FameEX Weekly Market Trend | January 13, 2025

2025-01-13 20:00:10

1. BTC Market Trend

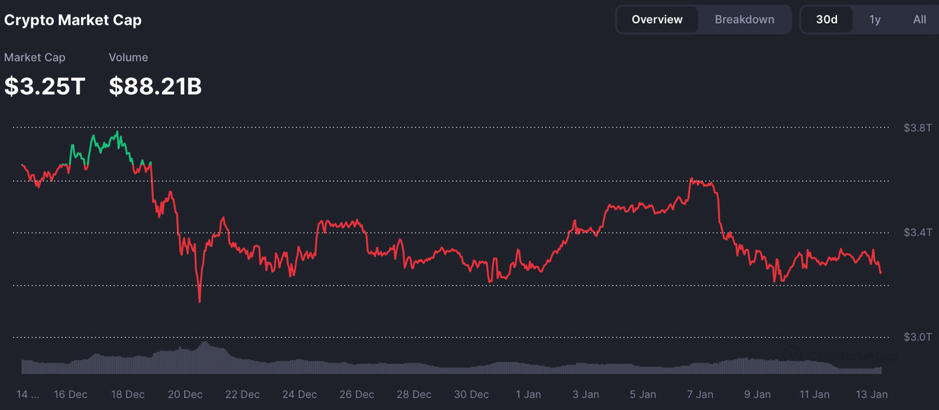

From January 9 to January 12, the BTC spot price swung from $90,935.57 to $95,885.53, a 5.44% range.

In the past four days, the Federal Reserve (Fed) has made the following important statements:

1) On January 9, according to the Fed meeting minutes, inflation is expected to continue slowing, but policies from the Trump administration may increase price pressure risks. Officials lean towards slowing the pace of rate cuts, with rising inflation risks.

Governor Waller did not believe the new administration would impose “harsh” tariff policies and expected tariffs would not significantly impact inflation. December meeting minutes suggested the Fed is at or near the point of slowing rate cuts, with some officials viewing the decision to hold rates steady in December as necessary. Inflation is expected to keep slowing, but concerns over new policies potentially increasing price pressures remain. Further rate cuts are supported this year.

Harker emphasized data dependence and avoiding hasty actions; the Fed would only issue digital currency if directed by Congress.

Collins indicated that the current outlook requires a gradual and patient approach to rate cuts.

2) On January 10, Fed’s Schmid indicated that interest rate policies may be “close” to the level required for the long term. Any further rate cuts should be gradual and data-driven.

Governor Bowman supported considering the December rate cut as the “final step” in policy adjustments.

Barkin stated that consumer debt levels remain far below 2018-2019 levels, believing long-term rates are driven by premiums, not inflation.

3) On January 11, Fed’s Mussa recommended more caution in rate cuts.

Goolsbee urged not to overreact to a single jobs report. If economic conditions remain stable, inflation does not rise, and full employment is maintained, rates should be lowered.

U.S. President-elect Donald Trump plans to issue a series of executive orders within hours of his inauguration on January 20, focusing on immigration, energy, federal workforce, and regulatory reforms. His planned orders include tightening border restrictions, authorizing the completion of the unfinished border wall, establishing mechanisms for mass deportations, and cutting federal resources to sanctuary cities until they stop protecting undocumented immigrants. The Trump team also intends to reduce the federal workforce by freezing government hiring and mandating the return of federal employees to offices.

At a press conference on January 10, China’s Ministry of Public Security reported the arrest of over 53,000 Chinese nationals involved in telecom fraud in northern Myanmar by the end of 2024. The notorious “Four Families” crime syndicate in Kokang, northern Myanmar, was dismantled. Despite these successes, the ministry warned that the crime situation remains severe as fraud groups increasingly leverage blockchain, virtual currencies, and AI tools for their operations. These tightly organized groups engage in cross-border app development, traffic generation, and money laundering activities. They create tailored fraud schemes targeting people of varying ages, professions, and educational backgrounds. While scam hubs near the Chinese border have been cleared, many foreign scam centers disguised as “tech parks” or “development zones” still exist.

Grayscale has announced the latest asset weightings for its various investment products:

Grayscale Decentralized AI Fund: Added LPT. Current holdings: NEAR, RENDER, TAO, FIL, GRT, and LPT.

Grayscale DeFi Fund (DEFG): Added CRV and removed SNX. Current holdings: UNI, AAVE, LDO, MKR, and CRV.

