FameEX Weekly Market Trend | November 30, 2023

2023-11-30 18:59:30

1. Market Trend

From Nov. 27 to Nov. 29, the BTC price swung from $36,707.00 to $38,450.00, with a volatility of 4.75%. The prior analysis mentioned waiting for BTC’s second surge to $38,000. Assessments will depend on the market’s response at $38,000. In the past few days, BTC has now met expectations with a second push to $38,000, showcasing an expected retracement through oscillations rather than a linear one. This suggests waning bearish forces, a bolstered bullish momentum, and a shift in market sentiment towards the bullish side. The market is expected to resume an upward trajectory after the oscillating downward retracement post the second surge to $38,000. There’s a high likelihood of it surpassing the $38,000 resistance level in an oscillating upward fashion without further retracements. For investors not yet in the market, the suggestion is to consider entry during the second surge to $38,000. If missed, entering below $38,000 remains viable for a breakthrough toward $40,000.On the daily chart, BTC’s volatility has slowed down recently, and the trading volume is relatively low. However, the upward trend remains unchanged. This analysis report maintains the viewpoint of holding positions for an expected rise and advises against frequent position changes.

Source: BTCUSDT | Binance Spot

Between Nov. 27 and Nov. 29, the price of ETH/BTC fluctuated within a range of 0.05368-0.05534, showing a 3.09% fluctuation. ETH/BTC did not maintain its expected strong momentum for upward oscillations but instead was suppressed by the 25-day MA (1-hour timeframe), trending downward. The next support level for ETH/BTC is at 0.05337. Aggressive investors may enter above this level, implementing a stop-loss exit if the support is breached and not reclaimed within the 1-hour timeframe. Cautious investors may consider staying away from this cryptocurrency temporarily.

Based on overall analysis, the current market direction remains in an upward oscillation, but the market’s volatility is lower than in the previous period, and the trading volume is slightly inadequate. However, the upward trend persists. Although the main theme remains unchanged, both trading volume and fluctuations have decreased. During such periods of reduced vigilance, sudden market changes may occur. Additionally, with the next significant psychological resistance level for BTC at $40,000, this provides motivation and fuel for potential changes. Therefore, it is strongly advised against shorting at this moment. Even for those with a bearish view, taking a short position should be avoided. The overall strategy for the broader market is to hold onto existing chips and wait for a rise.

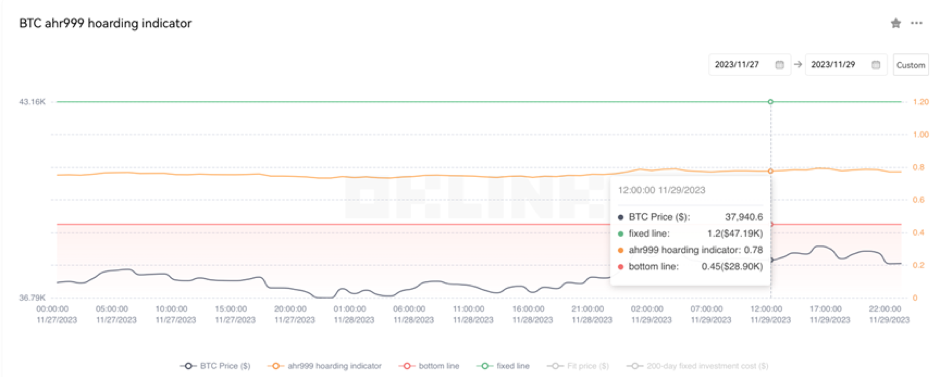

The Bitcoin Ahr999 index of 0.78 is between the buy-the-dip level ($28,900) and the DCA level ($47,190). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

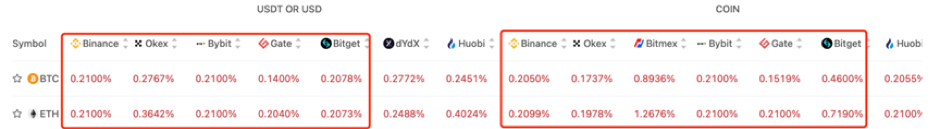

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

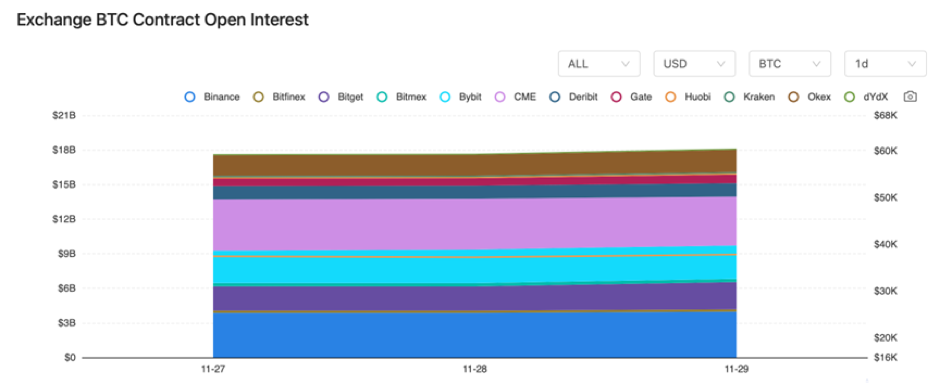

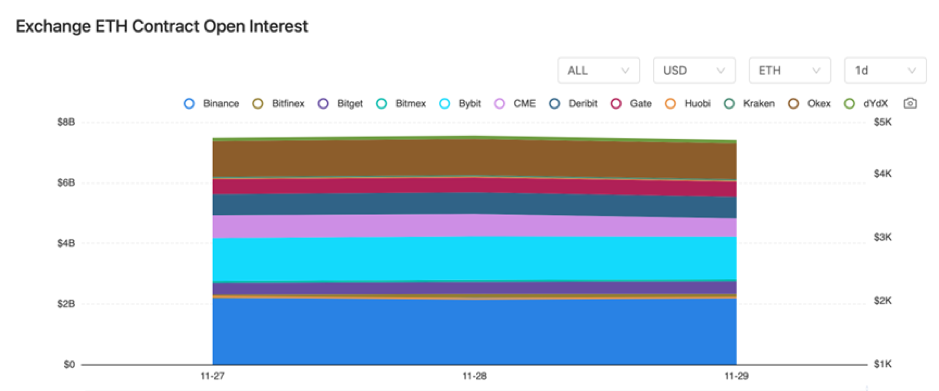

There were barely any changes in the BTC and ETH contract open interest from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On November 27, the U.S. Department of Justice (DOJ) stated that the “flight risk” of Zhao Changpeng (CZ) could be controlled.

2) On November 27, the newly appointed CEO of Binance mentioned that the company has a “robust timetable” for the board and financial disclosures.

3) On November 27, the open interest for CME’s BTC contracts reached a historic high of 118,540 BTC.

4) On November 28, a U.S. judge stated that CZ cannot return to the UAE until next year.

5) On November 28, Google Cloud confirmed its participation in the EigenLayer testnet.

6) On November 28, the Hong Kong Securities and Futures Commission stated that fraud on virtual asset trading platforms does not imply significant regulatory deficiencies.

7) On November 29, Standard Chartered Bank mentioned that Bitcoin is expected to reach $100,000 by the end of 2024.

8) On November 29, Franklin Templeton updated its prospectus for a spot Bitcoin ETF with the SEC.

9) On November 29, insiders reported that Coinbase is collaborating with the CFTC to determine the scope of trading data sharing.

10) On November 29, the Monetary Authority of Singapore Director stated that Bitcoin has no underlying assets and cannot be used for cross-border payments.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.