FameEX Weekly Market Trend | May 27, 2024

2024-05-27 20:05:25

1. BTC Market Trend

From May 23 to 26, the BTC price swung from $66,508.59 to $70,046.55, a 5.32% range. On May 22, the Federal Reserve (Fed) released minutes from its April 30 to May 1 interest rate meeting. As per the minutes, with U.S. inflation below expectations for three months, Fed officials believed that the period of keeping interest rates elevated would likely be longer than previously anticipated. They also discussed potentially lowering rates amid the labor market weakening. As anticipated, the Fed maintained interest rates at 5.25% to 5.5% and planned to ease balance sheet reduction starting June, reducing the monthly cap on U.S. Treasury redemptions from $60 billion to $25 billion. Many officials expressed readiness to further tighten policy if necessary, suggesting that the long-term neutral interest rate may be higher than previously expected. Some officials noted the risks of an excessively loose financial environment. Bostic stated, “We will not be caught in a tighter environment.”

Until May 18, the initial jobless claims in the United States were 215,000, slightly below the expected 220,000 and lower than the previous week’s 222,000, marking a new low since the week of April 27. This news negatively impacted cryptocurrencies and precious metals, dampening global market expectations of a Fed rate cut for this year. It also suppressed the bullish effects of the news regarding the approval of the Ethereum ETF plans. On May 24, the U.S. Securities and Exchange Commission (SEC) approved plans for Ethereum ETFs by the New York Stock Exchange, Chicago Board Options Exchange, and Nasdaq, with a potential listing in July or August. The fluctuations in Bitcoin’s price were primarily influenced by the market’s anticipation of a rate cut following the initial jobless claims data released on May 23 and the approval of the Ethereum ETF plans on May 24.

From May 27 to May 29, it is important to guard against a potential downtrend in Bitcoin’s daily candlesticks, influenced by global asset movements.

Starting from May 21 and continuing through June, July, and August, with the inflow of funds from Ethereum ETFs into the crypto market, Ethereum’s gains are expected to surpass those of Bitcoin.

Over the last weekend, we conducted further research and analysis on Ethereum. Based on technical analysis, Ethereum’s price is expected to rise to $4,700 in the coming months, with the next minor target price at $4,850. For users holding Ethereum, medium-term sell orders can be placed at $4,700 and $4,850 respectively. The minor buy-in price is $3,460. In the event of significant negative news during this period, $2,500 presents an excellent buying opportunity for long-term hodlers.

From May 27 to May 29, there is no need to cancel the sell orders placed at $77,500 and $72,500 for BTC spot, nor the buy order placed at $54,050.

According to the ahr999 coin hoarding indicator, the current indicator value for BTC is 1.23, which is above the DCA level. Therefore, for major coin dollar-cost averaging, it is advisable to only choose ETH.