Grayscale Digital Large Cap Fund (GDLC): Added ADA and removed AVAX. Current holdings: BTC, ETH, SOL, XRP, and ADA.

Grayscale Smart Contract Platform Ex-Ethereum Fund (GSCPxE): Added SUI. Current holdings: SOL, ADA, AVAX, SUI, NEAR, and DOT.

From January 13 to January 15, The sell order for the BTC spot at $169,400, the bottom-fishing buy orders at $73,970, $59,935, and $45,900, as well as the sell order for the ETH spot at $5,125 and the bottom-fishing buy orders at $2,040 and $1,730, do not need to be canceled.

2. CMC 7D Statistics Indicators

Overall market cap and volume, source:https://coinmarketcap.com/charts/

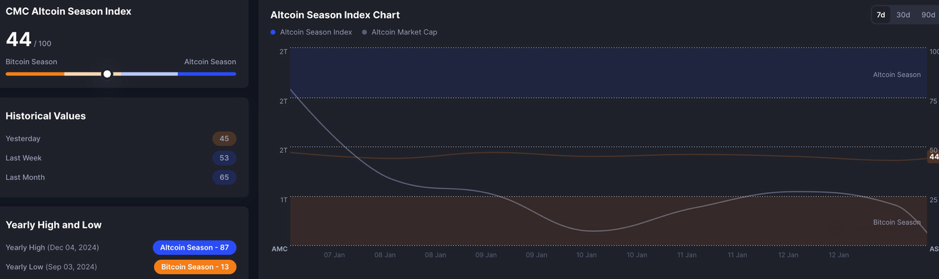

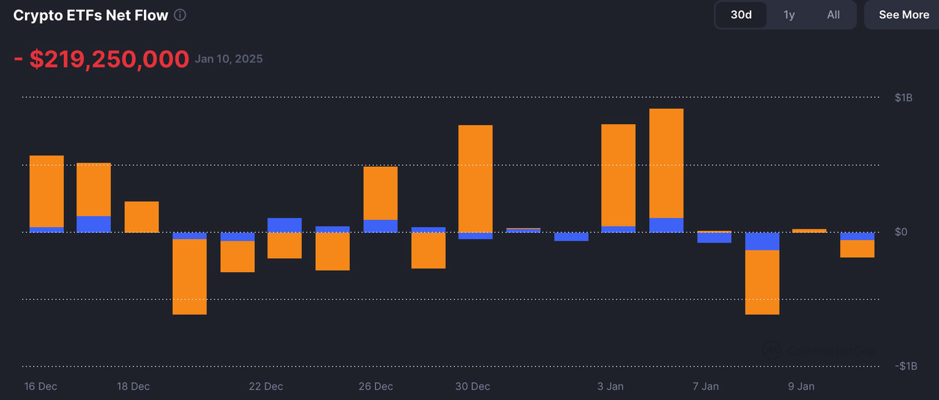

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

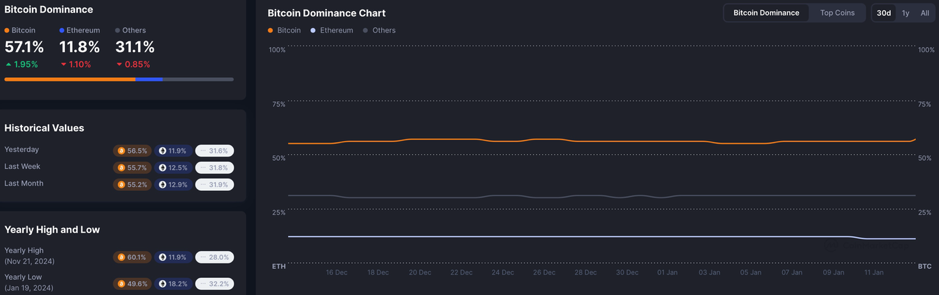

