FameEX Weekly Market Trend | February 1, 2024

2024-02-01 18:45:15

1. Market Trend

From Jan. 29 to Jan. 31, the BTC price swung from $41,620.00 to $43,882.36, with a volatility of 5.43%. The prior analysis noted $43,000 as a robust resistance. Despite hitting $42,800 recently and experiencing a pullback, the volume and extent are not significant (quick recovery after dropping down $42,000). The imminent $43,000 breakthrough is confirmed by recent attempts, reaching around $43,800 but falling short of $44,000 before the decline. Further efforts to breach $43,000 did not lead to stabilization. However, maintaining above $41,500 in retracement sufficiently reflects turnover during the upward process, contributing to stability in the later upward trend. Despite large outflows during Grayscale’s capital reduction, BTC’s upward trend persists, supported by funding and continuous inflows into Bitcoin spot ETF funds. The current bottom range for BTC is $41,200-$41,800, making it opportune for buying at a lower price, anticipating stability at $43,000 for a new upward trend.

Source: BTCUSDT | Binance Spot

Between Jan. 29 and Jan. 31, the price of ETH/BTC fluctuated within a range of 0.05309-0.05490, showing a 3.40% fluctuation. The previous analysis mentioned that ETH/BTC has not yet exited its previous downtrend and hit a new low recently. Therefore, the preferred approach to this cryptocurrency is to stay cautious until a reversal in the trend appears. Around 11:00 PM (UTC+8)on Jan. 30, ETH/BTC experienced a significant upward breakthrough. It broke through MA7 and MA25, but the subsequent decline was rapid, indicating persistent uncertainty between bulls and bears. The 1-hour chart has not broken out of the downtrend channel, and although the 4-hour chart shows a turning point in the moving averages, entering the market carries high risks until it breaks and stabilizes above 0.05450. Currently, it is advisable to patiently await a breakthrough of 0.05450 before considering a bullish pursuit.

Based on overall analysis, the current market is in a situation where the short-term bullish and bearish trends are not very clear. The $43,000 mark has been a battleground for bulls and bears recently. With continuous net inflows of funds, a stabilization at $43,000 seems imminent, and initiating the next phase of a new uptrend is only a matter of time. Therefore, at this stage, numerous chances exist for strategic placement, allowing individuals to invest in well-established currencies or trending altcoins (such as those in the NFT sector, SOL series, etc.) at the appropriate times.

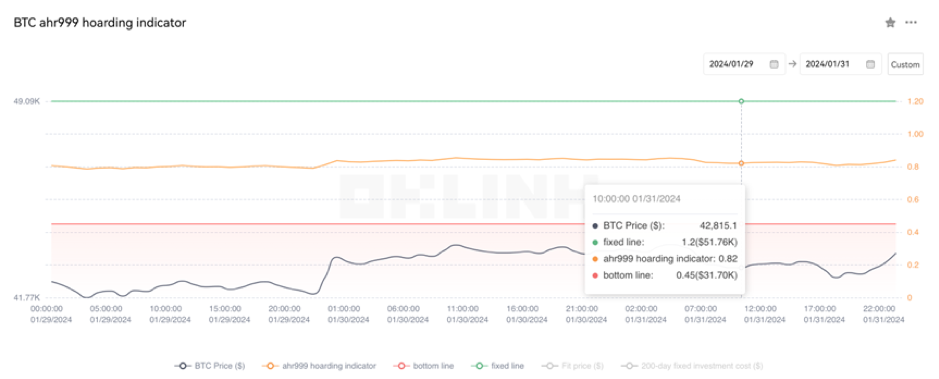

The Bitcoin Ahr999 index of 0.82 is between the buy-the-dip level ($31,700) and the DCA level ($51,760). Therefore, it is advised to purchase popular coins via DCA.

