FameEX Weekly Market Trend | August 22, 2024

2024-08-22 19:51:50

1. BTC Market Trend

From August 19 to August 21, the BTC spot price swung from $57,637.6 to $61,769.42, a 7.17% range. In the past four days, key statements from the Federal Reserve (Fed) and the European Central Bank (ECB) were as follows:

1) On August 19, Fed’s Kashkari expressed openness to a rate cut at the next meeting due to rising labor market weakness.

2) On August 19, Fed’s Daly felt “more confident” that inflation is under control and suggested it’s time to consider adjusting the 5.25%-5.50% rate range, noting a slowing but not weak labor market.

3) On August 20, Fed’s Kashkari stated that labor market weakness could justify a 25 basis point rate cut in September.

4) On August 21, Fed’s Bowman supported a rate cut if inflation continues to decline, while still seeing upside risks.

5) On August 20, ECB’s Rehn said rising negative growth risks in the Eurozone strengthen the case for a September rate cut.

6) On August 21, ECB’s Panetta expressed a desire for a rate cut in September.

The Japanese yen has appreciated by 2.4% against the US dollar since last Thursday, reaching 145 yen to 1 dollar, reflecting a preference for safe-haven currencies. A similar yen strength in early August triggered the unwinding of carry trades, leading to significant volatility in risk assets, including Bitcoin. The price of Bitcoin fell from around $70,000 to $50,000 over the eight days leading up to August 5, before rebounding to $60,000 as the dollar-yen exchange rate recovered. Notable trader Simon Ree and Goldman Sachs’ Head of Crypto Trading Andrei Kazantsev have both pointed out that the yen’s strength could lead to a negative feedback loop for global risk assets. According to ING’s analysis, the yen’s rebound might change market behaviors, increasing the willingness to buy when the yen weakens, thereby exacerbating the risk of further yen appreciation. In the coming weeks, as the Fed’s mid-September rate decision meeting approaches, the unwinding of carry trades may continue. Arnim Holzer, Global Macro Strategist at Easterly EAB Risk Solutions, stated that if the Fed cuts rates by 50 basis points, the market might initially rise and then fall, as concerns about the economy and the yen’s strength could once again trigger the unwinding of carry trades.

Digital asset banking group Sygnum has provided a $50 million Bitcoin-backed loan to crypto lender Ledn, marking the first time a regulated bank has issued a loan backed by Bitcoin. Ledn will use this loan to fund the growth of its retail book, offering its clients more flexible access to capital while using its BTC holdings as qualified custodied collateral to ensure the highest level of security and regulatory compliance. Additionally, this collateral will be pledged to Sygnum, providing bank-grade security for the assets and enhancing safety and risk management.

Matthew Sigel, Head of Research at VanEck, tweeted that according to an analysis conducted by the Centre for Economics and Business Research from April to June this year, businesses and consumers in 17 emerging markets are willing to pay a premium of 4.7% on average above the standard dollar price to acquire stablecoins. In countries like Argentina, this figure rises to 30%. By 2027, consumers in these countries are expected to pay $25.4 billion in premiums to acquire stablecoins.

An increasing number of Fed governors and voting members have expressed support for starting this round of interest rate cuts in September, marking the most significant bullish event of this market cycle. After the rate cuts, a large amount of global capital is likely to exit the U.S., with some potentially flowing into the cryptocurrency market, driving up the prices of Bitcoin and other crypto assets.

It’s crucial to seize the opportunity to buy the dips on all the cryptocurrencies currently held. There’s no need to cancel any previously recommended limit orders. You can consider slightly increasing the position of the ETH spot buy order at $1,850. Similarly, the BTC spot buy order at $42,950 can also be increased accordingly. These are highly certain, low-risk profit opportunities.

