FameEX Weekly Market Trend | August 14, 2023

2023-08-14 18:08:05

1. Market Trend

From August 10 to August 13, the BTC price fluctuated between $29,250.45 and $29,738.00, with a volatility of 1.66%. From the 1-hour chart, BTC’s volatility and trading volume have notably dropped, showing minimal weekend price fluctuation. BTC is currently above $29,000, and both longs and shorts are inactive in trading. “Extended sideways movement often precedes a drop” (a likely event, not guaranteed). Considering BTC’s recent trend, it treats apparent non-sideways movement (between $28,500 and $30,000) as sideways. These boundaries remain key trade reference points. BTC reached around $31,800 in its uptrend, then experienced a month moving in a slight retracement - sideways - slight retracement - sideways pattern before settling around $29,000. Historically, similar trends often led to a notable bullish candlestick forming before a complete reversal of declines. On the weekly chart, bullish-forming moving averages and decreasing trading volume indicate an impending turning point.

Source: BTCUSDT | Binance Spot

Between August 10 and August 13, the price of ETH/BTC fluctuated within a range of 0.06223-0.06303, showing a 1.28% fluctuation. From the 1-hour chart, although ETH/BTC is performing better than BTC on the trading platform with its price slowly rising and leaning against the moving average, upon closer observation, it can be noticed that there’s an increase in volume during price declines and a decrease during price increases. This likely indicates that large traders are selling while retail investors are buying. In the near term, it’s advisable to adopt a cautious approach with ETH/BTC, observing more and taking fewer actions. It’s better to wait for BTC to establish its direction before making a judgment.

Based on overall analysis, currently, led by BTC, most trading pairs exhibited low trading volumes and price fluctuations, indicating relative weakness. Some altcoins like SHIB, YGG, and BLZ showed independent trends. BTC’s price remained within a narrow range for an extended period, urgently needing a directional choice to alter the overall investment landscape and investor sentiment. Currently, the market lacks sufficient profit potential. It’s wise to adopt a cautious approach, preserve capital, and prepare for a potential shift in circumstances.

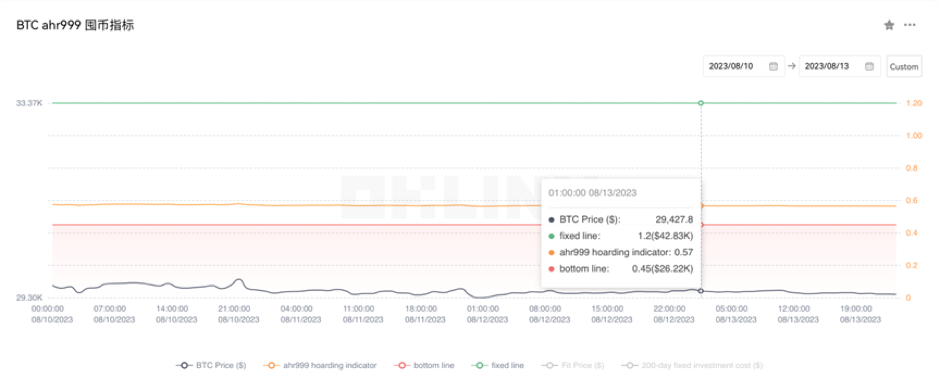

The Bitcoin Ahr999 index of 0.57 is above the buy-the-dip level ($26,220) but below the DCA level ($42,830). It is viable to purchase popular coins through DCA.

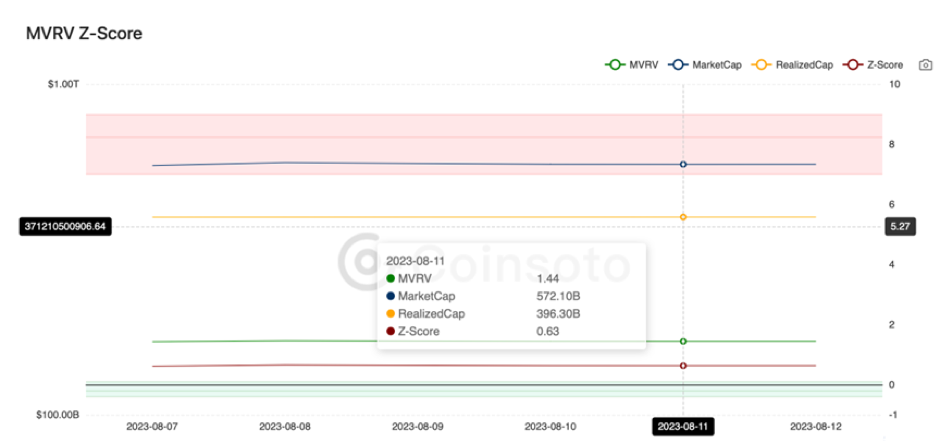

From the perspective of MVRV Z-Score, the value is 0.63. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buy-the-dip range (-0.33-0.06).

