Reasons Why Ethereum (ETH) Is Rising Compared to Bitcoin

2024-01-18 15:47:45

Despite bearish pressures in the overall cryptocurrency market, Ether is displaying resilience by maintaining strength at the crucial $2,500 support level.

Source: blockchain.news

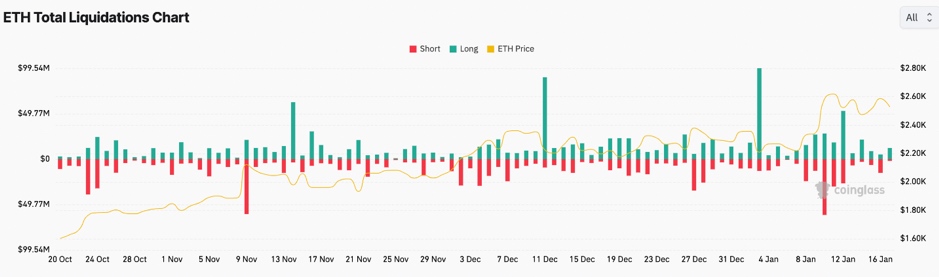

Even as futures liquidations have been on the rise, with data from Coinglass indicating $15.03 million in ETH shorts liquidated on January 16, compared to $5.3 million in long liquidations, Ether's price is steadfastly holding the $2,500 handle. This trend coincided with the ETH/USD pair reaching highs of $2,614, successfully breaking through the resistance at $2,500. A report by 10xResearch highlights Ether's growing share of open interest since the beginning of the year, indicating sustained market interest and confidence in the cryptocurrency.

Source: ETH liquidations graph. Source: Coinglass

Ether's ability to defy bearish market forces and maintain its position at $2,500 suggests a robust market sentiment and potential bullish momentum, as evidenced by the successful breach of the $2,500 resistance level amid rising futures liquidations. Additionally, the increasing share of open interest underscores a growing interest in and commitment to Ether within the cryptocurrency market.

Traders Anticipate That ETH/BTC Will Keep On Rise

10xResearch emphasized the Bitcoin dominance indicator falling below 50% for the fourth consecutive day, often interpreted as a signal for altcoins to potentially outperform Bitcoin. Notably, ETH's dominance reached a three-month high above 18%, marking a remarkable +22.4% increase in the past week, according to on-chain data from Santiment.

During this period, approximately 89,400 new Ethereum addresses were created daily, underscoring the platform's increasing popularity. On January 16 alone, an astounding 96,300 wallets came into existence. The data further indicates that ETH's supply on exchanges is nearing its all-time low of 8.05%, suggesting a shift towards self-custody and staking. This trend reduces the risk of an imminent sell-off and presents a more favorable scenario compared to concerns related to an increasing supply on exchanges.

These on-chain metrics provide insights into Ether's current market strength and its potential to outperform Bitcoin in the short term. Additionally, the latest Ethereum network upgrade, known as Cancun-Deneb or Dencun, has been deployed on the Goerli testnet. The implementation of EIP-4844 in Dencun is expected to significantly lower transaction costs on Ethereum layer 2s, including Optimism, Base, Polygon zkEVM, and others. This upgrade will also impose restrictions on self-destruct operations and introduce new bridge and staking pool features. As outlined in Ethereum's 2024 roadmap, the next significant milestone in Dencun's testing schedule is on January 30 when it is set to be implemented on the Sepolia testnet, followed by the Holesky testnet on February 7. The team has yet to announce a date for the mainnet implementation of the upgrade.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.