FameEX Weekly Market Trend | October 31, 2023

2023-10-31 18:46:30

1. Market Trend

From Oct. 26 to Oct. 30, the BTC price fluctuated between $33,390.95 and $35,132.85, with a volatility of 5.21%. The prior report stated that investors who haven’t entered the market can wait for BTC to retrace to about $34,000. BTC recently fell to about $33,400, mainly staying close to $34,000. The steep slope of the candlestick chart, resulting from a previous rapid surge, necessitates a period of fluctuation to realign the technical aspects. Meanwhile, increased turnover could boost the upward momentum for the next surge. Through comprehensive analysis from various data platforms, significant data emerged since BTC began its surge from around $26,000, including the sudden $2,000 surge from $31,000 to $33,000 (an area lacking retail investors). In the last two weeks, major institutions and large investors bought at an average of around $31,000. This data could indicate short-term market strength or weakness, especially as a potential signal for non-long-term investors to exit. Currently, the trends in the 1-hour, 4-hour, and 1-day charts remain robust without any structural breakdown. Although brief market consolidation periods occur, they have been quickly resolved in the short term. This is a strong signal that holding your coins is the best strategy unless there’s a major breakdown below $31,000 without a quick recovery. Avoid trying to profit from price differences via selling high or buying low or lowering your average holding price; these tactics are unwise in the current market. Practice patience, follow the trend, and hold onto assets for an upward move.

Source: BTCUSDT | Binance Spot

Between Oct. 26 and Oct. 30, the price of ETH/BTC fluctuated within a range of 0.05143-0.05376, showing a 4.53% fluctuation. ETH/BTC has not continued to hit new lows in recent days. Currently, ETH/BTC remains very weak, lingering at the bottom with a clear downward trend. The downward channel is obvious, so it is still advisable to stay away from this currency in the near term.

Based on overall analysis, with BTC on the rise, other cryptos are also experiencing a rare upward trend. As mentioned earlier, it’s a good time to look for some coins that urgently need to rise for a strategic position (specific methods were discussed in previous analysis reports). Recently, standout coins (such as SOL, AVAX, TRB, DOT, etc.), which are valuable (within the top 100 in market cap) and have experienced significant past declines, are the preferred choices. During BTC’s sideways trading phase, the price fluctuations of other coins in the market will be larger, with increased instances of market cleansing and substantial price swings. Users involved in futures trading should be extremely cautious, setting stop-loss positions at the moment of placing orders. Currently, the overall market trend is upward, where the trend reigns supreme (cease short-selling, even if there’s a short-term bearish view, refrain from actualizing it). Holding assets for an upward movement remains the primary strategy for the overall market.

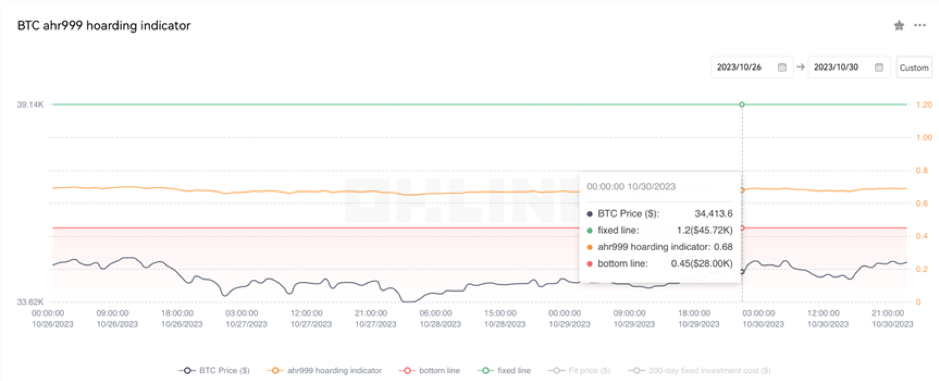

The Bitcoin Ahr999 index of 0.68 is between the buy-the-dip level ($28,000) and the DCA level ($45,720). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