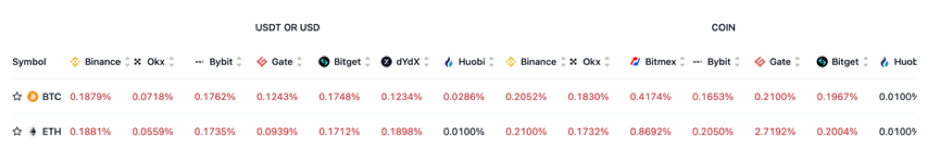

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

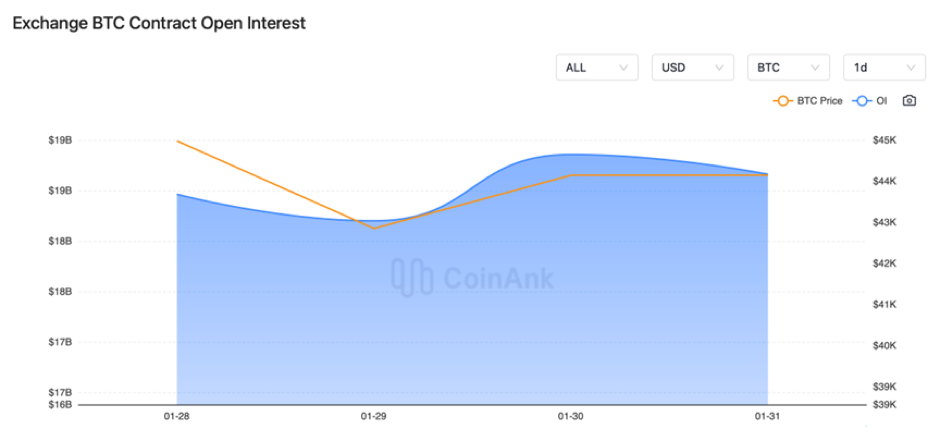

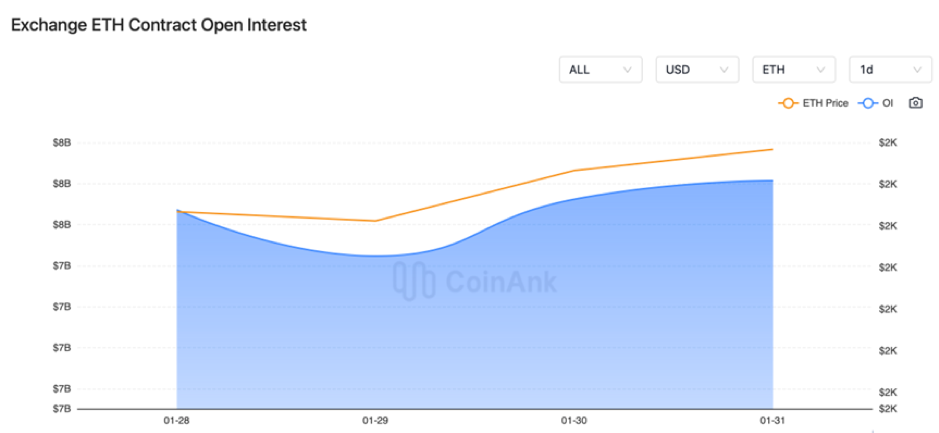

The BTC and ETH contract open interest both surged significantly from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On January 29, the number of new addresses on the Solana network surpassed 10 million.

2) On January 29, the founder of RSS3 announced that the RSS3 mainnet is set to launch soon.

3) On January 29, seven departments, including the Ministry of Industry and Information Technology, emphasized breaking through the entrance to the metaverse and other super terminals with explosive potential.

4) On January 30, official Grayscale data revealed that as of January 29, the GBTC Bitcoin holdings fell below 500,000 coins.

5) On January 29, the National Blockchain Innovation Application Pilot Summary and Exchange Conference was held in Chongqing.

6) On January 30, the Australian Securities Exchange (ASX) announced it would approve a spot Bitcoin ETF in the first half of this year.

7) On January 31, the President of 21Shares stated that a spot Bitcoin ETF is one of the best ETFs ever launched.

8) On January 31, Huatai Securities predicted that the price of Bitcoin would reach a historical high in 2024.

9) On January 31, the U.S. Bitcoin spot ETF saw a net inflow of $247 million on its 13th trading day.

10) On January 31, Tether’s net profit for the fourth quarter reached a historical high of $2.85 billion.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.