FameEX Weekly Market Trend | October 3, 2024

2024-10-03 21:08:10

1. BTC Market Trend

From September 30 to October 2, the BTC spot price swung from $59,893.54 to $65,663.05, a 9.63% range.

The market's decline over the past three days has been driven by two main factors: Iran launching new missiles against Israel, and concerns over the shrinking cryptocurrency reserves on the Coinbase exchange, which is seen as increasing risk. Significant statements made in the past 3 days by the Federal Reserve and the European Central Bank include:

1) On October 1, Federal Reserve Chairman Powell: The Fed is not in a hurry to cut interest rates quickly and will make decisions based on data. He does not believe the labor market requires further cooling. He expects two more 25 bps rate cuts this year and will consider all factors for the November rate decision.

2) On October 1, Fed's Bostic: He is open to considering another 50 bps rate cut if there is unexpected weakness in the labor market. If job growth falls significantly below 100,000, a deeper analysis of the situation will be needed.

3) October 1, Fed's Goolsbee: Rates will need to be cut significantly over the next 12 months, as inflation is close to target levels. He anticipates multiple rate cuts, with the process lasting a year or more.

4) On October 1, European Central Bank President Christine Lagarde: Looking ahead, the low levels of some survey indicators suggest the economic recovery is facing challenges. Policy rates will remain restrictive until their inflation target is achieved. They will not wait for all indicators to reach 2% before cutting rates.

New Situation in the Middle East:

The Israeli Defense Forces spokesman announced that Iran has launched a large-scale missile attack on Israel from its territory, firing more than 180 ballistic missiles. The missiles targeted Mossad headquarters and three air bases. Most of the incoming missiles were intercepted, but a few struck central Israel. The spokesman added that Israel will respond to the attack at a time and place of its choosing.

U.S. President Joe Biden affirmed that the U.S. fully supports Israel, and Vice President Harris stated that the U.S. would not hesitate to take all necessary actions to defend its interests against Iran. Israeli Prime Minister Netanyahu declared on the evening of October 1 that Iran had made a "serious mistake" and would "pay the price" for the attack. Meanwhile, Iran claimed its military operations had ended and warned Israel not to retaliate, threatening a devastating response.

On October 2, Yemen's Houthi rebels stated they would not hesitate to expand their campaign against Israel.

A Lebanese military source reported heavy exchanges of fire between Israeli forces and Hezbollah on the southern Lebanon border.

Israeli officials said they plan a major retaliation against Iran, with targets including oil production facilities. Two months ago, Israeli intelligence had released a map of Iran's nuclear sites.

UN Secretary-General António Guterres called for an immediate halt to the escalation in the region, but the Israeli Foreign Minister announced that Guterres has been barred from entering Israel.

As tensions rise, Israel, Lebanon, Iraq, and other countries have temporarily closed their airspace, while Kuwait Airways has adjusted some of its flight routes.

Iran’s delegation to the United Nations stated that the U.S. was not informed before the missile attack and was only warned afterward.

In response, Iraqi resistance groups have declared that U.S. bases in Iraq will be targeted if the U.S. intervenes against Iran or uses Iraqi airspace.

Jordan's military announced that its forces are on high alert to respond to any threat to national security.

As the situation in the Middle East escalates, Israeli officials confirmed that they are preparing a "major retaliation" against Iran in the coming days, after an Israeli airbase was hit by an Iranian missile.

FTX Auctioning 22.3 Million Locked Worldcoin Tokens at Significant Discount

According to The Block, FTX's bankruptcy management team is auctioning off 22.3 million locked Worldcoin (WLD) tokens, currently valued at approximately $37.7 million, at a considerable discount. This auction is part of FTX's ongoing efforts to recover funds for its creditors. Interested buyers must submit their bids by 8 p.m. ET on Wednesday, with discounts expected to range from 40% to 75%. The WLD tokens will be gradually unlocked daily through 2028. This auction follows FTX's previous asset sales, including Solana and Metaplex tokens. The FTX estate currently holds around $594 million in assets, most of which are less liquid FTT tokens.

Market Movements and Whale Activity

Ki Young Ju, the founder of CryptoQuant, recently shared on social media that the current market volatility is largely driven by the futures market. However, the real whales are pushing Bitcoin's price up through spot trading and over-the-counter (OTC) markets, which is why on-chain data is so crucial. Diamond-handed whales haven’t seen particularly high returns yet, and those who entered during the recent bull market have barely made any profit at all. Retail investors are unlikely to sell on trading platforms until they see significant liquidity inflows. Additionally, new whales are accumulating Bitcoin at an unprecedented rate, in a frenzy that the BTC market has never seen before. While some have speculated that this new wave of whale activity is driven by ETF inflows, recent behavior suggests these new whale addresses have little to no correlation with ETFs.

