FameEX Weekly Market Trend | November 3, 2023

2023-11-03 19:06:45

1. Market Trend

From Oct. 31 to Nov. 2, the BTC price swung from $34,025.00 to $35,984.99, with a volatility of 5.75%. The last report stated a key insight: a sudden 2000-point surge between $31,000 and $33,000 (an area lacking retail investors), which indicated major institutions and significant investors bought chips about $31,000 in the last two weeks, while most retail investors purchased them at prices above $33,000, implying market trends and future movements. 1. Sideways oscillation: BTC’s current rise isn’t the final point; it’s expected to continue. As BTC rises, most retail investors are likely to sell their chips. If the market surges now, the pressure from these sales will impede the uptrend. Hence, an oscillation is needed to boost turnovers among retail investors and allow major players to absorb more chips, crucial for starting a new upward trend. 2. Deeper pullback, swift recovery (within 4 hours): If main players lack the desired chip quantity or price, they refrain from a surge. Instead, they opt to buy chips at lower prices from retail investors. This may swiftly drop to about $31,000, matching the main players’ costs, without disrupting the upward trend. This could lead to losses for retail investors, causing many chips to exit the market. Major players can rapidly replicate the effects of multiple days of oscillation, potentially initiating another upward trend. Presently, the market hovers around $34,500, occasionally spiking to $35,900 and testing $36,000 before returning to $34,500. This suggests that major players still favor oscillation as their primary strategy. In this setting, two things are vital: 1. If holding costs are under $30,000, holding onto the currency and ignoring intraday fluctuations is advisable. 2. For holdings around $34,000, setting a stop-loss at $32,800 is recommended. Also, placing buy orders at $30,000, $30,500, and $31,000 can help counter any potential significant downturn.

Source: BTCUSDT | Binance Spot

Between Oct. 31 and Nov. 2, the price of ETH/BTC fluctuated within a range of 0.05176-0.05345, showing a 3.26% fluctuation. ETH/BTC still hasn’t broken out of the downward channel and remains in an extremely weak state. It is wise to keep a distance from this currency pair for the time being.

Based on overall analysis, the current market trend is characterized by a fluctuating situation. BTC has been oscillating at high levels for nearly 10 days. Major cryptocurrencies and altcoins have also magnified their fluctuations in this environment (such as MASK, CRV, ADA, XRP, etc.), but they are strongly correlated with BTC’s trend and are easily influenced by BTC. This is the pattern of the ‘early stages of a bull market’, with investors lacking confidence. In the current fluctuating market, it’s not advisable to open positions at this point. Traders should wait for a breakthrough or pullback to establish positions. Fundamentally, market capital inflow, user trading volume, and other aspects are currently in a healthy state. Patiently awaiting the market’s evolution is advised.

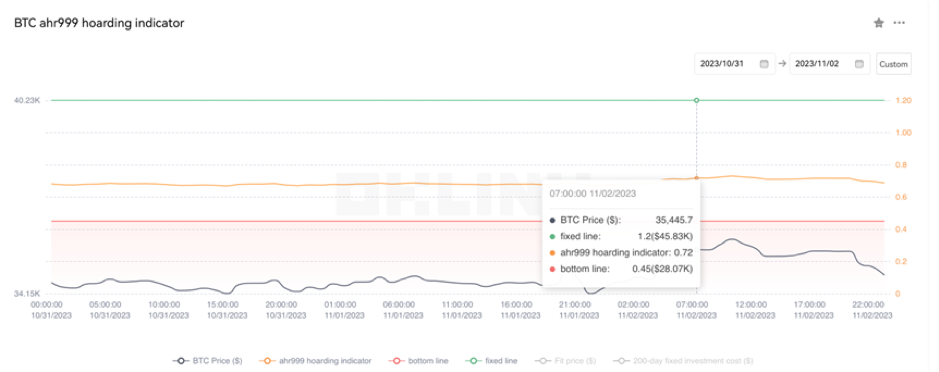

The Bitcoin Ahr999 index of 0.72 is between the buy-the-dip level ($28,070) and the DCA level ($45,830). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

