FameEX Weekly Market Trend | August 10, 2023

2023-08-10 18:15:55

1. Market Trend

Between August 7 and August 9, the BTC price fluctuated between $28,701.03 and $30,244.00, with a volatility of 5.37%. From the 1-hour chart, BTC has been running steadily within the range established on August 1 ($28,500-$30,000). During this time, the price frequently tested the range’s upper and lower bounds, leading to rapid rallies or pullbacks that reinforced the range’s reliability. On the 4-hour chart, the price broke above the 7-day and 99-day moving averages, gradually forming a supported structure. Given the price’s oscillation within this range, the consolidation’s boundaries might be breached in the near term. On the daily chart, the 7-day moving average has shown minor fluctuations in price over the past approximately 25 days since July 15. Currently, the market offers a clear direction, referencing the range’s upper and lower limits. If the price breaks and holds beyond these bounds, it’s wise to follow the breakout's trend.

Source: BTCUSDT | Binance Spot

Between August 7 and August 9, the price of ETH/BTC fluctuated within a range of 0.06204-0.06323, showing a 1.91% fluctuation. From the 1-hour chart,

ETH/BTC is currently positioned within a weakening downtrend channel. In both the 4-hour and 1-day timeframes, the price is being suppressed by moving averages, with a decreasing trading volume. This presents a scenario of weak momentum, characterized by price rising on low volume and falling on high volume. It’s advisable to steer clear of such cryptocurrency pairs in the near term. If unexpected market movements occur, exercise caution and make assessments before taking action. When dealing with coins exhibiting these characteristics, it’s recommended to prioritize observation over active trading.

Based on overall analysis, apart from a few altcoins that have experienced significant surges (such as YGG, C98, etc.), the majority of the market’s cryptocurrencies are following the movements of BTC in terms of price fluctuations. As long as BTC remains within its consolidation range, the overall market’s profit potential remains weak. Trading volume and capital inflow are also gradually diminishing, with smaller-cap coins exhibiting more pronounced effects. Based on the analysis of BTC above, BTC will be likely to break out of its consolidation range in the near term. This event could lead to varying trends among different cryptocurrencies in the market, thereby increasing overall market activity. In terms of trading strategy, it is advisable to align with BTC’s movements and use BTC as a reference point for trading other coins. (Especially during the initial stages of upward or downward movements, BTC’s influence within the broader market is particularly prominent.)

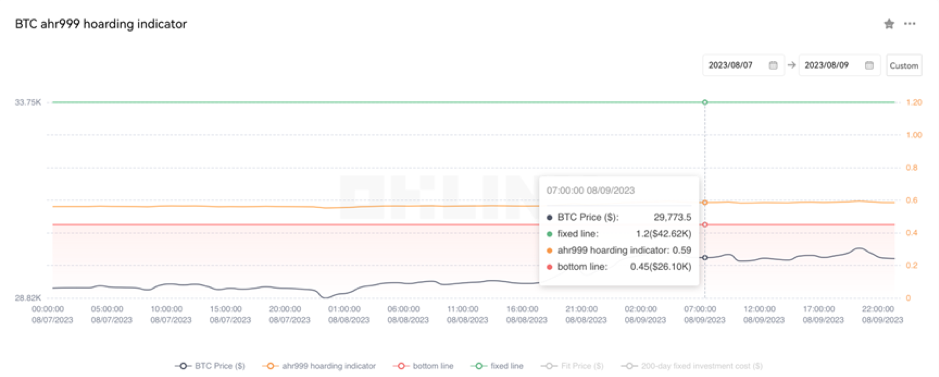

The Bitcoin Ahr999 index of 0.59 is above the buy-the-dip level ($26,100) but below the DCA level ($42,620). It is viable to purchase popular coins through DCA.

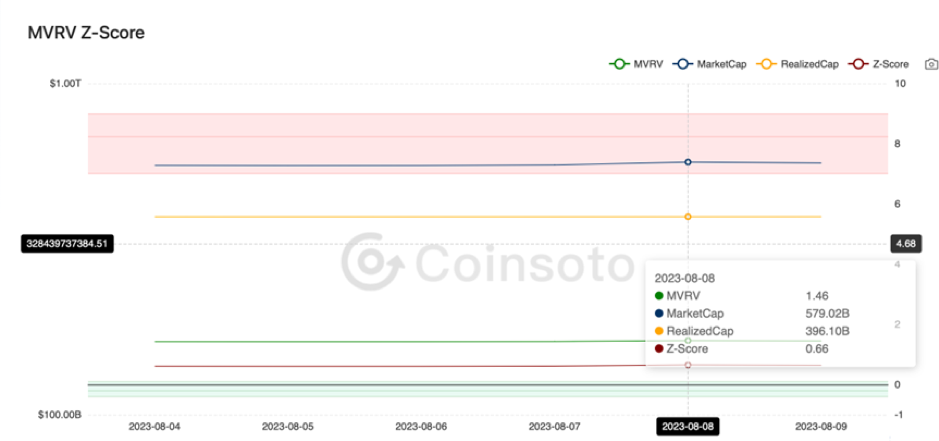

From the perspective of MVRV Z-Score, the value is 0.66. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buy-the-dip range (-0.44-0.09).

