Avalanche(AVAX)

Avalanche(AVAX)

Avalanche (AVAX)

2022-11-08 18:31:45

The Avalanche platform is built on a unique Proof of Stake (PoS) mechanism that addresses the blockchain trilemma of scalability, security, and decentralization.

The Avalanche platform is built on a unique Proof of Stake (PoS) mechanism that addresses the blockchain trilemma of scalability, security, and decentralization.

Avalanche also allows for the usage of smart contracts to run dApps, similar to Ethereum. By having smart contracts that are written in Solidity, the same language as Ethereum, Avalanche is looking to increase interoperability between different blockchains. This would include established DeFi projects such as AAVE.

The native token of the Avalanche platform, AVAX, is used to power transactions in its ecosystem and distribute system rewards. It also allows users to participate in governance and facilitates transactions on the network by paying fees.

Who Founded AVAX?

Team Rocket, a pseudonymous group of software developers, published an article in May 2018 detailing the basis for the Avalanche protocol. Soon after, Emin Gün Sirer, a Turkish professor of computer science at Cornell University and notable member of the Initiative for Cryptocurrencies and Contracts (IC3), founded AVA Labs with the goal of creating and developing the Avalanche blockchain. In 2003, Sirer also created Karma, a Proof of Work virtual currency for peer-to-peer file sharing systems that predated Bitcoin.

Emin Gün Sirer - Source: Coindesk

In July 2020, Avalanche drew big investments by raising $42 million through an ICO. In July 2021, the Avalanche Foundation continued to raise large investments by holding a token sale and raising $230 million dollars. Some of the participants in the token sale included venture capital companies such as Polychain capital and Three Arrows Capital.

How Does AVAX work?

There are three main aspects of Avalanche's design that distinguish it from other blockchain projects: its consensus mechanism, its incorporation of subnets, and its use of multiple built-in blockchains. Although Avalanche's platform is complex, these three aspects are what make it unique.

Consensus mechanism

A blockchain network must have a protocol that allows its nodes to reach agreement, or consensus, in order for it to validate transactions and remain secure. The conversation surrounding cryptocurrencies has focused on Proof of Work (PoW) vs Proof of Stake (PoS) as the leading methods for reaching this agreement.

When a user initiates a transaction, it's received and sampled by a validator node. This node then checks for agreement with a small, random set of other validators. If agreement is reached, the transaction is processed. If not, the process is repeated with different sets of validators until consensus is reached and the transaction is processed. Validator rewards are given according to how long a node has staked its tokens (Proof of Uptime) and if the node has followed the software's rules in the past (Proof of Correctness).

Subnets

Avalanche users can launch chains that specialize and operate using their own sets of rules. This system is comparable to blockchain scaling solutions like Polkadot (DOT) parachains. Consensus on these chains is reached by subnetworks (or subnets), which are groups of nodes that validate certain blockchains. The subnet validators also validate Avalanche's main network.

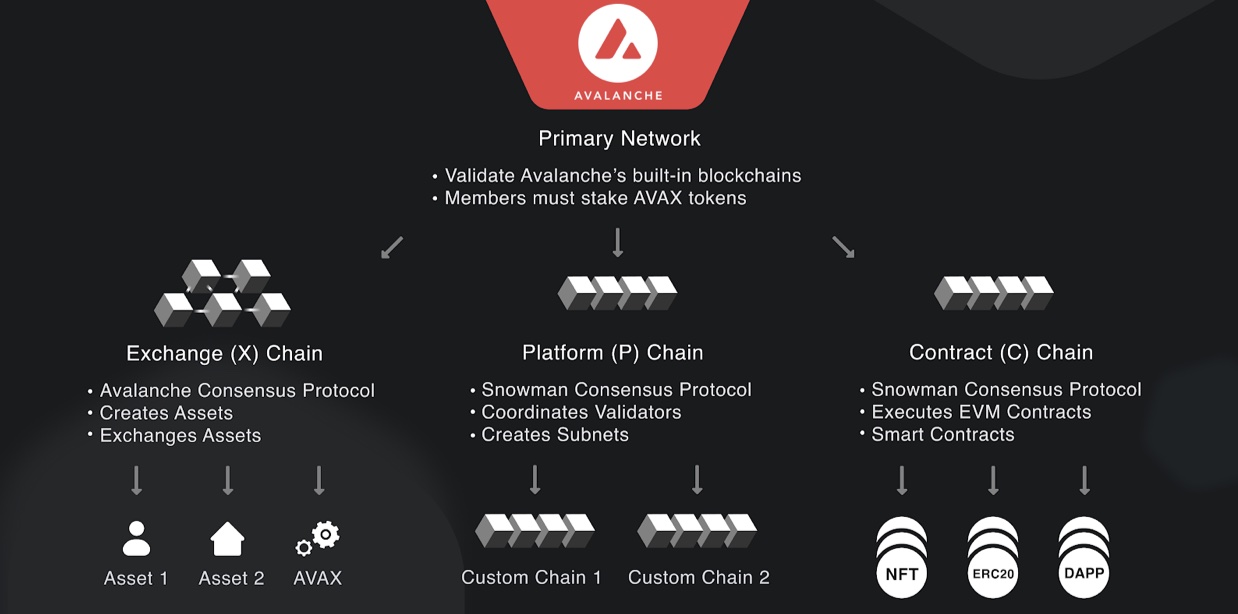

Avalanche uses three different blockchains to address the limitations of the blockchain trilemma. These include the Exchange Chain (X-Chain), the Contract Chain (C-Chain), and the Platform Chain (P-Chain).

The X-Chain is the default blockchain on which assets are created and exchanged. This includes Avalanche’s native token, AVAX.

The C-Chain allows for the creation and execution of smart contracts. Because it is based on the Ethereum Virtual Machine, Avalanche’s smart contracts can take advantage of cross-chain interoperability.

The P-Chain coordinates validators and enables the creation and management of subnets.

Source: docs.avax.network

Why You Might Consider Buying AVAX?

Avalanche's native token, AVAX, has a capped supply of 720 million, with half of that being distributed during the platform's launch in 2020. The other half is generated through minting rewards for staking.

This system is designed to keep the circulating supply low, even when demand is high, by incentivizing staking with Proof of Uptime and Proof of Correctness rewards.

Additionally, unlike in Ethereum or Bitcoin, all fees on Avalanche are burned rather than paid out to validators, which increases scarcity while also ensuring the long-term health of the network.

Important Avalanche (AVAX) links: