FameEX Weekly Market Trend | December 21, 2023

2023-12-21 19:22:00

1. Market Trend

From Dec. 18 to Dec. 20, the BTC price swung from $40,542.00 to $44,283.25, with a volatility of 9.23%. The prior report mentioned that for investors with positions, setting a stop-loss at $40,500 would be viable. Multiple instances of bottoming (over 3 times) are quite common in past upward trends. If these occurrences do not damage the structural adjustment but provide strong support, they can contribute to a more powerful backing for subsequent trends. In the past few days, BTC underwent the fourth retracement to a minimum of $40,542, just $42 short of the suggested stop-loss. Anticipating the retracement’s lowest point, a rebound started, reaching a high of $44,000-$44,200. The 1-hour chart shows a healthy trend, with a new upward channel formed after breaking below the uptrend line during the initial retracement. On the 4-hour chart, after initially falling below the MA99 (trend line), it has now reclaimed and stabilized above the MA99 and returned to the rising channel.

Interest rate cuts, halving, the applications for a BlackRock ETF, and the eruption of the BTC ecosystem are expected to bring a series of positive news in the future. It is believed that the current situation is just the beginning of a bull market. Additionally, it’s likely that the recent uptrend won’t experience further corrections shortly due to the substantial volume of this surge and the influx of significant funds. The $45,000 mark is likely to be a new high point in the next few days. Therefore, investors who have already bought in can hold their positions and wait for the rise. For those who haven’t entered yet, building positions in the range of $43,500 to $44,800 may be considered.

Source: BTCUSDT | Binance Spot

Between Dec. 18 and Dec. 20, the price of ETH/BTC fluctuated within a range of 0.04977-0.05343, showing a 7.35% fluctuation. ETH/BTC recently hit a new low, breaking below the key level of 0.0500. The current rebound lacks strength, indicating a concerning trend with substantial selling volume. The price movement has led to the liquidation of on-chain ETH for some users, raising upward resistance and increasing selling pressure. Breaking free from the current deadlock appears challenging in the short term, and the coin’s trajectory is notably out of sync with the overall market. It is recommended to consider staying away from this cryptocurrency for now.

Based on overall analysis, the market is currently witnessing another rise in BTC, approaching the year’s new high. Increased trading volume accompanied by a stable and gradual upward trend implies the healthiest form of growth. While other cryptocurrencies in the market haven’t experienced widespread surges yet, it may be due to the current dominance of BTC. However, their upward phase is likely just a matter of time. In the coming months, a series of positive factors is expected, so investors are advised to hold onto their assets and wait for further increases.

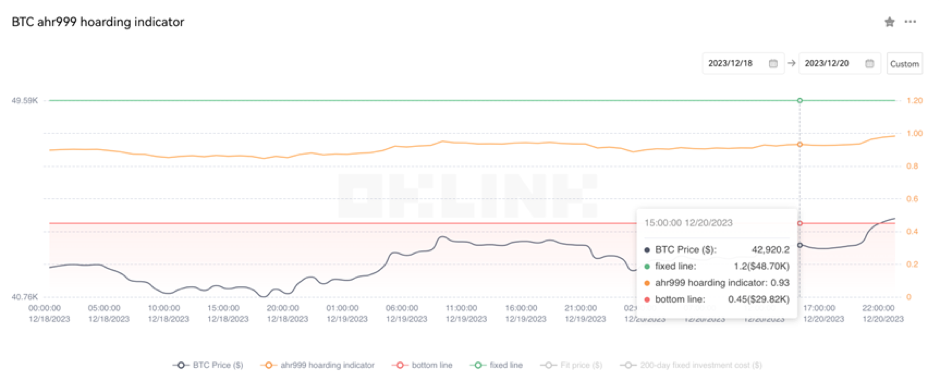

The Bitcoin Ahr999 index of 0.93 is between the buy-the-dip level ($29,820) and the DCA level ($48,700). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

