FameEX Weekly Market Trend | June 11, 2024

2024-06-11 16:41:40

1. BTC Market Trend

From June 6 to June 9, the BTC price swung from $68,629.74 to $71,885.26, a 4.74% range.

Key points from the ECB interest rate decision and Lagarde’s press conference:

Interest rate decision: The first cut in five years will remain sufficiently restrictive, with no commitment to the future path.

1) Interest rate level: As expected, the ECB cut interest rates by 25 basis points, marking the first rate cut since 2019. This makes the ECB the second central bank among G7 members to lower rates recently.

2) Interest rate outlook: The ECB will maintain sufficiently restrictive interest rates as long as necessary and has not committed to any specific future rate path.

3) Economic outlook: GDP growth is projected at 0.9% for 2024, 1.4% for 2025, and 1.6% for 2026, compared to March forecasts of 0.6%, 1.5%, and 1.6%, respectively.

4) Inflation outlook: Inflation is forecasted at 2.5% for 2024, 2.2% for 2025, and 1.9% for 2026, compared to March forecasts of 2.3%, 2.0%, and 1.9%, respectively. The core inflation is expected to be 2.8% in 2024 and 2.2% in 2025, compared to previous forecasts of 2.6% and 2.1%. The core inflation forecast for 2026 remains unchanged at 2.0%.

5) Quantitative tightening: The ECB reiterated its plan to reduce the Pandemic Emergency Purchase Programme (PEPP) portfolio in the second half of 2024, confirming that it will decrease PEPP assets by €7.5 billion per month in the latter half of the year.

6) Market impact: The euro (EUR/USD) rose by 30 pips against the US dollar shortly. Eurozone bond yields increased, and the Stoxx Europe 600 Index narrowed its gains. The money market now expects an additional 59 basis points cut in interest rates for 2024, slightly down from the 64 basis points expected before the announcement.

Lagarde’s press conference: Not entering a rate-cut phase, inflation to reach target by next year’s second half.

1) Interest rate outlook: The ECB refrains from committing to a specific interest rate trajectory, indicating no definitive entry into a rate-cutting phase. Uncertainty persists regarding the timing and pace of any potential rate adjustments, as current rates remain distant from neutrality.

2) Inflation risks: Domestic inflation remains high. Inflation is expected to fluctuate at current levels for the rest of this year, then gradually decline to the target level by the second half of 2025.

3) Economic outlook: Economic growth is expected to remain sluggish, with medium-term growth risks tilted to the downside.

4) Labor Market: Wages continue to rise at a high rate, and labor costs may fluctuate in the short term. Forward-looking indicators suggest a slowdown in wage growth trends.

It is noted that Governing Council member Holzmann disagreed with the rate cut, and several ECB hawks regretted committing to rate cuts too early. On June 9, ECB President Lagarde reiterated the unwavering determination to achieve the 2% inflation target. She stated that future policy decisions will depend on three factors: whether inflation continues to return to target in a timely manner, whether overall economic price pressures ease, and whether monetary policy remains effective in curbing inflation.

The report from the U.S. Bureau of Labor Statistics on June 7 revealed that non-farm employment increased by 272,000 last month, surpassing all economists’ predictions. The unemployment rate rose from 3.9% to 4%, marking the first time in over two years it reached this level. Average hourly earnings increased by 0.4% from April and by 4.1% compared to the same period last year. Over the past two years, the job market has largely exceeded expectations, driving the overall economy. However, this strong momentum is expected to slow down as prolonged high interest rates put pressure on hiring plans and broader economic activities. This report is one of the last significant pieces of data Fed officials will review before next week’s meeting, where the Fed is widely expected to maintain borrowing costs at their highest level in 20 years.

On June 9, SlowMist founder Yu Xian reported on the X platform about a case where a user’s CEX account was maliciously manipulated to steal assets worth millions of dollars. The team is currently analyzing the incident. According to Yu Xian, the CEX web platform faces various attack methods, including malicious extensions, clipboard attacks, form and request tampering, reverse proxy phishing, and trojan viruses. These vulnerabilities require higher risk control strategies compared to the app platform.

