FameEX Weekly Market Trend | November 7, 2024

2024-11-08 14:21:25

1. BTC Market Trend

From November 4 to November 6, the BTC spot price swung from $66,508.69 to $76,299.15, a 14.72% range. During this period, the price increase is mainly attributed to Republican candidate Donald Trump, who supports cryptocurrency, winning the next U.S. presidential election. Due to the U.S. election and daylight saving time, the Federal Reserve (Fed) will announce its rate decision at 2:00 PM ET on Thursday, November 7. Typically, the Fed holds its policy meetings on Tuesday and Wednesday, with the decision released on Wednesday. However, this time, the meeting was postponed by one day to accommodate the U.S. election voting.

Former Russian President and current Deputy Chairman of the Security Council, Dmitry Medvedev, stated that the outcome of the U.S. presidential election is unimportant, as both candidates believe “Russia must be defeated”. He suggested that if Trump were elected and attempted to intervene in the Russia-Ukraine conflict, he might face assassination. Medvedev also reiterated that Ukraine’s entry into NATO could potentially trigger a third world war.

Following Trump’s election as the next U.S. president, USD/JPY rose to a three-month high, with Japanese stocks closing higher and the Nikkei 225 index up 2.6%. The market has increased its bets on a Bank of England rate cut, anticipating a 31-basis-point cut by December, and on a European Central Bank (ECB) rate cut, expecting a 30-basis-point cut by December. Meanwhile, traders have reduced their expectations for a U.S. Fed rate cut next year, now predicting a 100-basis-point cut by September.

The Public Security Bureau of Futian District, Shenzhen, Guangdong Province, China, issued a notice stating that Dingyifeng and its associated companies are suspected of issuing fraudulent financial products, including “DDO Digital Options” (categorized as “air coins”), and engaging in illegal activities. To combat crime and protect investors’ legal rights, authorities have imposed criminal measures on suspects, including Sui and Ma, for alleged fundraising fraud. The case is under further investigation. The police urge investors to actively cooperate in providing evidence, report facts truthfully, express demands lawfully, and avoid spreading or believing rumors.

From November 7 to November 10, new spot positions can moderately increase allocations to altcoins, and continue to watch for trading opportunities in the ETH spot. Keep sell orders at $3,425 and $5,040, and dip-buy orders at $1,730 and $2,040 for ETH. Similarly, for the BTC spot, keep sell orders at $79,870 and $96,820, and dip-buy orders at $36,720 and $45,900 without cancellation.

2. Insights on Macro Trends & Crypto Trading Skills

After Trump’s successful return to the U.S. presidency, central bank governors worldwide are gauging whether their worst fears about Trump will become reality. Trump has promised to impose tariffs on U.S. imports, which would disrupt global trade; tax cuts would further stretch the federal budget; and the deportation of undocumented immigrants would reduce the pool of cheap labor.

This poses two major risks: a slowdown in global economic expansion and faster inflation in the U.S., which could make the Fed less inclined to lower interest rates. The result may be a stronger dollar, limiting room for developing countries to ease their own monetary conditions. Goldman Sachs expects the ECB to cut rates again, citing Trump’s policies as a reason for slower economic growth. Facing steep tariffs, it is also anticipated that China might ease its policies more than originally planned. However, not all regions have this flexibility. Emerging markets eager to support their own currencies may become more hawkish.

Currency officials saw a glimpse of what may come this Wednesday. The dollar surged against major currencies to its highest levels since 2020, while a spike in U.S. Treasury yields prompted some Asian authorities to pledge measures to protect their currencies. China is in a similar situation, being a key target of Trump’s tariff agenda.

Bloomberg economists noted, “Trump’s election victory could herald a broad surge in global tariffs: he has threatened to raise tariffs on Chinese imports to 60% and tariffs on other countries to 20%. This would push the U.S. average tariff rate above 20%, its highest level since the early 20th century. The hardest hit would be America’s closest partners, Mexico and Canada. For most other countries, the GDP impact would be relatively minor but would mask significant shifts in trade flows from the U.S.”

Alicia Garcia-Herrero, Chief Asia-Pacific Economist at Natixis, commented, “The U.S. market may celebrate, but Asian economies could be big losers. Trump’s policies will mean less room for rate cuts just when central banks most need it.”