2. Perpetual Futures

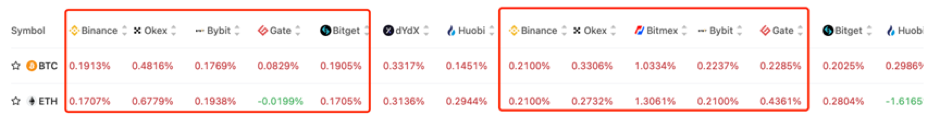

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

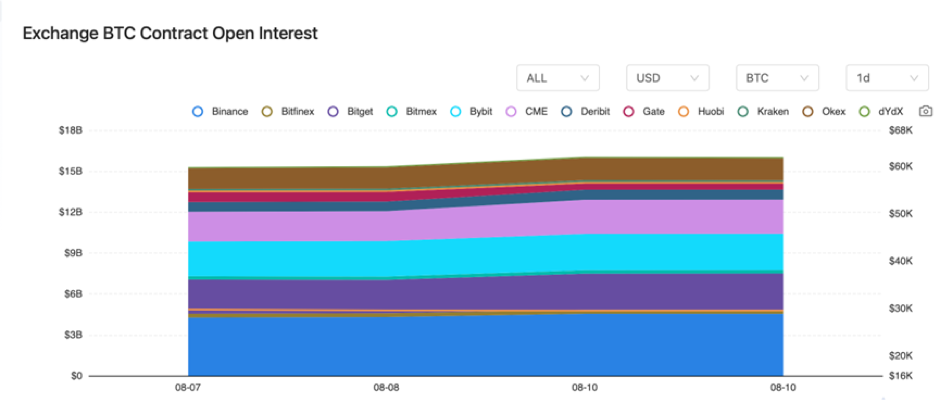

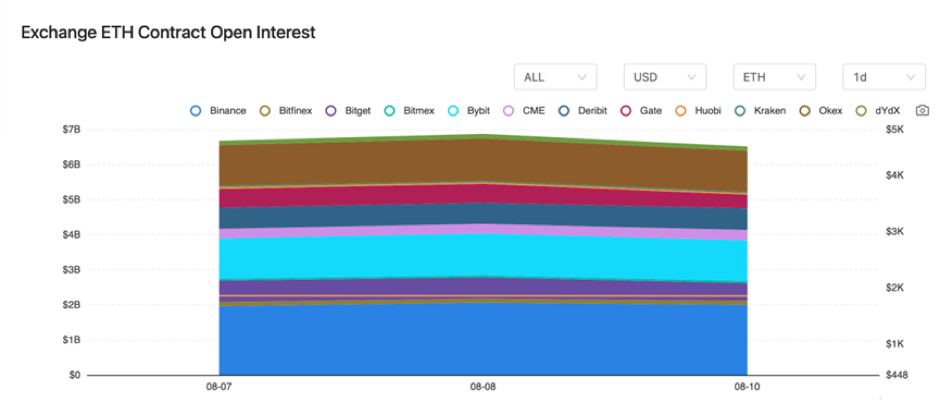

The BTC contract open interest has experienced a slight increase, while the ETH contract open interest has witnessed growth followed by a minor retracement to its initial level.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On August 7, Stephen Chow announced his entry into the Web3+AI space and interacted with OKX.

2) August 7, Singapore was set to provide a $150 million fund for technologies like Web3.

3) On August 7, the Hong Kong Securities and Futures Commission noted improper operational practices by certain unlicensed virtual asset trading platforms.

4) On August 8, Uniswap was deployed on the Base network.

5) On August 8, Blockchain.com was granted a major payment institution license by the Monetary Authority of Singapore.

6) On August 8, Tether’s CTO announced the redemption of over 325 million USDT tokens today.

7) On August 8, the Bank of England advanced its plans for a systemic stablecoin regime.

8) On August 9, the Total Value Locked (TVL) of the RWA track project surpassed $1 billion.

9) On August 9, Hubei Police cracked a case of virtual currency money laundering involving a total amount of 300 million RMB.

10) On August 9, based on analysis, July inflation data was unlikely to drive Bitcoin’s rise.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.