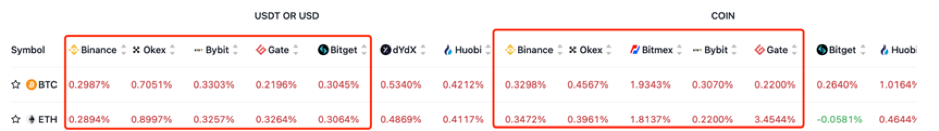

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

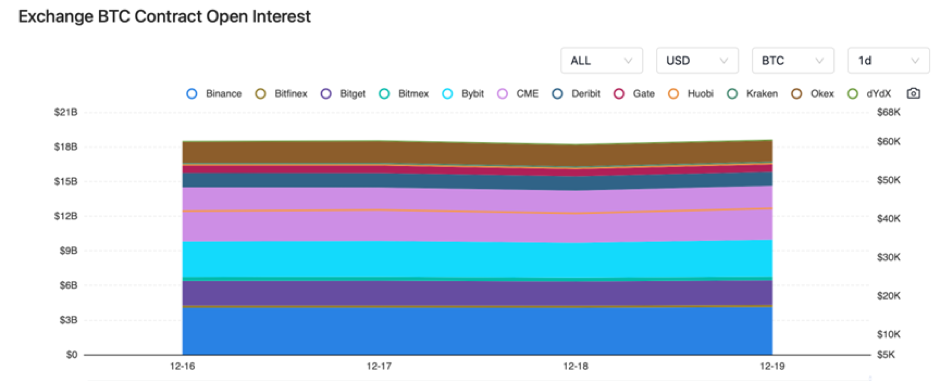

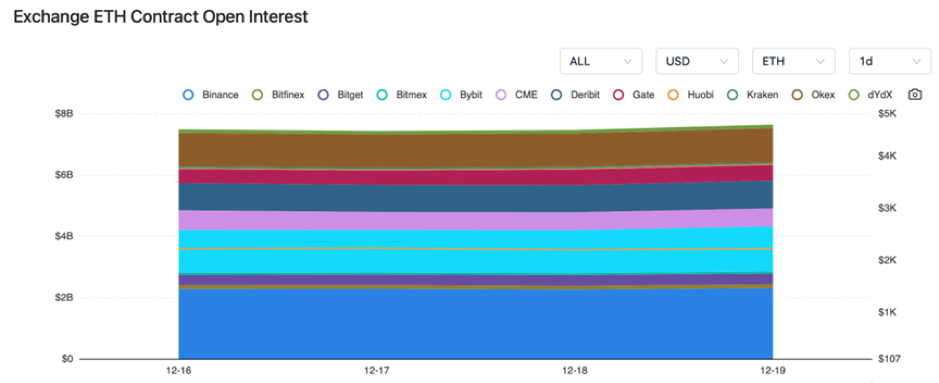

The BTC and ETH contract open interest remained unchanged from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On December 18, MetisDAO launched a $100 million ecosystem development fund.

2) On December 18, BC Technology Group planned to rename itself OSL Group Limited.

3) On December 18, the OKX NFT market surpassed Blur and Opensea in trading volume.

4) On December 19, the SEC postponed the resolution on the Hashdex Ethereum ETF.

5) On December 19, the court approved the settlement agreement between Binance and the CFTC. As a result, CZ will pay $150 million, and Binance will pay $2.7 billion to the CFTC.

6) On December 19, BlackRock resubmitted the revised Bitcoin spot ETF filing with the trading code IBIT.

7) On December 20, SOL’s market capitalization jumped to fifth place.

8) On December 20, Ripple obtained registration as a virtual asset service provider from the Central Bank of Ireland.

9) On December 20, a meeting took place discussing the Bitcoin spot ETF, involving BlackRock, Nasdaq, and the SEC.

10) On December 20, Xai announced a token airdrop scheduled for this month.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.