Europe is also feeling the tremors of the election, especially in Eastern regions, where there are concerns that the U.S. might reduce support for Ukraine as it defends against Russian forces. Fears of heightened tensions between Washington and Brussels pushed the euro closer to parity with the dollar.

Christopher Kent, Assistant Governor of the Reserve Bank of Australia, stated at a parliamentary panel in Canberra, “As for tariffs, we simply don’t know the scope or whom they’ll target. The biggest worry is a large tariff on China, which could negatively impact us.”

After the Indonesian rupiah hit its weakest level in nearly three months, Indonesia’s central bank indicated readiness to stabilize the currency and prevent excessive fluctuations. Bank Indonesia Governor Perry Warjiyo told Parliament that Trump’s victory could keep the dollar strong and U.S. Treasury yields elevated.

3. CMC 7D Statistics Indicators

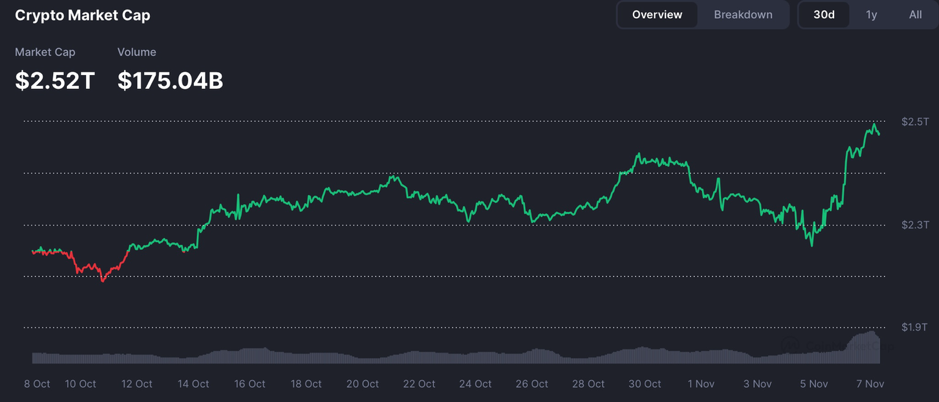

Overall market cap and volume, source: https://coinmarketcap.com/charts/

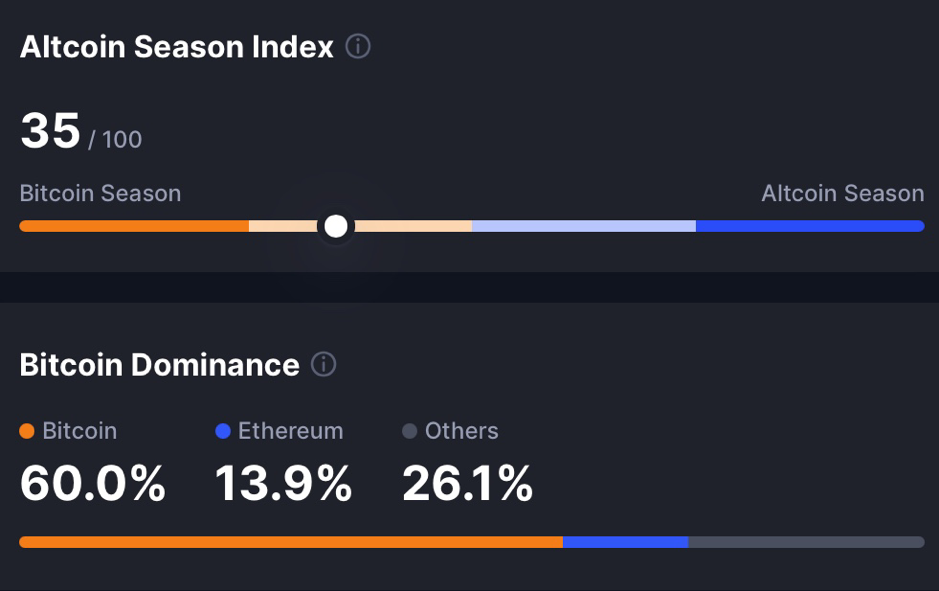

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

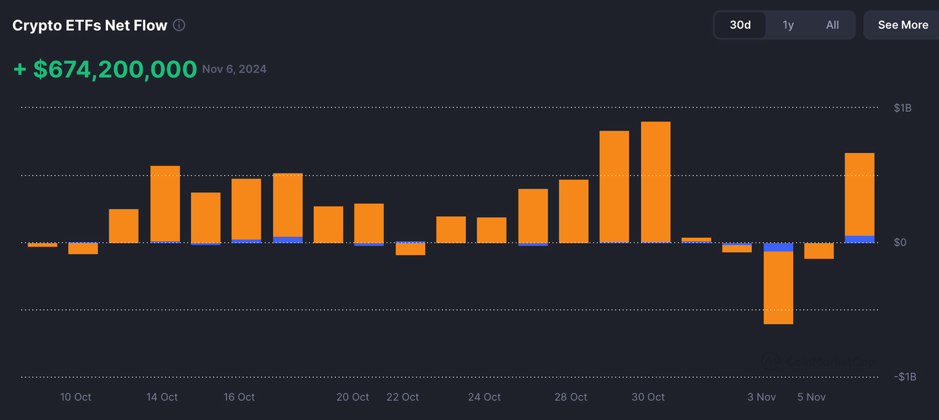

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

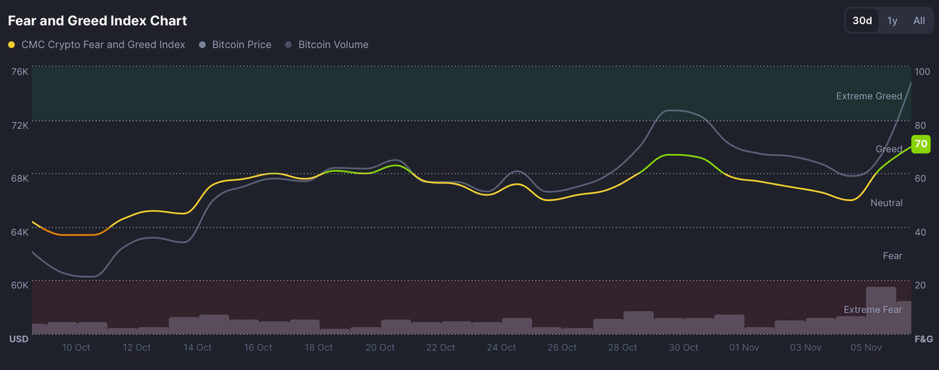

Fear & Greed Index, source: https://coinmarketcap.com/charts/

4. Perpetual Futures

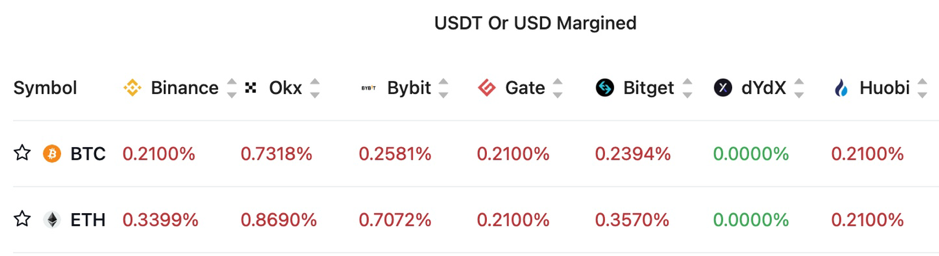

Funding fees for mainstream coins on major exchanges have generally remained positive over the past 7 days.