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

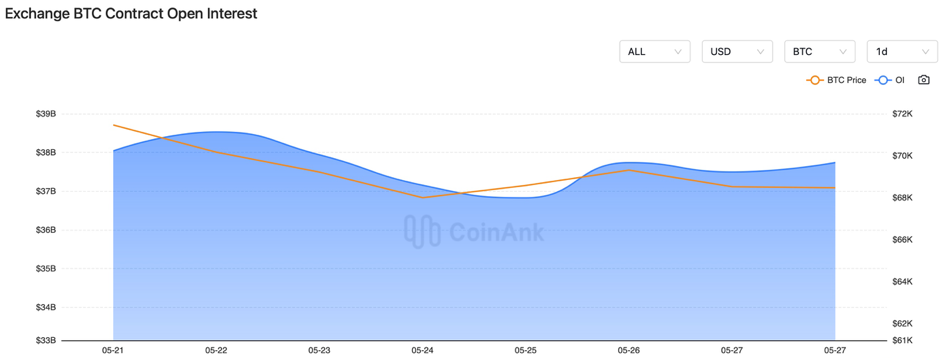

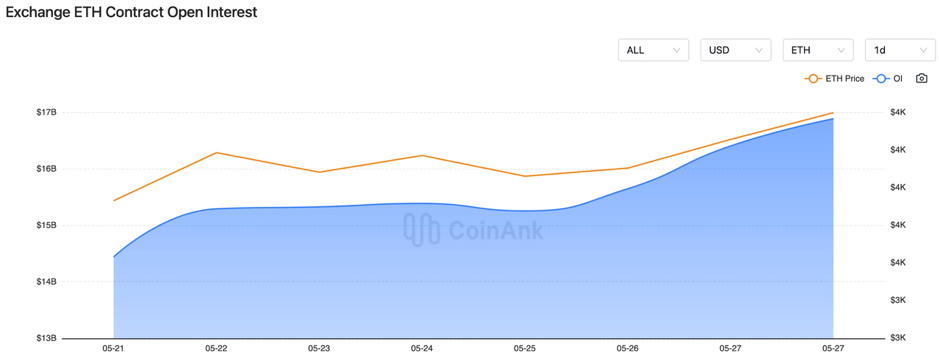

Recently, BTC contract open interest has been fluctuating within a range, while ETH contract open interest has been steadily increasing alongside positive news.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On May 23, the UK announced an early election on July 4, potentially impacting cryptocurrency support within the Conservative Party.

2) On May 23, it was reported that Biden’s stance towards cryptocurrencies may significantly shift to prevent Trump from gaining support from the crypto community.

3) On May 23, the U.S. House of Representatives passed a bill prohibiting the Fed from creating a Central Bank Digital Currency (CBDC).

4) On May 23, the U.S. House of Representatives passed the Financial Innovation and Technology Act (FIT21) by a vote of 279 to 136.

5) On May 23, the DXY short-term increase of nearly 30 points delayed the market’s expectation of the Fed’s first rate cut until December.

6) On May 23, a Bloomberg analyst suggested that while there may be significant demand for SOL ETFs, the SEC’s tough stance could pose a significant obstacle.

7) On May 24, the U.S. one-year inflation expectation was 3.3%, slightly below the expected 3.40% and previous 3.50%.

8) On May 24th, ECB board member Müller stated that if inflation continues to slow down, the ECB has further room for easing. Villeroy de Galhau mentioned that a rate cut in June is highly likely.

9) On May 24, a HashKey analyst predicted that Ethereum spot ETFs may adopt a staking mechanism, potentially reaching 75% of the market size of Bitcoin spot ETFs.

10) On May 24, Russia pursued compensation from the U.S. for losses caused to the Russian Central Bank, allowing for the seizure of U.S. assets in Russia.

11) On May 24, a trader profited $42 million from investments in PEPE, ONDO, and BEAM within a year.

12) On May 24, the final deadline for Biden’s decision on the “Repeal SAB 121” resolution was extended to June 3.

13) On May 24, Dutch crypto fund Icoinic was acquired by Coinmerce and will now operate as Coinmerce Capital.

14) On May 24, Grayscale noted that the Stacks Trust could introduce DApps into the Bitcoin ecosystem, increasing institutional interest.

15) On May 24, the Ethereum Foundation announced accelerated development of formal policies to address potential conflicts of interest.

16) On May 25, the International Court of Justice ordered Israel to cease military attacks on Gaza, with Saudi Arabia, UAE, and South Africa expressing support.

17) On May 25, the CEO of Wan Bitcoin stated that the likelihood of NVIDIA stocks outperforming Bitcoin in the next ten years is “almost zero”.

18) On May 26, it was revealed that the launch pace of new cryptocurrency funds is significantly lower than during the peak of 2017.

19) On May 26, Paraguayan authorities seized nearly 400 Bitcoin miners in the city of Sapucaí.

20) On May 26, Trump pledged to ensure the future of cryptocurrencies and Bitcoin in the U.S., promising to pardon the founder of Silk Road if re-elected and supporting cryptocurrencies while protesting Biden’s crackdown.

21) On May 26, Ethereum network gas fees dropped to 3 gwei, with the Ethereum Pectra upgrade scheduled for the first quarter of 2025.

22) On May 26, Ethereum on-chain DEX traded $18.808 billion in the past seven days, ranking first with a 7-day increase of 89.85%.

23) On May 26, PEPE broke $0.000016 USDT, reaching a new all-time high.

24) On May 26, the U.S. Treasury Secretary stated that there is no rigid rule for the ratio of interest expenditure adjusted for inflation to GDP, but hopes it remains below 2%.

25) On May 26, tokens such as OP, DYDX, SUI, ENA, 1INCH, PRIME, YGG, AGIX, ZETA, NYM, MANTA, ACA, and TORN, with a total value of approximately $380 million, would be unlocked next week.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.