FameEX Weekly Market Trend | March 11, 2024

2024-03-12 09:53:35

1. Market Trend

From Mar. 7 to Mar. 10, the BTC price swung from $65,551.00 to $69,990.00, a 6.77% range. The prior report noted that as long as the daily closing price stays above $63,000, the upward trend persists. Presently, neither the weekly nor daily charts have signaled a peak, but expect increased price fluctuations (intraday fluctuations of tens of thousands of dollars may occur more frequently, and futures traders must set stop-loss prices). There hasn’t been a retest of the $63,000 level in recent BTC price trends, and the lowest price remains some distance away from that mark. This suggests bearish weakness, indirectly affirming the unchanged upward trend. Additionally, on Mar. 8 at 23:00 (UTC+8), BTC surged to $70,000 but retreated to settle near $66,000, with a $40,000 fluctuation. Notably, BTC swiftly recovered with significant volume, oscillating upward afterward and reflecting a strong trend. The surge can be seen as a resistance test, and breaking through $70,000 appears inevitable.

In bull and bear markets, indicators have limited guidance, but in volatility, they’re more significant. Thus, investors can enter below $70,000 and await new highs. Adjust stop-loss from $63,000 to $68,000. Hodlers should patiently follow the trend, avoiding frequent trading.

Source: BTCUSDT | Binance Spot

From Mar. 7 to Mar. 10, the price of ETH/BTC fluctuated between 0.05611 and 0.05894, a 5.04% range. In the previous discussion, for those who haven’t entered the market yet within the range of 0.05600-0.05650, it’s an opportunity for low-buy trades. For those already in, holding firmly for future gains is advised. Currently, both the weekly and daily charts of ETH show no signs of a bearish trend, indicating a strong momentum. The breakthrough of the $4,000 psychological barrier is only a matter of time (even though there was a dip from $3800 to $3200 at one point, the recovery was rapid, and new highs were reached). Although ETH/BTC is currently approaching the lower Bollinger Band, the likelihood of a rebound far outweighs the probability of further decline, so maintaining the status quo for low-buy opportunities and holding for future gains is recommended.

Based on overall analysis, BTC’s strong momentum is evident, and $70,000 is by no means the peak of this bull market. Instead, if BTC continues its strong breakthrough past $70,000, it will usher in a new wave of upward opportunities, establishing a new upward channel. Other mainstream and altcoins in the market will naturally follow BTC to another level of growth. At this stage, it’s advisable to seek out coins with superior performance in the market (those showing strength compared to BTC, preferably those that rise with minimal declines). Additionally, in sector rotations, prioritize coins that rank high among those currently rising and haven’t experienced significant price surges. Adopting a bullish stance without short-selling is suitable for all coins in the current market phase. It’s essential to trade in line with the correct trend.

The Bitcoin Ahr999 index of 1.84 is over the DCA level ($55,610), indicating the need to be cautious of investment risks.

2. Perpetual Futures

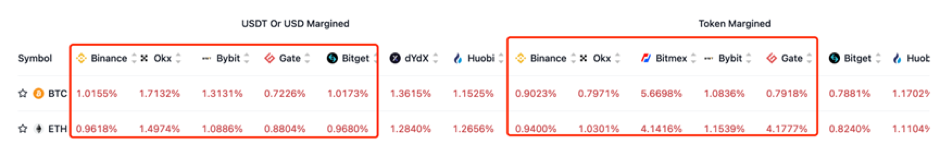

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

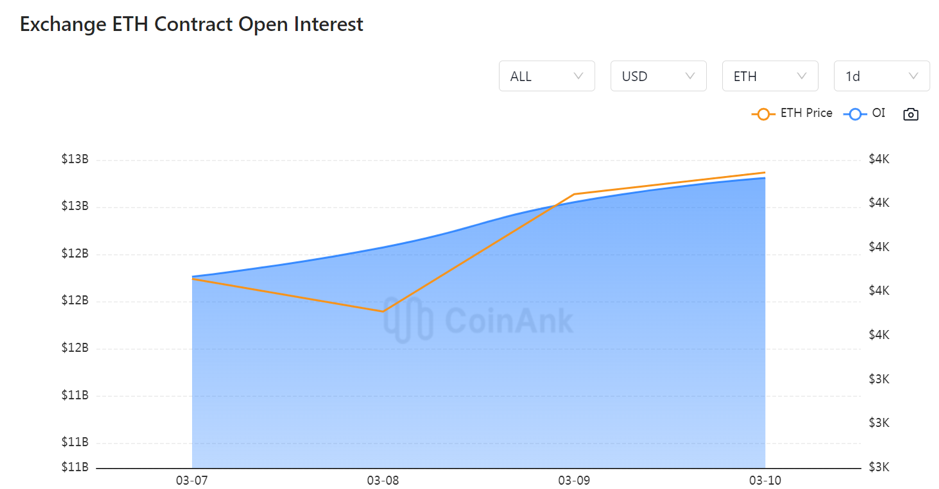

In the recent period, both BTC and ETH contract open interest have experienced a rise.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On March 7, the market capitalization of AI sector tokens surpassed $25 billion.

2) On March 7, Musk stated: “If OpenAI changes its name to ClosedAI, I'll withdraw the lawsuit.”

3) On March 7, Asia Weekly: Hong Kong appears to lean towards overly conservative crypto policies, failing to fully leverage the potential flexibility of cryptocurrencies.

4) On March 8, JPMorgan: Bitcoin has “surpassed” gold.

5) On March 8, Powell reiterated: Without congressional approval, the Fed cannot launch a CBDC.

6) On March 8, the total net inflow of Bitcoin spot ETF was $472 million yesterday.

7) On March 9, Grayscale’s holdings of Bitcoin dropped to 395,700.

8) On March 9, the cumulative net inflow since the launch of Bitcoin spot ETF reached $9.5947 billion.

9) On March 10, the total assets under management of Bitcoin ETF exceeded $55 billion.

10) On March 10, Bitwise CEO: Wall Street won’t control Bitcoin.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.