From September 30th to October 2nd, traders can keep an eye on ETH spot trading opportunities with sell orders at $3,425 and $5,040, and buy orders at $1,730 and $2,040. For BTC, there are sell orders at $67,900, $79,870, and $96,820, and buy orders at $36,720 and $44,370. For other cryptocurrencies, it is recommended to prioritize short-term selling opportunities.

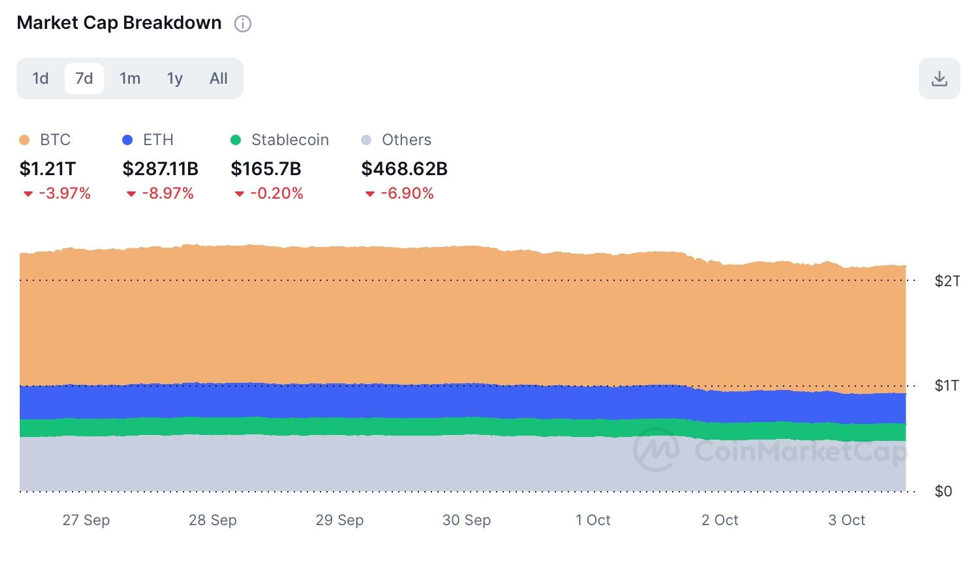

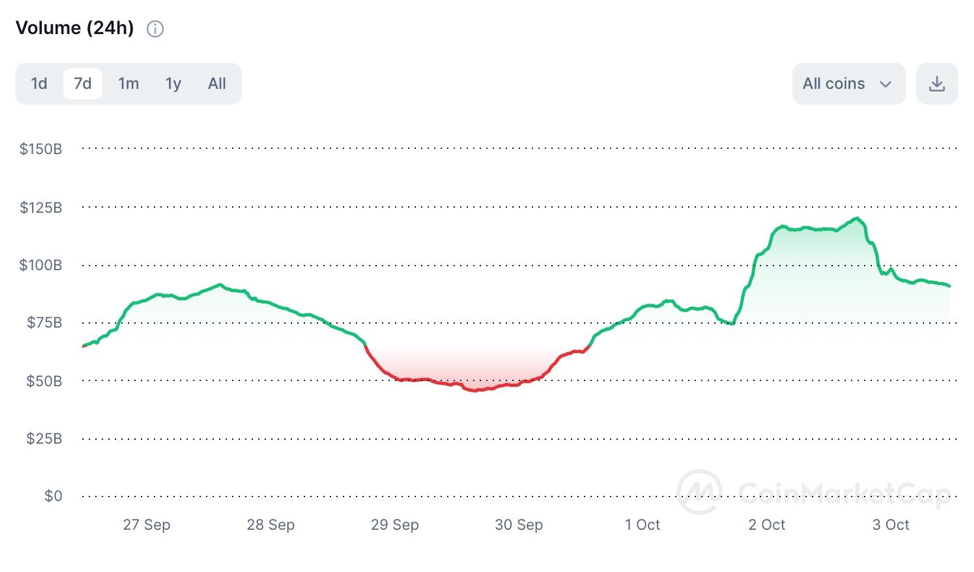

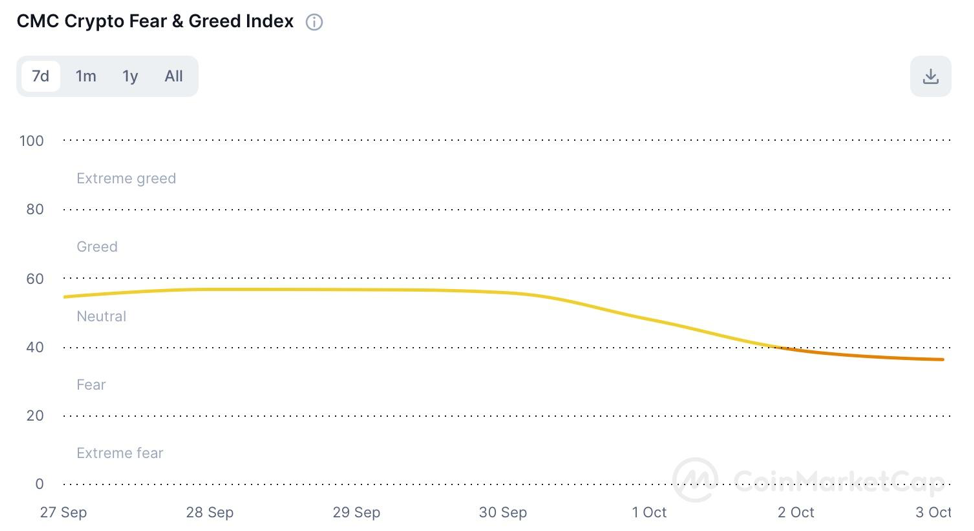

2. CMC 7D Statistics Indicators

Overall market cap analysis, source: https://coinmarketcap.com/charts/

24h trading volume, source: https://coinmarketcap.com/charts/

Fear & Greed Index, source: https://coinmarketcap.com/charts/

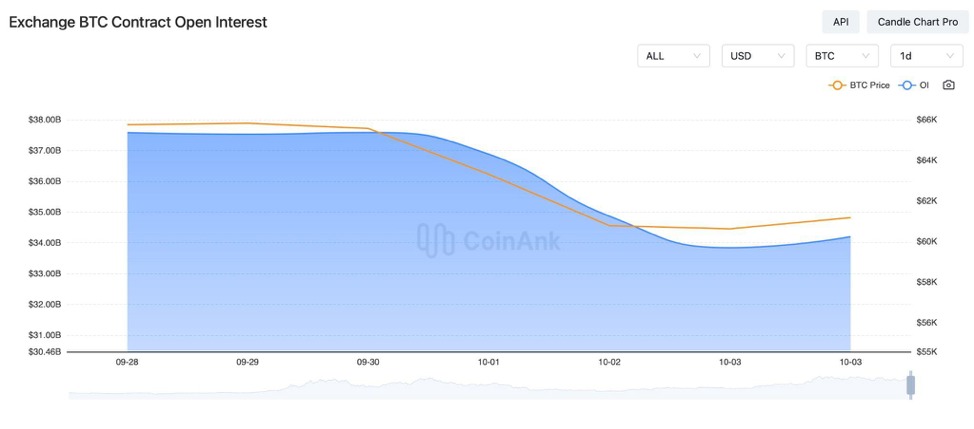