On June 12 at 20:30 (UTC+8), the U.S. will release the May CPI data. The market expects the unadjusted annual CPI rate for May to remain unchanged at 3.4%, while the seasonally adjusted monthly CPI rate for May is projected to be 0.1%, down from the previous value of 0.3%. Some institutions forecast that the overall CPI will increase by 0.1% month-on-month in May, marking the smallest monthly gain since October last year, partly due to an unusual drop in gasoline prices at this time of the year. Excluding food and energy, May’s core inflation is expected to rise by 0.3%, similar to April’s drivers. On June 13 at 02:00 (UTC+8), The Fed will announce its interest rate decision and summary of economic projections. On June 27, the Fed will release the results of its annual bank stress tests.

From June 10 to 12, users should be cautious as the cryptocurrency market may follow the short-term downturn of global major asset classes. There is no need to cancel the sell orders for the ETH spot at $4,700, the buy orders at $3,460, and the sell orders for the BTC spot at $72,500, as well as the buy orders at $54,050.

According to the ahr999 coin hoarding indicator, the current indicator value for BTC is 1.25, which is below the DCA level ($69,870) but above the buy-the-dip level ($42,790). Therefore, it is advisable to adopt a wait-and-watch approach and hold off on investing in mainstream cryptocurrencies for the time being.

