FameEX Weekly Market Trend | June 6, 2024

2024-06-06 18:28:06

1. BTC Market Trend

From June 3 to June 5, the BTC price swung from $67,580.2 to $71,765.85, a 6.19% range. The imbalance in the U.S. labor market continued to ease, with job vacancies in April falling below 8.1 million and the job vacancy to unemployment ratio dropping to 1.24, reaching the level of October 2019. This development is bullish for gold, silver, and cryptocurrencies. U.S. ADP employment increased by 152,000 in May, with an expected 175,000, and the previous figure was 192,000, marking the smallest increase since January this year.

In terms of the international situation, on May 31, U.S. President Biden outlined a possible agreement, claiming it was proposed by Israel. According to the agreement, the war will cease, and Israeli hostages held by Hamas in Gaza will be released. He said the ultimate goal is to end the conflict.

On June 3, G7 leaders unanimously endorsed the plan, stating it would “promote an immediate ceasefire in Gaza, release all hostages, significantly and continuously increase humanitarian aid to the entire Gaza region, and completely end this crisis while ensuring Israel’s security interests and the safety of Gaza civilians.” However, on June 4 and 5, both Israel and Hamas ignored Biden’s efforts to end the Gaza war, with both sides stating that their conflicting permanent ceasefire conditions must be met before agreeing to pause fighting.

The EU elections will begin on June 6. For cryptocurrencies, this means that key lawmakers might lose their seats in the new 720-member parliament, leading to a turbulent period for the industry’s policy agenda. Over the past five years, the EU has systematically addressed the challenges of crypto assets by adopting a comprehensive regime known as MiCA. The crypto industry will be watching who will hold several key positions in the new parliament, such as the Committee on Economic and Monetary Affairs, which has played a crucial role in amending and drafting crypto legislation over the past five years. It formed MiCA, the Markets in Crypto-Assets Regulation, and anti-money laundering rules. The Civil Liberties, Justice and Home Affairs Committee, and the Internal Market and Consumer Protection Committee have also impacted crypto legislation, with other important positions being the coordinators of the parliament's political factions.

From June 6 to 9, the overall cryptocurrency market is likely to see a slight increase, following the trends of other major global assets. Attention should be focused on the U.S. May unemployment rate and May non-farm payroll data, which will be released this Friday, June 7.

There is no need to cancel the sell orders for the ETH spot at $4,700, the buy orders at $3,460, and the sell orders for the BTC spot at $72,500 and $77,500, as well as the buy orders at $54,050.

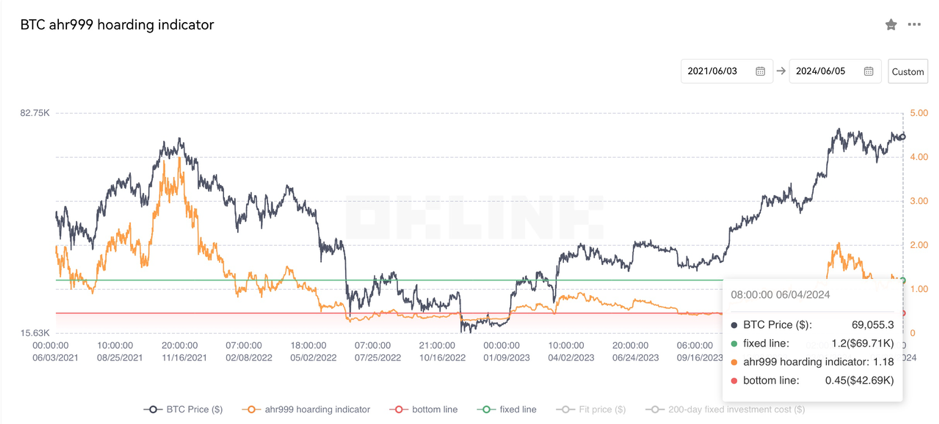

According to the ahr999 coin hoarding indicator, the current indicator value for BTC is 1.18, which exceeds the DCA level ($69,710). Therefore, it is advisable to adopt a wait-and-watch approach and hold off on investing in mainstream cryptocurrencies for the time being.

