FameEX Weekly Market Trend | June 26, 2023

2023-06-26 18:06:50

1. Market Trend

Between June 21 and June 25, the BTC price fluctuated between $27001.73 and $31431.94, with a volatility of 16.4%. Based on the 1-hour candle chart, BTC entered a bullish trend starting from the early morning of June 21, consistently surpassing key levels and eventually surpassing $30,000. After breaking this level, there was no significant pullback or selling pressure, and the price consolidated around $30,000, indicating a strong market signal. As BTC rose, many other cryptocurrencies in the market also began to break their resistance levels, confirming market approval and providing some assurance for BTC’s price continuation. In the early morning of June 23, BTC once again broke through $31,000, reaching a new high of $31,400, surpassing the previous high on April 14 at $31,000. It then retraced slightly above $30,000. Based on the previous analysis reports, there were opportune entry points for long positions. Investors who entered at those levels can still hold their positions and set their stop-loss above the entry point to secure profits. (please bear in mind that this is an individual opinion and does not constitute investment advice).

Source: BTCUSDT | Binance Spot

Between June 21 and June 25, the price of ETH/BTC fluctuated within a range of 0.06108 to 0.06404, showing a 4.84% fluctuation. Looking at the hourly candlestick chart, despite BTC’s strong rally, the ETH/BTC trend remains weak, continuing its downward movement within a descending channel. It has yet to break out of the channel and has reached its lowest level in over six months. Currently, it is advisable to stay away from this trading pair and adopt a wait-and-see approach.

Based on overall analysis, the market recently has shown relative prosperity driven by the strong rally of BTC. Trading volume has increased, and there has been an influx of funds into the market. The majority of cryptocurrencies have followed BTC’s upward movement, breaking through resistance levels and displaying a bullish trend. Currently, the BTC price is consolidating around the $30,000 level. The key focus is whether the $30,000 support level can hold in the short term. If it successfully stabilizes at this level, maintaining the bullish structure, there is a high probability that prices will continue to climb further.

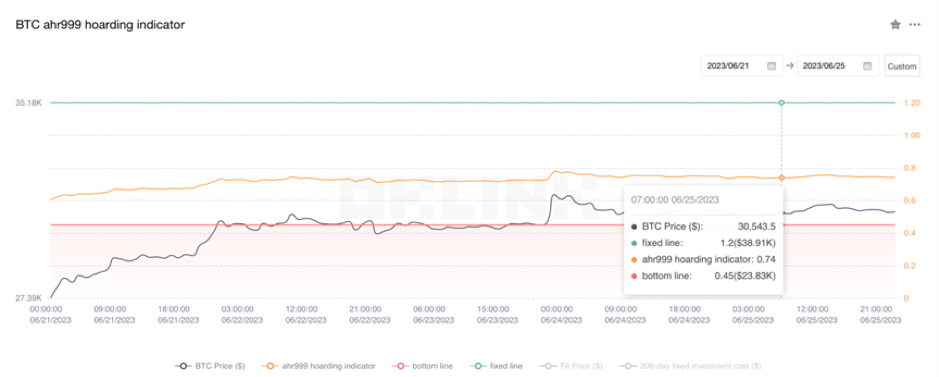

The Bitcoin Ahr999 index of 0.74 is above the buy-the-dip level ($23,830) but below the DCA level ($38,910). It is viable to purchase popular coins through DCA.

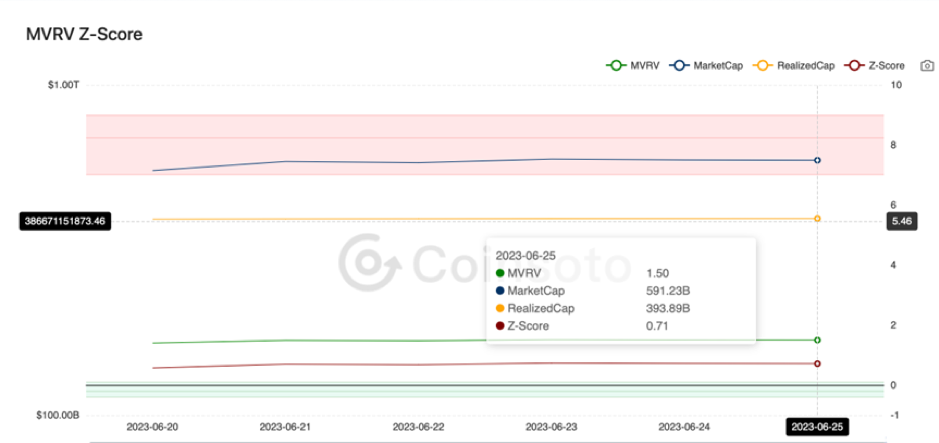

From the perspective of MVRV Z-Score, the value is 0.71. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buying-the-dip range (-0.44-0.09).

