan's policy meeting showed unanimous agreement that inflation expectations were rising moderately. Members also agreed that if economic and price trends develop as expected, interest rates should be raised. A few members stated that inflation risks had been contained, reducing the urgency for further hikes.

21) On January 29, Norway’s sovereign wealth fund reported a 13% investment return for 2024.

22) On January 30, Europe’s economic growth stalled in Q4 2024, with France, Germany, and Italy contributing to the slowdown.

23) On January 30, Canada's GDP for November contracted by 0.2% month-over-month, worse than the expected -0.1%, following a previous 0.3% increase.

24) On February 1, China assumed the rotating presidency of the United Nations Security Council (UNSC) once again.

25) On February 1, U.S. President Donald Trump signed an executive order imposing a 10% tariff on imports from China.

26) On February 2, spot gold reached a new all-time high of $2,817 per ounce.

27) On February 2, Canadian Prime Minister Justin Trudeau and Mexican President Diego Simbaum each announced countermeasures against U.S. tariffs.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.