3. Perpetual Futures

The 7-day cumulative funding rates for major cryptocurrencies across major exchanges are generally positive, clearly indicating that the overall market sentiment is bullish with only a brief correction occurring over the past three days.

In the past three days, the holdings for BTC and ETH positions have continued to decrease.

Exchange BTC Contract Open Interest:

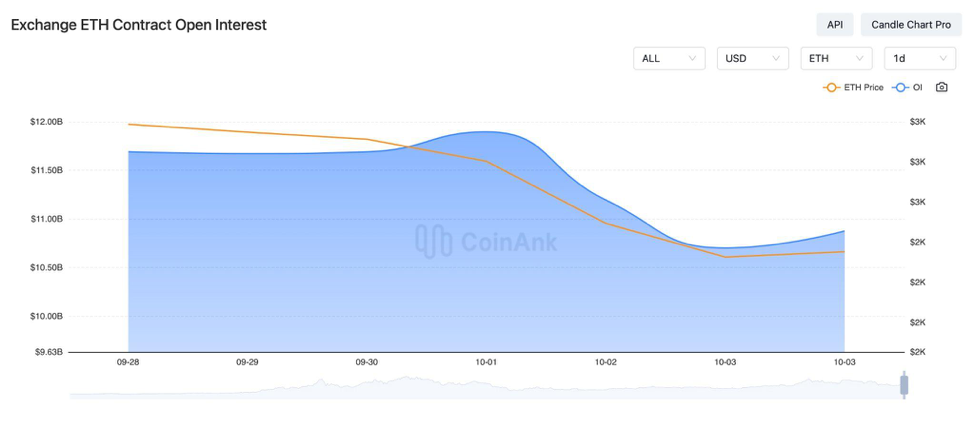

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On September 30, Kasikornbank (KBank), Thailand's second-largest bank, announced plans to launch the country's first licensed digital asset custody service. Thailand's Deputy Finance Minister stated that there is no limit to the number of virtual banking licenses that can be issued.

