FameEX Weekly Market Trend | March 7, 2024

2024-03-07 19:26:30

1. Market Trend

From Mar. 4 to Mar. 6, the BTC price swung from $59,005.00 to $69,300.00, a 17.45% range. The last report advised investors to wait for around $62,500 for a buying opportunity. Hodlers were urged to maintain their positions. On Mar. 6, at 11 p.m. (UTC+8), BTC surged to a historical high, then sharply dropped below $60,000, inducing panic with significant volume. This released BTC turnover at the high, providing an advantage for later chip holding tightness. BTC closed above $60,000 that day, a strong performance. The uptrend remains intact as long as the daily close stays above $63,000. Topping signals are absent on weekly and daily charts, but anticipate higher price fluctuations, possibly reaching tens of thousands of dollars intraday. Hence, futures traders should set stop-loss orders. $63,000 serves as a crucial support level. If breached without recovery within 4 hours, consider closing positions for observation. Otherwise, hold onto chips firmly and ride the upward trend.

Source: BTCUSDT | Binance Spot

From Mar. 4 to Mar. 6, the price of ETH/BTC fluctuated between 0.05290 and 0.05822, a 10.05% range. In the previous report, we noted the significant sector rotation within the bull market, with Ethereum currently experiencing relative weakness. It’s a good time to establish positions and await Ethereum’s next surge. Recently, ETH/BTC has shown considerable strength, breaking through a key resistance level (0.05500), with a high likelihood of not revisiting this level in the short term. Ethereum has also just surpassed the significant resistance at $3,500 from March 2023, now serving as strong support. With this momentum, we are confidently looking towards $4,000. For investors who haven’t entered the market yet, consider buying at the 0.05600-0.05650 range. For those already invested, hold firm and wait for the rise.

Based on overall analysis, following BTC’s recent historic high, there was a significant pullback, but currently the gap created by this pullback has been gradually recovered. High turnover rates at these levels indicate strong upward momentum. Continuing to climb along the new high position is now a certainty. Both BTC and ETH, as leading indicators, have seen consistent and substantial net inflows of funds recently. This has been adequately reflected in their prices. It’s highly probable that BTC and ETH will continue to set new highs in the near future, providing a favorable environment for mainstream and many altcoins to rise. Therefore, it’s advisable to maintain a strategy of buying low and avoid shorting, following the market trend.

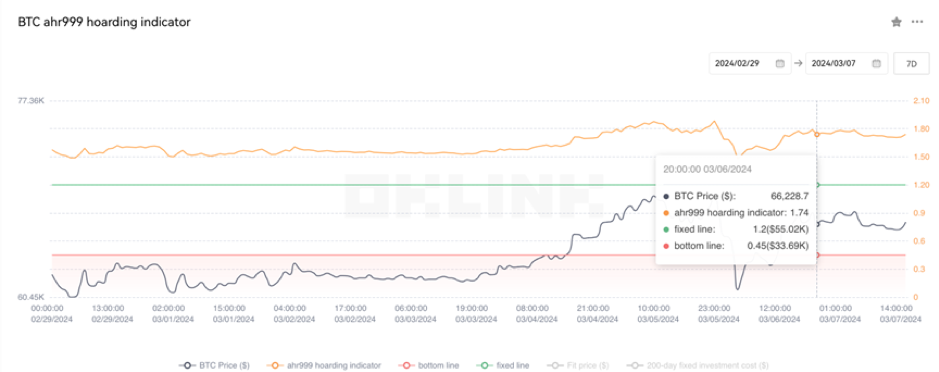

The Bitcoin Ahr999 index of 1.74 is over the DCA level ($55,020), indicating the need to be cautious of investment risks.