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

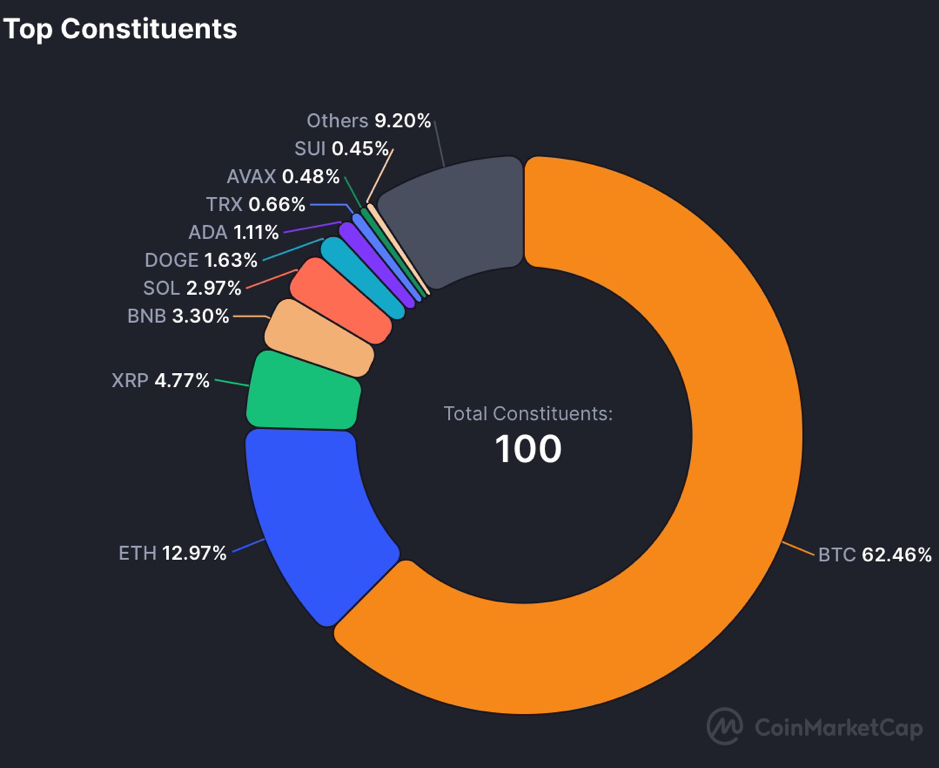

CoinMarketCap 100 Index: https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

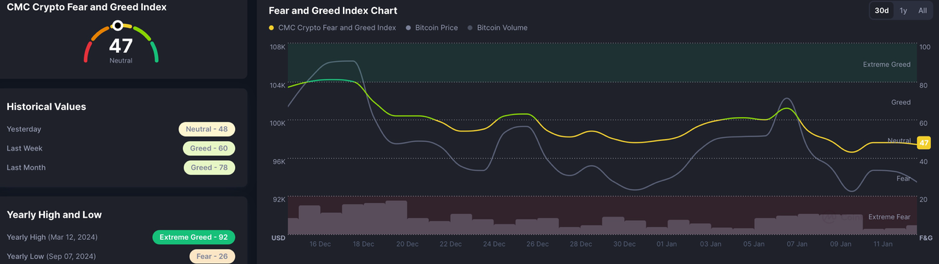

Fear & Greed Index, source: https://coinmarketcap.com/charts/

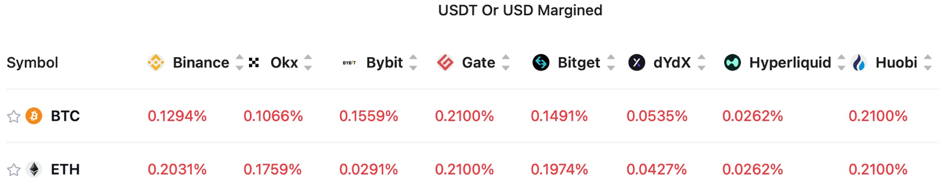

3. Perpetual Futures

The 7-day cumulative funding rates for major exchanges’ mainstream cryptocurrencies are generally positive.

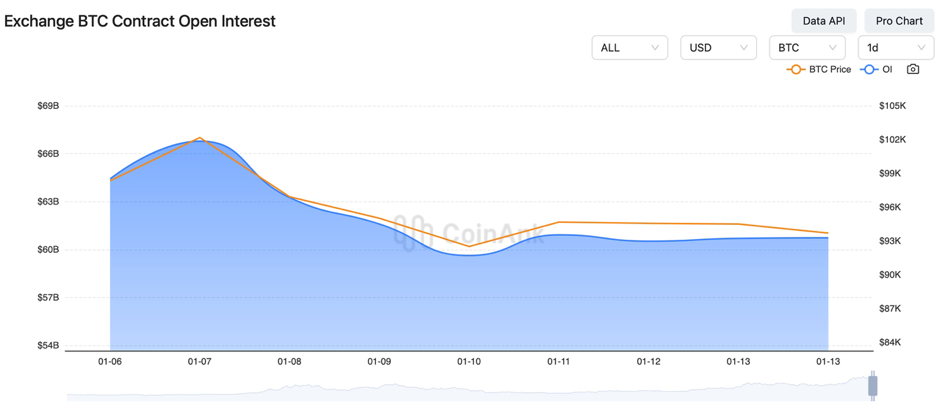

In the past four days, the open interest for BTC and ETH contracts has seen a slight decline.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On January 9, U.S. Treasury Secretary Yellen stated that rising term premiums and interest rate repricing have driven U.S. Treasury yields higher.