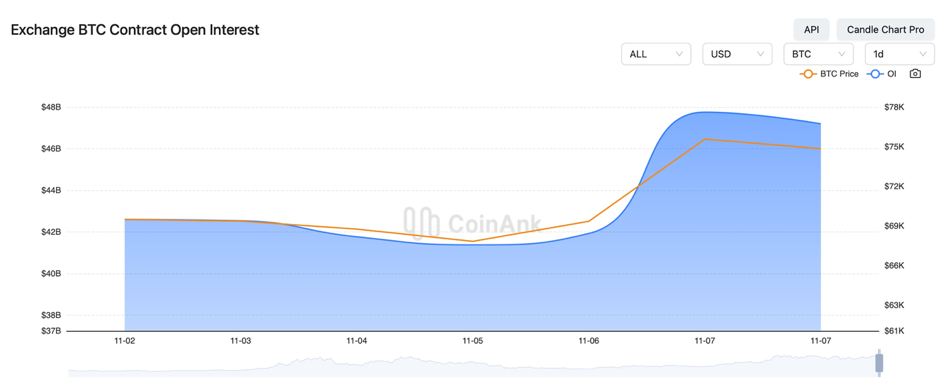

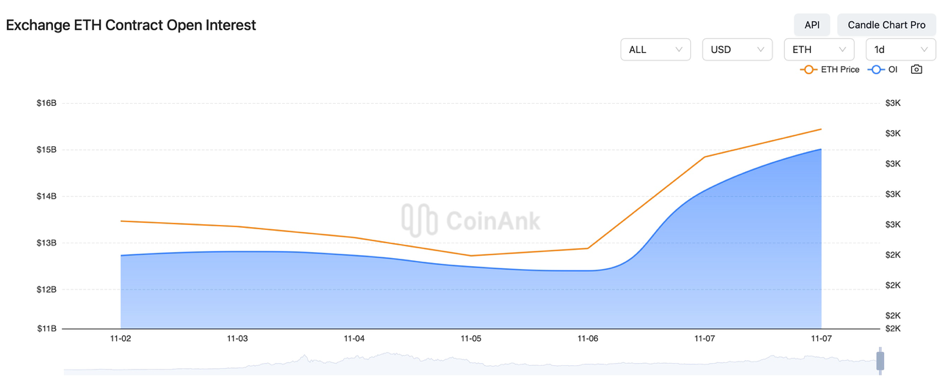

In the past three days, the open interest for BTC and ETH contracts has slightly decreased.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

5. Industry Roundup

1) On November 4, October Web3 and crypto security incidents caused a $147 million loss.

2) On November 4, asset management firm Strive launched a wealth management division, adding Bitcoin to its standard portfolio.

3) On November 4, investor Naval stated most crypto projects fail because founders get rich too soon.

4) On November 4, the State Bank of Pakistan proposed legalizing digital assets as legal tender.

5) On November 4, Grayscale’s multi-token fund GDLC applied to list as an ETP, potentially the first multi-crypto asset ETP.

6) On November 4, it was reported that UnionPay cards issued outside China now fully support linking to WeChat Pay and Alipay.

7) On November 5, Ding Yifeng Holdings (00612.HK) dropped over 40% as “Ding Yifeng” is suspected of fundraising fraud via “DDO Digital Options”. Criminal measures were taken against key individuals.

8) On November 5, China’s third draft of the Anti-Money Laundering Law allows financial institutions to refuse services in high-risk money laundering cases.

9) On November 5, a16z donated over $23 million to U.S. crypto industry political activities.

10) On November 5, Michigan’s pension fund held $10 million in an Ethereum ETF, making it the first state-level pension to invest in ETH. A UK pension fund now allocates 3% to Bitcoin.

11) On November 5, analysis suggested Bitcoin might rise post-U.S. election regardless of the winner.

12) On November 5, CZ (Changpeng Zhao) commented on the “listing fee” debate, stating that the focus should be on the project itself, noting that Bitcoin has never paid any listing fee. He also expressed optimism about investment opportunities in the Middle East, with plans to expand not only in blockchain but also in AI and biotechnology.

13) On November 6, Ukraine launched its first attack on North Korean troops in Russia. The U.S. and South Korea signed a nuclear cooperation MOU for civil nuclear energy.

14) On November 6, TON completed its first layer DeFi primitives. Layer 2 projects include Launchpad, options, and derivatives.

15) On November 6, Eurozone September PPI MoM was at -0.6%, in line with expectations and down from the previous 0.6%.

16) On November 6, Bitcoin hit a new high as the global crypto market cap surpassed $2.6 trillion.

17) On November 6, U.S. election - Trump Media & Technology Group shares experienced volatility, triggering multiple halts. According to the analysis, over 250 pro-crypto candidates were elected, with a GOP Senate majority suggesting a more “crypto-friendly” Congress.

18) On November 6, Dow Jones futures reached a historic high; U.S. 30-year Treasury yield rose by 23 basis points, the largest daily increase since March 2020, exceeding 5%.

19) On November 6, UK’s 30-year Treasury yield climbed above 5% for the first time since 2023.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.