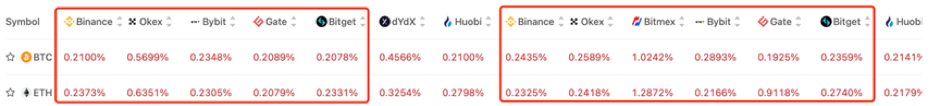

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

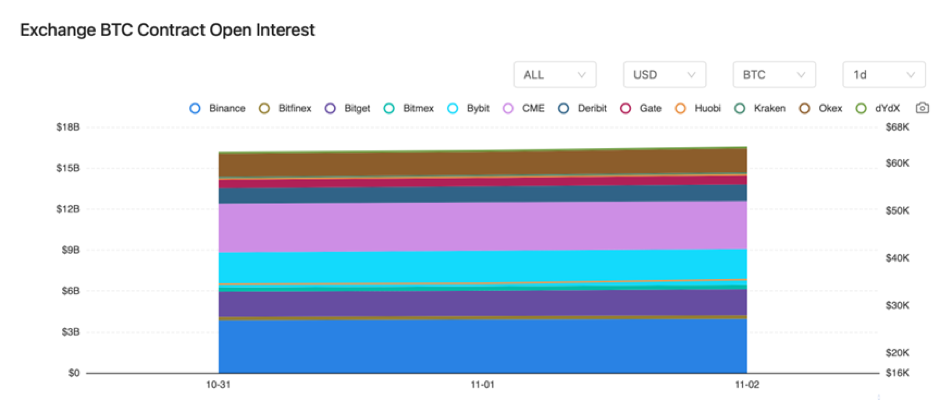

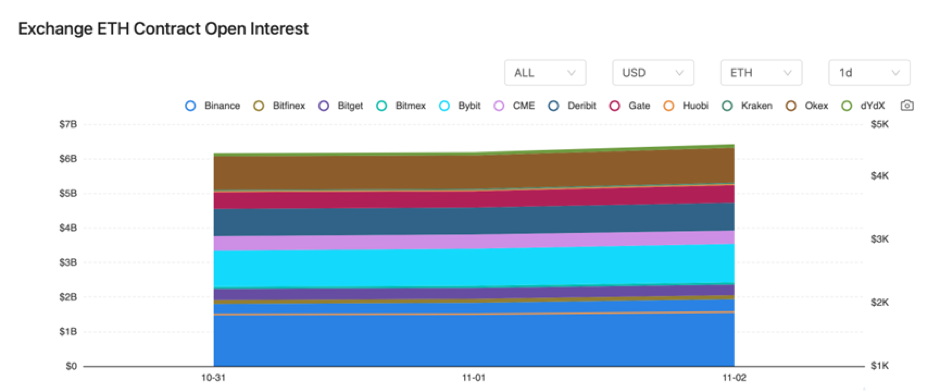

There were barely any changes in the BTC and ETH contract interest from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

1) On October 31, Tether’s Q3 report stated total assets of approximately $86.384 billion, with total assets surpassing its total liabilities. 2) On October 31, the number of profitable Bitcoin addresses reached 39.1 million, marking a historic high. 3) On October 31, a Ripple co-founder invested $500 million in Nvidia for AI innovation. 4) On November 1, the Chairman of the U.S. SEC congratulated Bitcoin on the 15th anniversary of its whitepaper release. 5) On November 1, Elon Musk mentioned that NFTs are just a link to a JPEG image; at the very least, they should be encoded on the blockchain. 6) On November 1, Yu Weiwen stated that stablecoin regulation would help maintain financial stability and promote sustainable development. 7) On November 2, PayPal reported revenue of $7.4 billion in the third quarter, showing a 9% year-on-year growth. 8) On November 2, the Hong Kong Treasury Secretary announced that the Securities and Futures Commission would issue notices regarding intermediaries engaging in tokenized securities activities. 9) On November 2, the UK’s Financial Conduct Authority (FCA) declared it would provide marketing rule guidance for crypto companies. 10) On November 2, the Abu Dhabi Global Market’s regulatory authority released regulations concerning Distributed Ledger Technology (DLT). Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.3. Industry Roundup