2) On January 9, the People’s Bank of China moved to stabilize the exchange rate by issuing 60 billion yuan in offshore central bank bills in Hong Kong.

3) On January 9, Nansen analysts noted that crypto investors are seeking new developments to “drive a bull market”, including cooling U.S. inflation and labor market data.

4) On January 9, an Oklahoma state legislator proposed the “Bitcoin Freedom Act” to allow state employees to receive wages in Bitcoin.

5) On January 9, China’s December CPI year-on-year was 0.1% (expected 0.1%, previous 0.2%). The annual CPI increase for 2024 was 0.2%.

6) On January 9, the CEO of K-pop giant Cube Entertainment was accused of involvement in a crypto investment scam.

7) On January 10, the Bank of England Deputy Governor supported rate cuts but noted uncertainty over the pace, closely monitoring the government bond market.

8) On January 10, Trump’s “hush money” case verdict: 34 counts guilty, no penalties imposed. Bloomberg reported several crypto CEOs are seeking meetings with Trump as his inauguration approaches.

9) On January 10, Coinbase, Google, and a16z team members launched Aiccelerate, a Decentralized Autonomous Organization (DAO), to advance crypto and AI integration.

10) On January 10, former PBoC Governor Zhou Xiaochuan warned of global public debt nearing $100 trillion and the financial impact of crypto assets.

11) On January 10, Arthur Hayes commented on the U.S. DOJ’s approval to sell $6.5 billion worth of Bitcoin, indicating he is ready to buy the dip.

12) On January 10, Canada’s December employment rose by 90.9k (forecast 25k, previous 50.5k). The U.S. December unemployment rate was 4.1% (forecast 4.2%, previous 4.2%).

13) On January 11, Ethereum and Solana staking were no longer classified as collective investment schemes in the UK. Former UK PM Liz Truss expressed support for Bitcoin and cryptocurrencies.

14) On January 11, Standard Chartered Bank received a license to launch digital asset custody services in the EU.

15) On January 11, Grayscale adjusted its crypto large-cap fund, raising BTC and ETH to 90% and including XRP, SOL, and ADA while removing AVAX.

16) On January 11, Canadian PM candidate Pierre Poilievre voiced support for crypto and DeFi.

17) On January 11, the U.S. DOJ approved the sale of $6.5 billion in Bitcoin linked to the Silk Road case. The CFTC subpoenaed Coinbase regarding Polymarket, seeking customer data.

18) On January 11, BlackRock, MicroStrategy, and Fidelity collectively purchased around $100 billion in Bitcoin.

19) On January 12, PeckShield reported over 300 crypto hacks in 2024, primarily targeting DeFi protocols.

20) On January 12, Shenzhen’s Development and Reform Commission solicited projects focusing on blockchain cross-border payments and digital yuan applications. Hong Kong’s Monetary Authority launched a regulatory sandbox for distributed ledger technology.

21) On January 12, China’s Ministry of Finance announced plans to enhance fiscal and monetary policy coordination in 2025.

22) On January 12, D-Wave Quantum’s CEO disputed Nvidia’s CEO's claim that practical quantum computing is 15 years away. Billionaire Mark Cuban stated he prefers holding Bitcoin over gold during economic downturns.

23) On January 12, the percentage of U.S. financial advisors allocating crypto assets for clients doubled to 22% in 2024. The IMF advised Kenya to establish a clear crypto regulatory framework.

24) On January 12, the Thai police seized 996 Bitcoin mining machines involved in electricity theft. A UK judge dismissed a $770 million Bitcoin hard drive landfill excavation case.

25) On January 12, it was announced that the U.S. December CPI data will be released next Wednesday, while China’s 2024 annual GDP growth rate, total GDP, and Q4 GDP annual rate will be released next Thursday.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.