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

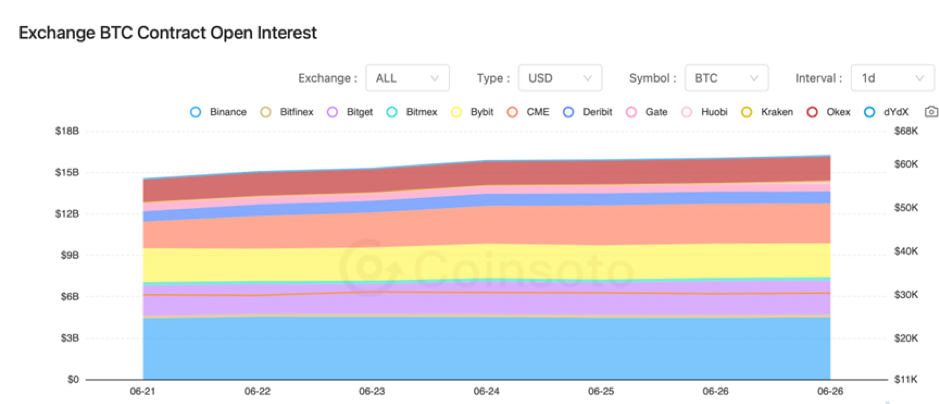

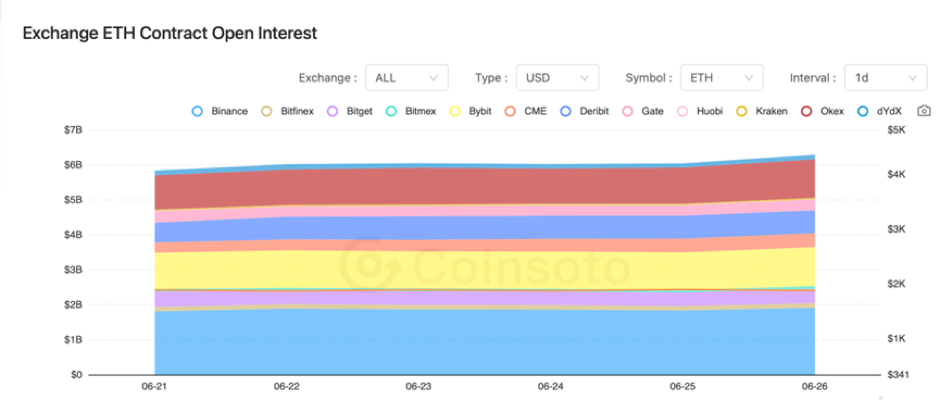

Between June 21 and June 25, the contract open interest of BTC and ETH from major exchanges went up, with BTC experiencing a more pronounced increase compared to ETH.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On June 21, the Monetary Authority of Singapore proposed standards for digital currencies.

2) On June 21, HSBC bank submitted new trademark applications related to metaverse and NFT.

3) On June 21, Tether announced the upcoming issuance of native USDT on the Kava platform.

4) On June 22, Ripple received provisional approval from the Monetary Authority of Singapore for a major payment institution license.

5) On June 22, Federal Reserve Chairman Powell stated that two more interest rate hikes this year would be appropriate.

6) On June 23, Coinbase added VET and VTHO to its listing roadmap.

7) On June 23, a U.S. presidential candidate expressed support for Bitcoin and policies promoting transaction freedom while opposing CBDC.

8) On June 24, Coinbase announced support for the withdrawal and storage of USDC via the Stellar network.

9) On June 24, the U.S. CFTC initiated a review of the contracts offered by KalshiEX LLC, which are used for betting on congressional control.

10) On June 25, the open interest of Bitcoin futures contracts reached a new annual high.

11) On June 25, multiple well-known companies expressed interest in the relaunch of FTX 2.0, according to foreign media.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.