Bitcoin's Price Appears Poised For A Significant Shift

2024-05-23 16:20:30

As on-chain metrics reset, Bitcoin's price seems ready for a substantial move.

Source: www.bankrate.com

Bitcoin's price struggled to maintain its position above $70,000 on May 22, with analysts indicating that the leading cryptocurrency is gearing up for a significant upward movement.

Reduced Distribution and a Decline in Selling Pressure Are Supporting Bitcoin’s Price

Data reveals that Bitcoin's price has been steadily rising following an extended downtrend from its all-time highs. Throughout this decline, BTC markets faced periods of intense selling pressure, driving its price to a low of $56,500 on May 1, the lowest since March 5. Recent reports from Exchanges suggest that Bitcoin's recent rebound to $71,000 is attributed to a slowdown in selling pressure and a compression of volatility, despite most key on-chain metrics approaching equilibrium.

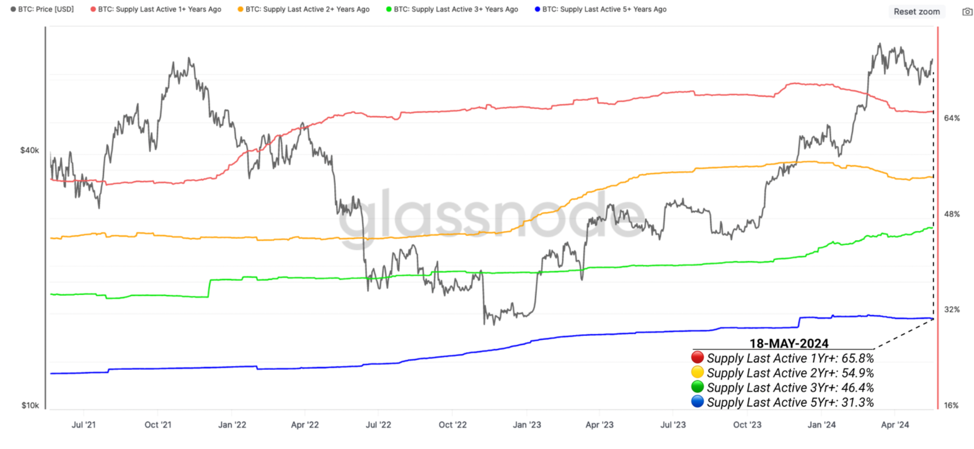

Analyzing the Supply Last Active Age Band metric, analysts observed a significant decrease in the one-year and two-year cohorts over the past two months. Meanwhile, the 3y+ cohort continues to grow, indicating that this group is generally holding onto their coins, waiting for higher prices before considering selling. Meanwhile, the Long-Term Holder (LTH) Binary Spending Indicator has been declining over the past few weeks, indicating a reduction in distribution pressure.

Bitcoin: Supply Last Active 1yr+ Age Bands. Source: Glassnode

Macro Resets Have Been Observed

Bitcoin's price rebound from the $56,500 low appears to have reset price valuations and investor expectations for the longer-term market outlook across various criteria. According to the Glassnode report, significant on-chain metrics have rebalanced, indicating a potentially substantial upward movement for BTC.

Although new capital inflows into the Bitcoin network have significantly slowed from their all-time highs, the realized cap remains positive enough to drive price action. By using the Sell-Side Risk metric to gauge volatility, analysts assessed the total value locked in by coins spent on-chain (Realized Profit + Realized Loss) relative to the size of the asset class (Realized Cap). They discovered that the Sell-Side Risk Ratio has notably decreased in recent weeks, implying that the market has achieved a level of equilibrium during this correction. In conclusion, analysts suggest that while there was an intense period of distribution by mature investors following Bitcoin's surge towards the $73,835 all-time high, sell-side pressure has significantly diminished.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.