FameEX Weekly Market Trend | January 29, 2024

2024-01-29 19:39:35

1. Market Trend

From Jan. 25 to Jan. 28, the BTC price was from $39,484.19 to $42,842.68, with a volatility of 8.50%. The prior report suggested gradually increasing positions after BTC stabilizes above $40,000, with further considerations at $43,000. Despite recent declines, BTC hasn’t disrupted the overall upward structure. The market shows a benign competition between bulls and bears, mainly driven by users exiting Grayscale. Since the recent low at $38,555, no consecutive declines have occurred. Reclaiming $40,000 stabilized the price, and breaking through $41,000 signaled strong momentum in subsequent oscillations. Currently, a notable detail is the consistently higher trading volume in rising candles, a historically strong signal. While the trend approaches the target, the $43,000 accumulation point remains unattained, a historically significant consolidation area for over half a month. Avoid adding positions; wait for a clearer market outlook before entering higher-probability events.

$43,000 is currently a strong resistance level. In recent days, it reached around $42,800 and experienced a pullback. However, it’s essential to note that the volume and magnitude of this failed attempt to breach $43,000 are not significant (briefly dropping below $42,000 but quickly recovering). The breakthrough of $43,000 is only a matter of time. It is still advisable to maintain consistency with the previous analysis and prepare to enter the market after $43,000 stabilizes.

Source: BTCUSDT | Binance Spot

Between Jan. 25 and Jan. 28, the price of ETH/BTC fluctuated within a range of 0.05357-0.05596, showing a 4.5% fluctuation. The previous mention of ETH/BTC indicated a continuous decline without any rebound signals. On the 1-hour timeframe, it has formed a clear downward channel. Whether this trend will persist on larger timeframes remains to be seen. It’s advisable not to pay too much attention to such currencies for now. Wait for rebound signals before considering entry opportunities. In the past few days, despite BTC’s rebound, ETH/BTC did not follow the upward trend but instead showed signs of stabilization. The probability of a false rebound is high, and there is no significant increase in trading volume. Moreover, it has not broken out of the previous downward channel or set a new low in recent times. Therefore, the current approach to this currency is still to stay away. Reevaluate the situation when a trend reversal occurs.

Based on the overall analysis, the current market is in a rebound phase, and the extent of the rebound will ultimately be determined by the market. The $43,000 level has become a crucial point in the recent rebound. Stabilizing and breaking through this level is likely to reverse the current dominance of the bearish trend and, to some extent, open up a new upward channel. Ethereum has shown a relatively weak trend recently, highlighting the demand for retracement, which is something to be aware of. At the same time, most cryptocurrencies in the overall market are waiting for BTC’s direction to determine their respective trends. Therefore, it is advisable to stay on the sidelines before BTC reaches $43,000, observing the market and participating in trading when the situation becomes clearer.

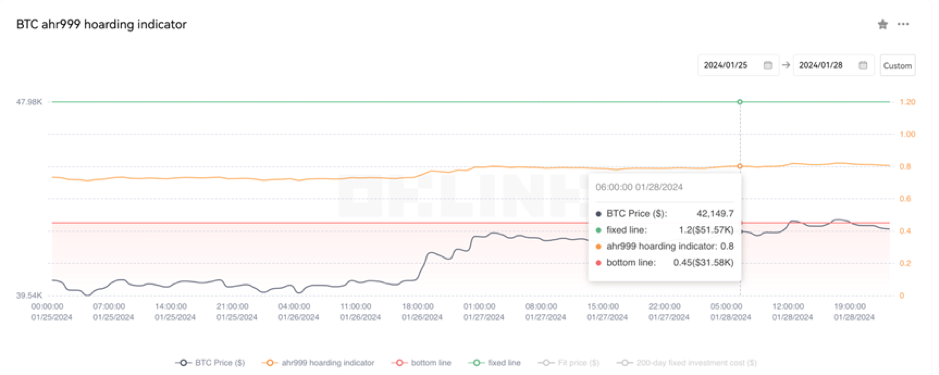

The Bitcoin Ahr999 index of 0.80 is between the buy-the-dip level ($31,580) and the DCA level ($51,570). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

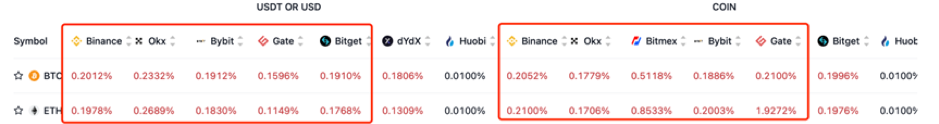

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

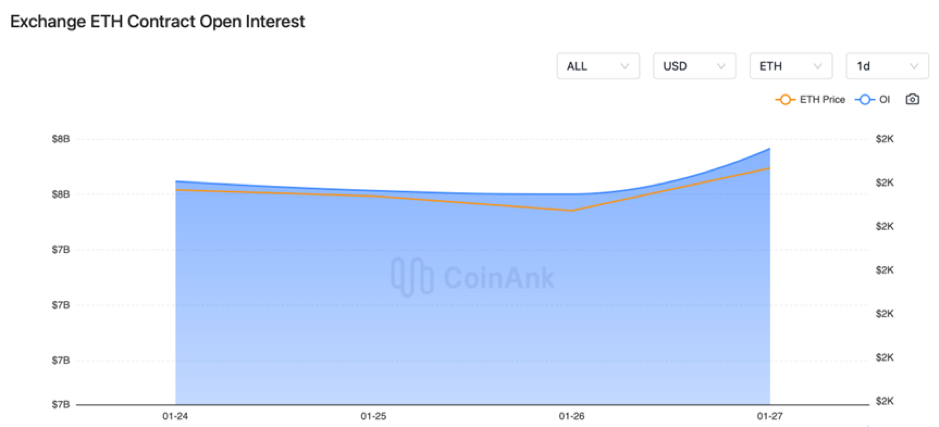

Both the BTC and ETH contract open interest has experienced a slight increase from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On January 25, the Hong Kong Securities and Futures Commission noted a trend of tokenization in traditional financial products.

2) On January 25, Tiger Securities’ License No. 1 upgrade was approved, allowing access to virtual asset trading.

3) On January 25, the EU announced plans to explore collaboration and information sharing with Hong Kong in the field of virtual assets.

4) On January 26, Grayscale reported a reduction of approximately 10,871 BTC in GBTC Bitcoin holdings compared to the previous day.

5) On January 26, OKX announced the delisting of mining pool products and related services.

6) On January 27, a U.S. SEC commissioner stated that regulatory authorities are very afraid of power decentralization.

7) On January 27, the assets under management for BlackRock’s physically-backed Bitcoin ETF surpassed $2 billion.

8) On January 28, Ordinals cumulative fee income exceeded 5,900 BTC.

9) On January 28, data showed a 290% increase in the SOL/BTC ratio since October 2023.

10) On January 28, Bloomberg reported that FTX’s cash reserves had grown to $4.4 billion by the end of 2023.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.