2. Perpetual Futures

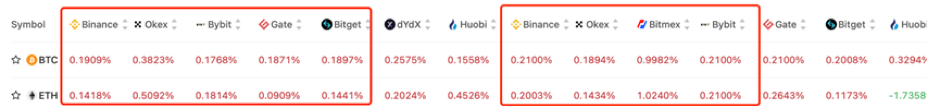

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

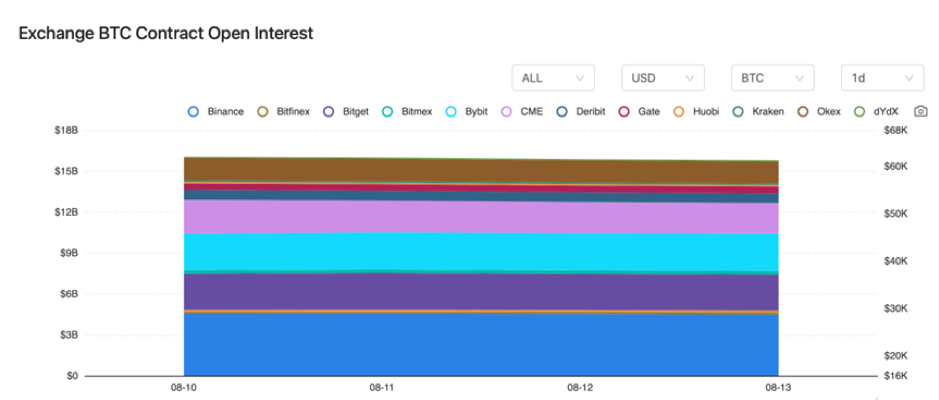

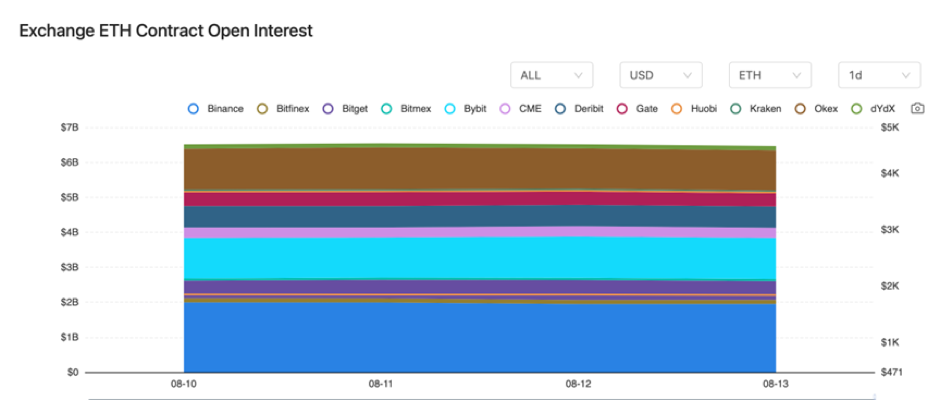

There were barely any changes in BTC and ETH contract open interest from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On August 10, Binance Labs committed to a $5 million investment in CRV and supported the deployment of Curve on the BNB Chain.

2) On August 10, India expressed an intent to use cryptocurrency tokens for digitally signing documents.

3) On August 11, based on data, nearly 132 million funds flowed into the Base bridge in the past 12 days.

4) On August 11, Hong Kong-listed company Boyaa Interactive approved a budget of $5 million for purchasing cryptocurrencies.

5) On August 11, Hong Kong’s Securities and Futures Commission (SFC) stated that claims of certain platforms having submitted license applications were untrue. Licensed entities currently only include OSL and Hashkey.

6) On August 12, a US judge revoked SBF’s bail, leading to his detention.

7) On August 12, it was reported that former US President Trump holds $250,000 worth of ETH.

8) On August 13, Vitalik Buterin referred to XRP as fully centralized, triggering dissatisfaction within the XRP community.

9) On August 13, a report revealed that ChatGPT costs about $700,000 daily, suggesting that OpenAI might be on the verge of bankruptcy.

10) On August 13, according to data, TVL on the Base chain exceeded 100,000 ETH.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.