2. Perpetual Futures

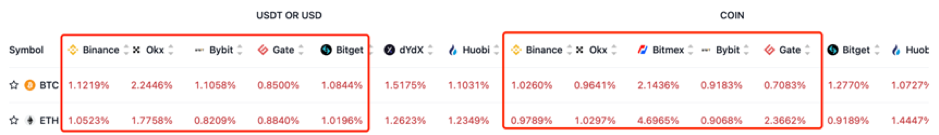

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

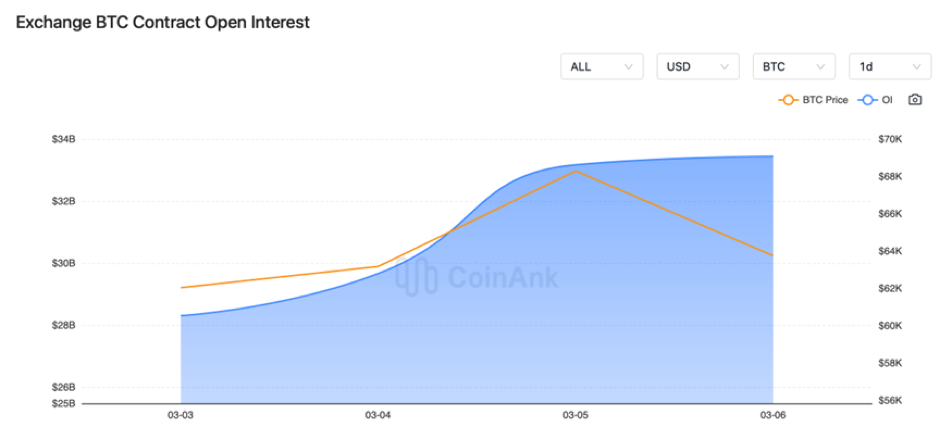

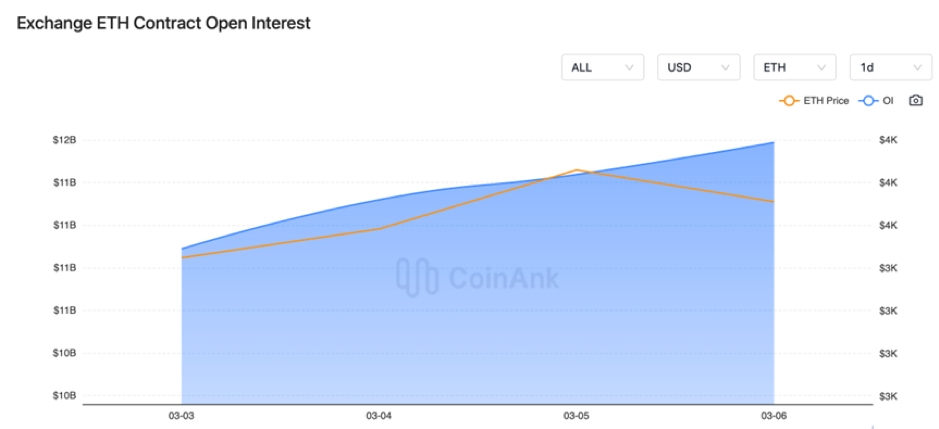

In the recent period, both BTC and ETH contract open interest have experienced a significant rise.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On March 4, South Korea announced its impending investigation into Worldcoin.

2) On March 4, the CEO of the Dubai Financial Services Authority stated that Dubai plans to ease regulations on virtual assets.

3) On March 4, Bitcoin reached new highs against the Euro, Pound Sterling, and Canadian Dollar.

4) On March 5, Deutsche Börse launched a crypto spot platform for institutional clients.

5) On March 5, Ethereum’s market cap surged to become the 23rd largest global asset market cap.

6) On March 5, South Korean authorities are discussing the prospects of approving a Bitcoin spot ETF.

7) On March 6, Victory Securities announced the launch of a Bitcoin fund accepting stablecoin subscriptions.

8) On March 6, the U.S. SEC delayed a decision on Fidelity’s Ethereum spot ETF application.

9) On March 6, the total market capitalization of meme coins across the internet exceeded $60 billion.

10) On March 6, according to Franklin Templeton, blockchain technology will bring a wealth of investment opportunities, and Hong Kong is an essential part of investment strategies.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.