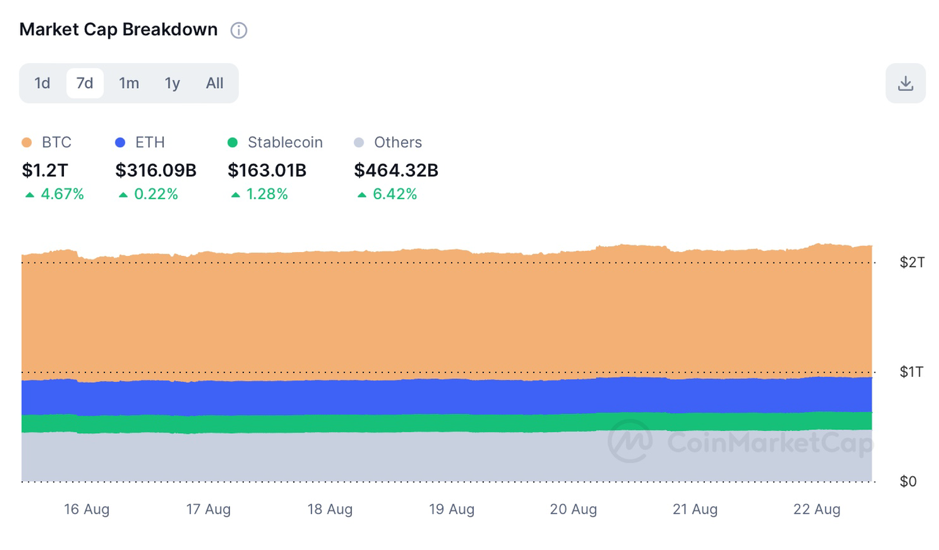

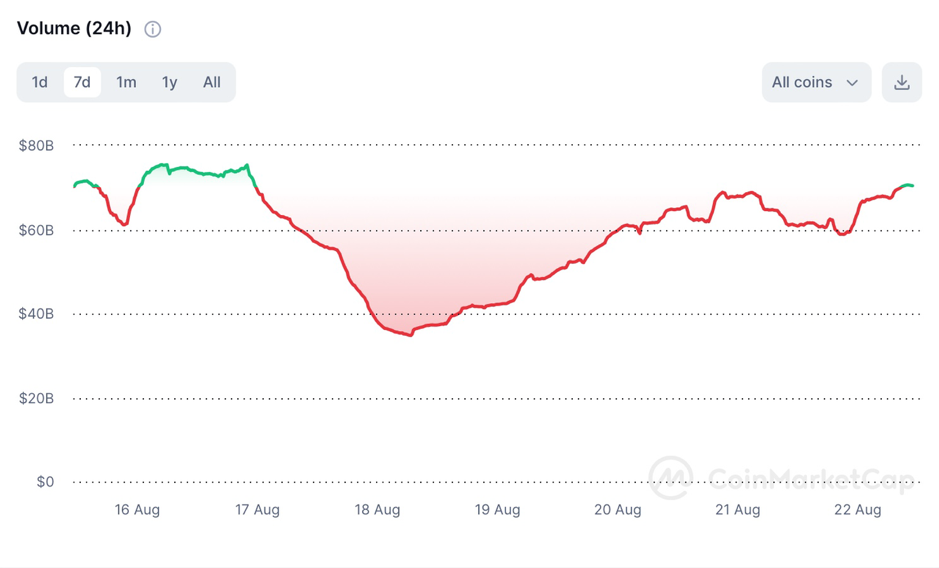

2. CMC 7D Statistics Indicators

Overall market cap analysis, source: https://coinmarketcap.com/charts/

24h trading volume, source: https://coinmarketcap.com/charts/

Fear & Greed Index, source: https://coinmarketcap.com/charts/

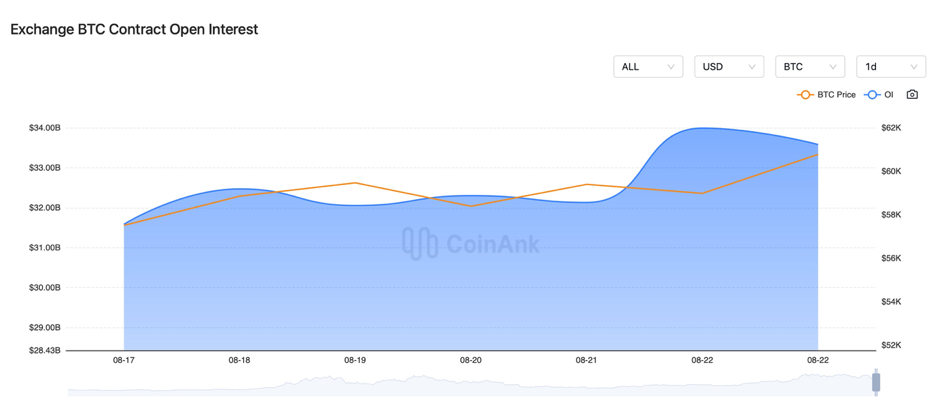

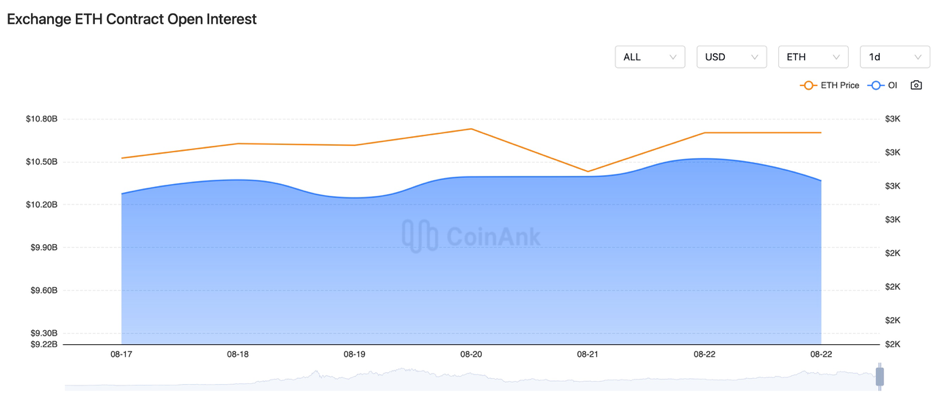

3. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are negative, indicating that short leverages are relatively high.