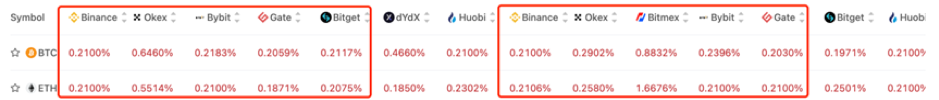

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

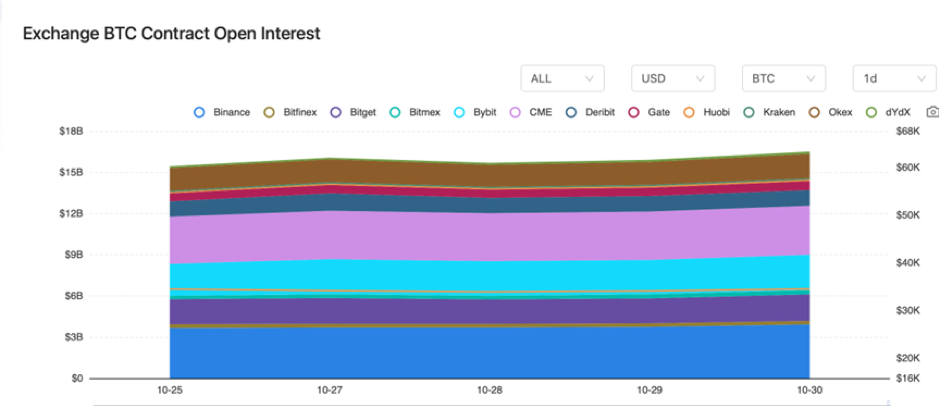

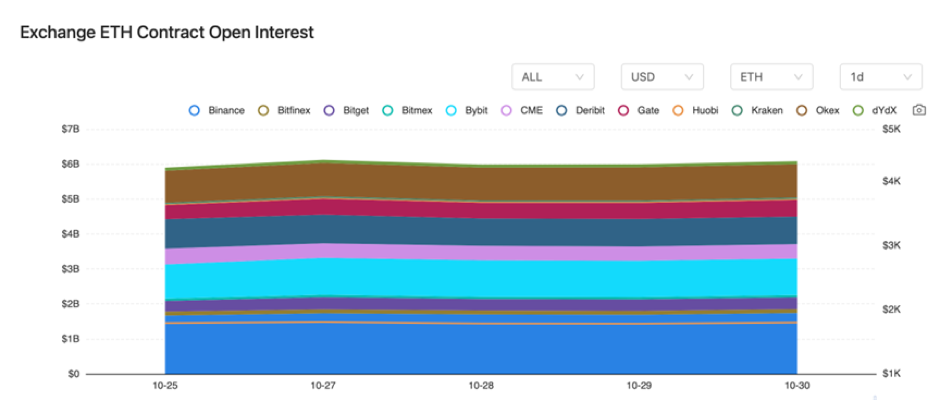

There were minor rises in the BTC and ETH contract interest from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On October 26, the SEC Chairman stated that the SEC has 8-10 applications regarding potential Bitcoin ETF launches.

2) On October 26, according to JPMorgan, SEC rejection of the Bitcoin spot ETF could lead to lawsuits.

3) On October 26, Xianyu (an online marketplace platform operated by Alibaba Group) allowed digital collectible trading.

4) On October 27, searches for “buy Bitcoin” on Google surged by 826% in the UK within 7 days.

5) On October 27, Turkey planned to finalize cryptocurrency regulations by 2024.

6) On October 28, SBF declared that there had been a plan to sell FTX to Binance.

7) On October 28, the Hong Kong SFC Chairman announced regulatory work related to OTC trading of virtual assets was initiated.

8) On October 29, data showed that Bitcoin whales had accumulated over 30,000 BTC in the past 5 days.

9) On October 29, Linea mainnet bridge crossings surpassed 100,000 ETH.

10) On October 30, the adoption of USDT in Brazil surged, accounting for 80% of total crypto transactions.

11) On October 30, Coinbase stated that the spot trading volume in October reached $282 billion, a 100% increase from September.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.