FameEX Weekly Market Trend | May 30, 2024

2024-05-30 20:30:20

1. BTC Market Trend

From May 27 to 30, the BTC price swung from $67,139.05 to $70,607.35, a 5.17% range. The European Union, second only to the United States, is the second-largest global economic entity influencing the cryptocurrency industry. Recent remarks from ECB governing council members all support a rate cut in June this year:

1) Centeno: Inflation is under control, and the rate cut process is about to begin; current real wage growth is in line with the ECB’s inflation target.

2) Hernandez de Cos: June will see the first rate cut, followed by a cautious approach.

3) Knot: The risk of a hard landing in the Eurozone is rapidly diminishing.

4) Holzmann: Will support an ECB rate cut next week, expecting two rate cuts in 2024, with a maximum of three.

5) Nagel: The ECB may cut rates in June, and then we might have to wait until September for the next action.

6) Kazaks: June seems to be a suitable time to start cutting rates, but subsequent measures should be determined by upcoming data.

7) Rehn: Inflation is trending towards our 2% target in a sustained manner, so June is the time to ease monetary policy and start cutting rates.

8) Villeroy: Unless unexpected circumstances arise, the ECB will cut rates in June and should not rule out the possibility of a second rate cut in July; there is significant room for reduction from the current 4% rate level.

Regarding the Federal Reserve (Fed), on May 29, Kashkari stated that rates might remain unchanged indefinitely, with a low likelihood of a rate hike. However, no one has ruled it out. There will be no more than two rate cuts this year; the Fed should wait for significant progress on inflation before cutting rates, and if inflation does not decline further, a rate hike is possible, so there is no need to rush into cutting rates. Bowman mentioned that with the high usage of overnight reverse repos, it is better to slow down the balance sheet reduction or slow it down by a smaller margin. Mester suggested that the Fed’s statements should be longer to avoid making certain words overly significant; they should be able to publish an anonymous matrix linking the series of forecasts from SEP members (the Fed will conduct a monetary policy framework review later this year, and Mester will retire in June).

Additionally, in recent days, another important piece of good news came from the Consensus 2024 conference, where NYSE President Lynn Martin stated that if the regulatory environment for cryptocurrency trading becomes clearer, NYSE will consider offering cryptocurrency trading services.

From May 30 to June 2, it is still necessary to guard against potential declines in BTC spot daily candlestick charts caused by global macro asset movements. Overall, positive news should help counteract this effect. BTC spot is expected to have a volatility of less than 10% during this period. It is advisable to continue focusing on trading opportunities for the ETH spot. There is no need to cancel any existing buy or sell orders; just keep observing the market.

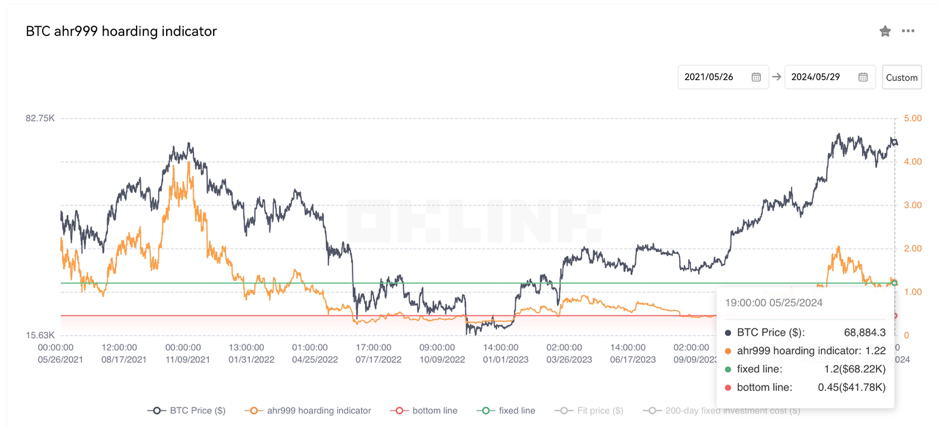

According to the ahr999 coin hoarding indicator, the current indicator value for BTC is 1.22, which is below the DCA level ($68,220) but above the buy-the-dip level ($41,780). Therefore, it is advisable to continue dollar-cost averaging into ETH.