2. Perpetual Futures

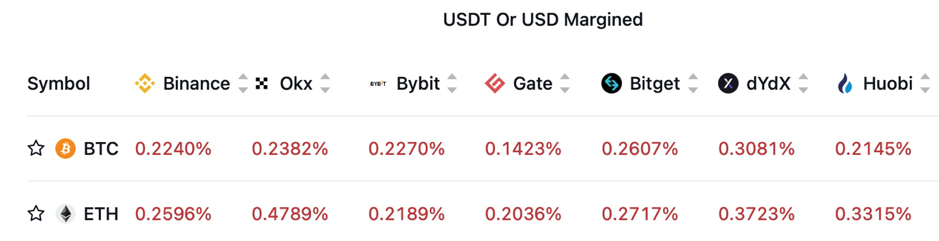

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

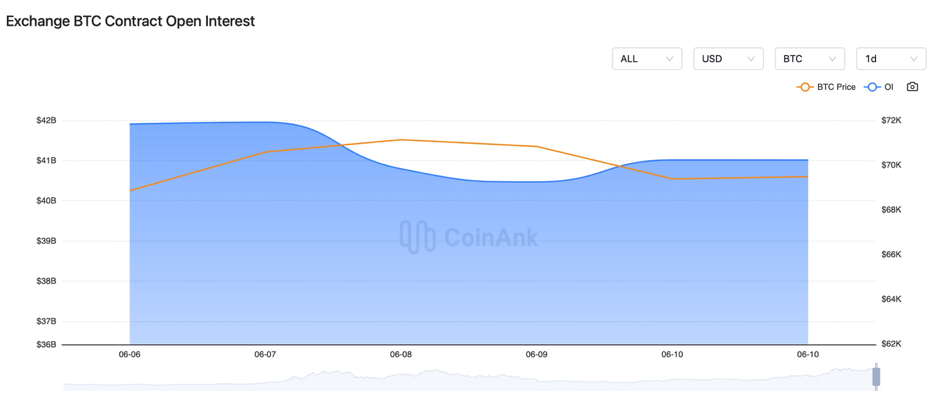

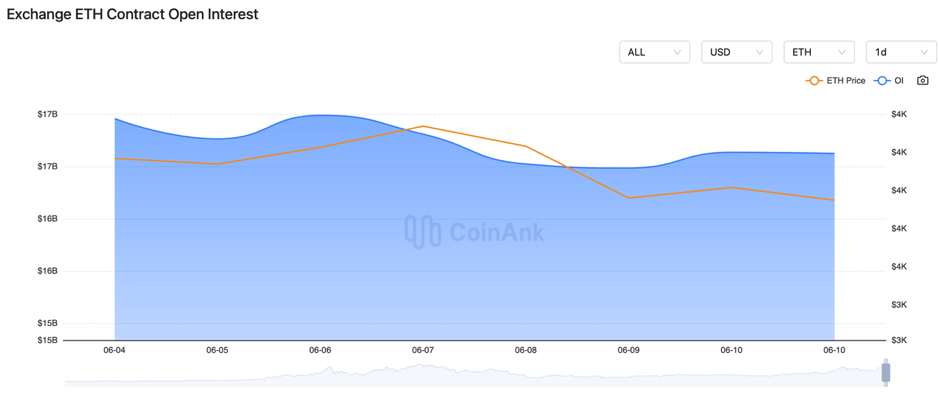

Recently, both the BTC and ETH contract open interest has declined.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On June 6, initial jobless claims in the US for the week ending June 1 were 229,000, slightly higher than the expected 220,000 and the previous week’s 219,000.

2) On June 6, a new law granting the US president the power to block access to digital assets raised concerns among industry professionals.

3) On June 6, the FBI warned the public to beware of scams related to “work from home” schemes, which were actually attempts to steal cryptocurrency.

4) On June 6, the US announced investigations into Nvidia, Microsoft, and OpenAI for antitrust violations.

5) On June 6, the author of “Rich Dad Poor Dad” stated that due to the incompetence of US leaders, he increased his holdings in Bitcoin, Solana, and Ethereum.

6) On June 6, the head of the Hong Kong Securities and Futures Commission stated that Bitcoin’s endurance through multiple cycles of rise and fall over 15 years demonstrates its resilience as an alternative asset.

7) On June 6, a Chinese university student born in the 2000s was sentenced to four years and six months in prison and fined 30,000 yuan for fraud after withdrawing liquidity seconds after launching a memecoin.

8) On June 6, the SEC chairman stated that inadequate disclosure of information would not exempt cryptocurrency exchanges from lawsuits, and the law would never allow traditional securities exchanges to engage in activities that cryptocurrency exchanges are currently engaged in.

9) On June 6, the Ethereum market sentiment index reached its highest level since March 2023.

10) On June 6, the Financial Services Commission of South Korea announced plans to establish a new virtual asset department.

11) On June 7, the Eurozone’s GDP for the first quarter had a final annualized value of 0.4%, in line with expectations and unchanged from the previous value. The seasonally adjusted employment rate for the first quarter was 0.3%, as expected and unchanged from the previous value.

12) On June 7, Russia announced plans to use central bank digital currencies for international transactions starting in the second half of 2025.

13) On June 7, Bloomberg reported that cryptocurrency custody and trading company Bakkt is considering a sale or spin-off.

14) On June 7, former US President Trump touted himself as the “crypto president” at a tech fundraising event in San Francisco, with nearly $300 million raised by his campaign team in May.

15) On June 7, the founder of cryptocurrency venture capital firm Shima Capital was accused of misappropriating assets, leading to the resignation of several company executives.

16) On June 7, the New York Attorney General sued cryptocurrency company NovaTech for $1 billion in cryptocurrency fraud.

17) On June 8, 17 countries including the US, UK, and France issued a joint statement “urging” Hamas to accept a ceasefire agreement.

18) On June 8, according to sources, the EU would propose the start of accession negotiations with Ukraine this month. Surveys showed that trust in Zelensky has fallen to its lowest level since the Russia-Ukraine conflict began.

19) On June 8, Biden administration aide Vaddi stated that the US would continue to comply with the New START treaty’s restrictions on deploying strategic nuclear weapons, hoping that Russia would agree to discuss a follow-up treaty. The US cannot let Russia’s nuclear threat hinder US military aid to Ukraine.

20) On June 8, the Gemholic project team disappeared from social media after misappropriating $3.3 million.

21) On June 8, US senators proposed a bill to abolish the Fed.

22) On June 9, the market value of BTC surpassed the combined total of the world’s top three banks.

23) On June 9, Indian authorities cracked down on a cryptocurrency fraud ring targeting foreigners.

24) On June 9, the White House announced the deployment of around 80,000 US troops in NATO countries, including 2,300 in Saudi Arabia, 3,800 in Jordan, 700 in Niger, and 75 in Lebanon.

25) On June 9, according to CCTV, South Korea announced the resumption of loudspeaker broadcasts to North Korea, while South Korean media reported that North Korea had once again sent “garbage balloons” to South Korea.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.