2) On September 30, FTX's bankruptcy distribution plan was still pending approval, and compensation payments did not begin as expected. FTX provided an update to its proposed settlement for preferred shareholders, seeking a distribution plan that puts them on equal footing with creditors.

3) ANALYSIS On September 30: Paxos Gold's total value locked (TVL) has surpassed $500 million, indicating growing interest from traditional financial institutions in gold-backed cryptocurrencies.

4) On September 30, UK regulators opened a sandbox in response to the $14 trillion tokenization boom. The UK Finance Minister is advocating for blockchain-based digital gilt issuance. Meanwhile, the UK's first case of illegal cryptocurrency ATM operation, involving £2.6 million, has led to sentencing.

5) On September 30, several U.S. listed companies continued to increase their Bitcoin holdings after its record high in March, with corporate Bitcoin purchases significantly accelerating. A U.S. Senator from Ohio introduced a bill that would allow cryptocurrencies to be used for state and local taxes and fees.

6) On September 30, one of the top exchanges reported having met with Singapore police to explore opportunities for strengthening cooperation.

7) On September 30, Hong Kong's Chung On Bank received approval to trade in virtual assets.

8) On September 30, Coinbase faced user backlash over restrictions on sending cryptocurrencies, raising questions about insufficient reserves. Coinbase announced plans to add proof of reserves for cbBTC.

9) On October 1, legal experts weighed in on the U.S. SEC v. Green United case, which focuses on specific fraudulent behavior.

10) On October 1, the U.S. core PCE annual rate slightly rebounded to 2.7% in August, while the core PCE monthly rate declined to 0.1%. U.S. unemployment climbed to a three-month high, surpassing economists' expectations. The ISM manufacturing price index saw its largest drop since May 2023.

11) On October 1, minutes from the Bank of Japan's meeting revealed that the central bank sees no immediate need to raise interest rates amid market instability. However, there is still an expectation that rates will rise in the future, but solely for Japan's economic purposes.

12) On October 1, Japan’s unemployment rate for August stood at 2.5%, better than the expected 2.6% and down from the previous 2.7%. Japan's financial regulator is considering reducing the tax on crypto gains from a maximum of 55% to 20% and reviewing cryptocurrency regulations, potentially launching a crypto fund.

13) On October 1, Ripple received approval in principle for its financial services license from the Dubai Financial Services Authority, enabling the launch of its end-to-end managed payment services in the UAE.

14) On October 1, the Eurozone unemployment rate for August was 6.4%, matching expectations and remaining unchanged from the previous month.

15) On October 1, Apollo Crypto, an investment management firm, released a report highlighting the potential for a second wave of growth in decentralized finance (DeFi), citing macroeconomic factors such as recent Federal Reserve interest rate cuts and China's credit expansion as key drivers.

16) On October 2, Russia's Deputy Foreign Minister declared that Russia is prepared for a long-term confrontation with the U.S. and has issued all necessary warnings.

17) ANALYSIS on October 2: Tokenization is making collateral transfers more efficient, with Digital Asset, Euroclear Bank, and the World Gold Council standing out in a pilot program.

18) On October 2, a leading exchange introduced risk warning banners and pop-up notices for tokens that have experienced significant changes in their tokenomics over the past 18 months, including Travala (AVA), Chiliz (CHZ), Enjin Coin (ENJ), IOTA (IOTA), Lisk (LSK), Metal DAO (MTL), Orion (ORN), Self Chain (SLF), Solar (SXP), and Vanar Chain (VANRY).

19) On October 2, Hashdex filed an amended S-1 for the NASDAQ Crypto Index ETF.

20) On October 2, several individuals in China's Yunnan Province were sentenced for creating an online platform to issue virtual currencies, suspected to be a pyramid scheme.

21) On October 2, an Indiana man pleaded guilty to charges of wire fraud, money laundering, and stealing over $37 million in cryptocurrency.

22) On October 2, Indonesia Post launched NFT stamps. Christie's announced it would offer blockchain ownership certificates for photography collections, and the cryptocurrency organization COPA launched a campaign to curb blockchain 'patent giants.'

23) On October 2, the U.S. ADP employment figure for September was reported at 143,000, bouncing back after five consecutive months of slowing growth.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.