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

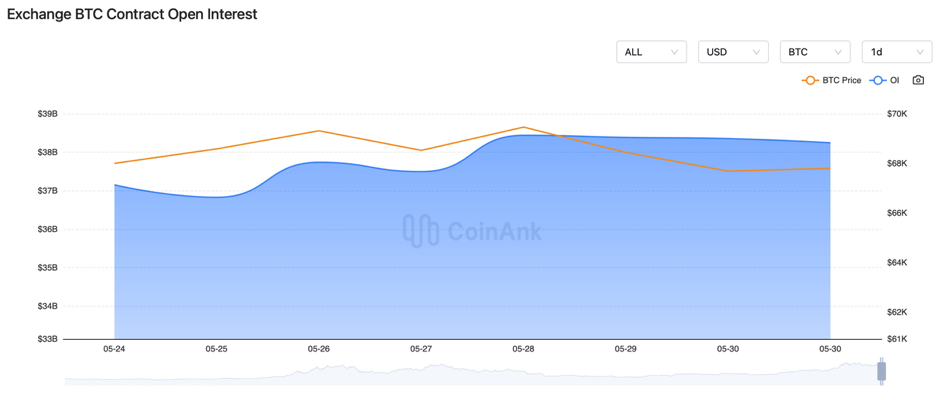

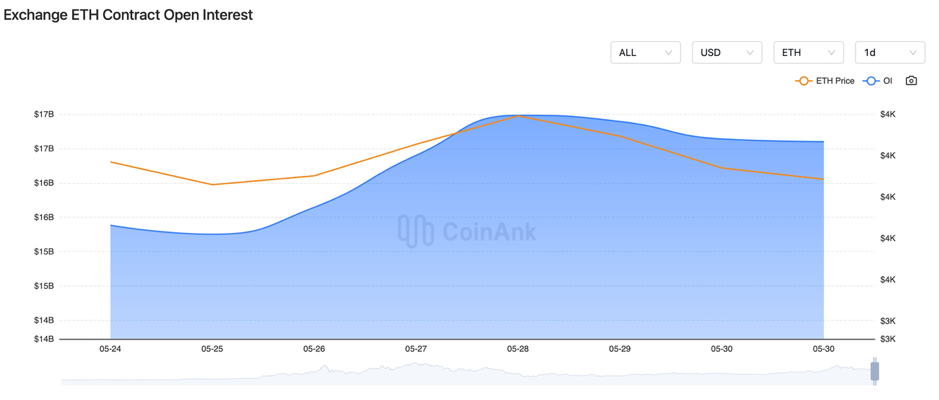

Recently, the contract open interest for both BTC and ETH has been increasing, with ETH growing at a faster rate.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On May 27, PEPE’s market cap surpassed UNI, rising to 19th place. Analysts attributed the memecoins’ surge to Asian traders.

2) On May 27, a trader made $2.7 million in three days with the Trump-themed MAGA (TRUMP) token; another trader gained 187x in eleven days with MAGA.

3) On May 27, ETH/BTC bull James Fickel had unrealized gains of $8.06 million.

4) On May 27, according to Interfax, the Kremlin stated that NATO is now in direct confrontation with Russia.

5) On May 27, industry insiders revealed that high compliance costs and low local market appeal have led several platforms to withdraw their Hong Kong VASP license applications.

6) On May 27, it was reported that the SEC’s approval of a spot Ethereum ETF is putting pressure on Korean regulators.

7) On May 27, the total trading volume of Bitcoin ordinals last week exceeded $47.6 million, a 92.3% increase week-over-week.

8) On May 27, Venezuelan authorities seized over 6,000 Bitcoin mining machines.

9) On May 27, Securitize’s CEO stated that the approval of Ethereum ETFs means tokenized assets are now “completely safe”.

10) On May 28, a survey found that 33% of American voters consider candidates’ stances on cryptocurrency before voting.

11) On May 28, the global number of cryptocurrency holders surpassed 560 million, accounting for 6.8% of the world’s population.

12) On May 28, traffic from Russian users on global cryptocurrency exchanges surged, prompting warnings from the Russian central bank about Western sanctions.

13) On May 28, four out of the top ten cryptocurrency contracts by open interest were memecoins, with PEPE’s open interest exceeding $800 million.

14) On May 28, an address sold WIF at an average price of $3.7, making over $24 million in total profits.

15) On May 29, the Eurasian Economic Commission minister stated that trade settlements between China and Russia could use digital currencies.

16) On May 29, it was reported that Canada is expected to adopt the International Crypto Asset Reporting Framework (CARF) for taxation by 2026.

17) On May 29, U.S. Representative Tom Emmer said the year-end session is the best chance for passing cryptocurrency legislation.

18) On May 29, a trader achieved a 762x return on MOTHER within 5 hours.

19) On May 29, the number of daily active addresses for memecoins surged over the past month, with PEPE growing by 230%.

20) On May 29, a Grayscale survey found that nearly half of the surveyed American voters want to include cryptocurrency in their investment portfolios.

21) On May 29, Ethereum’s May gains approached 30%, marking its best monthly performance since February.

22) On May 29, the Eurasian Economic Commission minister stated that the Eurasian Economic Union is further promoting local currency settlements and considering the use of digital currencies.

23) On May 29, a Bloomberg analyst suggested that the scale of Ethereum and Bitcoin ETFs might be similar to that of silver and gold ETFs.

24) On May 29, Trump asked if Bitcoin could help solve the U.S. national debt of $35 trillion.

25) On May 29, Hong Kong’s Securities and Futures Commission stated that the grace period for operating virtual asset trading platforms without a license will end on June 1.

26) On May 29, BlackRock’s Bitcoin ETF became the world’s largest Bitcoin fund.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.