In the past three days, the BTC contract open interest has remained nearly unchanged, while the ETH contract open interest has slightly increased.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On August 19, Gemini co-founder urged U.S. crypto holders to unite and push for the dismissal of the SEC Chairman by Harris before the upcoming election.

2) On August 19, the Australian Securities and Investments Commission reported that crypto scams caused $1.3 billion in losses last year, with an average of 20 websites shut down daily.

3) On August 19, the market capitalization of memecoins has shrunk by over $20 billion since late May. Google Trends showed a significant drop in search interest.

4) On August 19, State Street Bank selected Taurus for cryptocurrency custody and tokenization. Payment platform PEXX acquired Singapore blockchain media Chain Debrief.

5) On August 19, since the implementation of South Korea’s “Virtual Asset User Protection Act”, the number of newly listed cryptocurrencies has sharply decreased.

6) On August 19, it was reported that the U.S. is considering implementing statutory reporting requirements for cryptocurrency transfers.

7) On August 19, UAE state-owned bank RAKBANK partnered with Bitpanda to launch a digital asset platform for residents.

8) On August 19, Polyflow launched a crypto payment debit card that supports crypto asset deposits.

9) On August 19, a virtual currency “mining” pyramid scheme case involving millions of yuan was publicly tried in Xingyi City, Guizhou Province, China.

10) On August 20, the Eurozone July CPI MoM was 0%, in line with expectations; the Eurozone July CPI YoY final value was 2.6%, also matching expectations.

11) On August 20, Trump stated that he has the right to discuss interest rate issues, but this does not mean issuing orders; Trump said that if elected, he would consider appointing Elon Musk to a cabinet or advisory role.

12) On August 20, it was reported that the U.S. is considering revising the Bank Secrecy Act to enhance financial institutions’ reporting requirements for cryptocurrency transactions.

13) On August 20, it was reported that France, Germany, and the UK are considering recognizing Palestine as a state, provided Iran makes significant concessions, including recognizing Israel and ceasing support for regional resistance groups.

14) On August 20, Iran’s UN delegation stated that Iran would adjust its response to Israel to avoid impacting the Gaza ceasefire and would take coordinated action to achieve a “maximum surprise”.

15) On August 20, Canada’s July CPI MoM was 0.4%, matching expectations; the previous value was -0.1%.

16) On August 21, Montenegrin police arrested a FutureNet co-founder for fraud involving $21 million.

17) On August 21, the Malaysian police destroyed 985 Bitcoin mining rigs with a steamroller.

18) On August 21, Bitcoin Magazine reported that U.S. presidential candidate Robert Kennedy Jr. is considering withdrawing and teaming up with Trump, as both support Bitcoin.

19) On August 21, Premier Li Qiang and Russian Prime Minister Mishustin co-chaired the 29th Regular Meeting between the Chinese and Russian Prime Ministers, agreeing to further optimize the cooperation structure and steadily advance cooperation in emerging fields; the 10th Sino-Russian Finance Ministers Dialogue was held in Moscow.

20) On August 21, the U.S. Bureau of Labor Statistics released a preliminary report on non-farm employment and wage data for Q1 2024, revising the total non-farm employment as of March 2024 down by 818,000 jobs, a 0.5% revision, with the release time delayed.

21) On August 21, the Russian Foreign Ministry stated that about 90% of settlements within the Eurasian Economic Union are conducted in local currencies.

22) On August 21, it was reported that Wyoming, USA, may launch a stablecoin and list it on a centralized exchange (CEX) in Q1 2025.

23) On August 21, a campaign policy advisor stated that U.S. Vice President Kamala Harris would support measures to foster the growth of the digital asset sector and emphasized efforts to attract the emerging cryptocurrency industry to expand its political influence.

24) On August 21, Vitalik Buterin expressed optimism about experimenting with the concept of diversity across three areas: blockchain, social media, and government.

25) On August 21, Tether announced plans to launch a stablecoin pegged to the UAE Dirham; Abu Dhabi proposed a regulatory framework for fiat-referenced tokens to strengthen stablecoin regulation.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.