2. Perpetual Futures

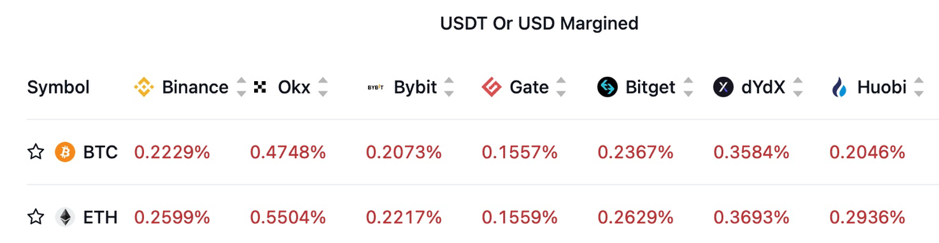

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

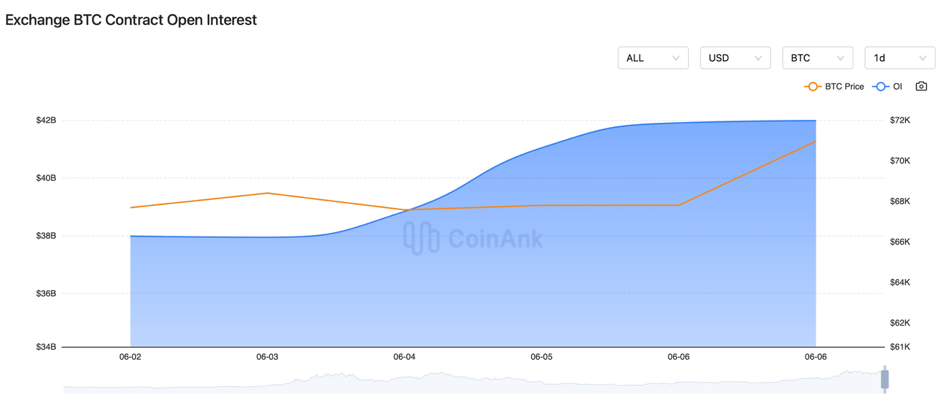

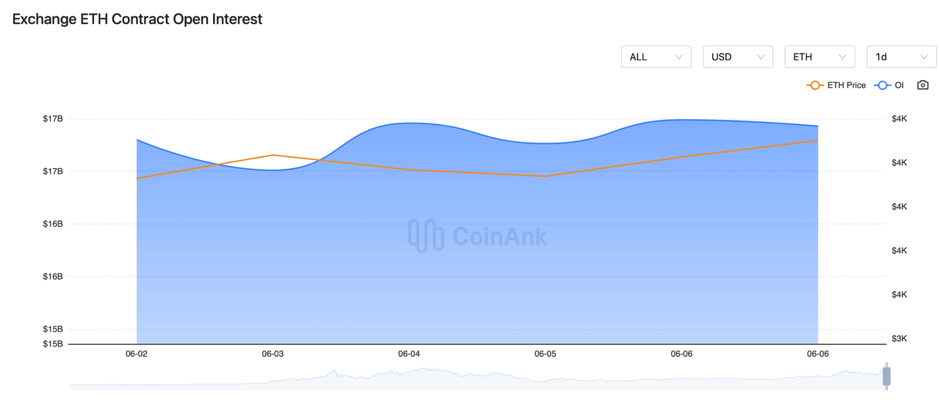

Recently, the BTC contract open interest has been continuously increasing, while the ETH contract open interest has been fluctuating sideways.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On June 3, South Korea announced it would halt the effect of the September 19 Panmunjom Declaration’s military agreement.

2) On June 3, May’s CEX spot trading volume decreased by 22.5% month-on-month, and DEX spot trading volume decreased by 30.6% month-on-month.

3) On June 3, a report stated that global cryptocurrency holders are expected to reach 562 million by 2024, a year-on-year increase of 34%.

4) On June 3, Claudia Sheinbaum, a member of Mexico’s ruling party, was elected president. Therefore, the country’s crypto policies are likely to continue.

5) On June 3, Hong Kong police reported a surge in the use of counterfeit and training notes in cryptocurrency fraud cases.

6) On June 3, the U.S. Navy sought private sector collaboration to advance “PARANOID” blockchain technology.

7) On June 3, Australia’s first Bitcoin spot ETF would begin trading the next day.

8) On June 3, 10x Research identified the Fed’s policies and inflation data as key variables driving Bitcoin to new all-time highs.

9) On June 4, 200 Bitcoins, dormant for 11 years, were transferred, with their current value up 197,785% from 2013.

10) On June 4, Wisconsin’s pension plan might increase investments in Bitcoin spot ETFs.

11) On June 4, a report indicated that up to 88% of deepfake cases in 2023 occurred in the cryptocurrency industry.

12) On June 4, the Thailand Securities and Exchange Commission approved the country’s first Bitcoin spot ETF.

13) On June 4, Hong Kong police announced a crackdown on illegal cryptocurrency gambling during the UEFA European Championship.

14) On June 4, Coinbase CEO urged the crypto community to vote out anti-crypto politicians in the U.S.

15) On June 4, Wisconsin’s pension plan might increase investments in Bitcoin spot ETFs.

16) On June 4, Turkey considered imposing a capital gains tax on stocks and cryptocurrency assets.

17) On June 4, the NSA recommended users reboot their phones weekly can effectively protect against hacking, along with installing the latest security patches, using strong passwords, and enabling two-factor authentication.

18) On June 5, JPMorgan stated that Bitcoin mining companies with substantial electricity supplies could become potential acquisition targets for AI giants.

19) On June 5, the SEC Chair’s stance on cryptocurrencies shifted from “all tokens are securities” to “tokens lack proper disclosure”.

20) On June 5, the Bank of Canada announced a 25 basis point rate cut, becoming the first G7 country to do so.

21) On June 5, Rune’s 24-hour trading volume reached $17.33 million, a 24-hour increase of 16.34%, and its total market cap reached $2.16 billion.

22) On June 5, Argentina officially launched a virtual asset service provider registry.

23) On June 5, Iran’s Revolutionary Guard Corps stated it would respond to Israel’s latest attack in Syria; an Iranian military adviser was killed in Syria on June 2 due to an Israeli attack.

24) On June 5, Modi’s party might win the Indian elections; a surprise result could cause a stock market crash and further delay cryptocurrency legislation.

25) On June 5, a new South Korean law required interest payments on crypto deposits.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.