FameEX Daily Technical Analysis | FOMC Kicks off Interest Rate Meeting, Tending to Suspend Rate Hikes

2023-03-22 14:53:00

Yesterday, all major cryptos exhibited price appreciation with fluctuations between 0.05% and 19.75%. With a weak trend, SOL only edged up 0.05%. Conversely, XRP showed the strongest trend, soaring 19.75%. BTC and ETH, two of the leading cryptocurrencies, gained 0.76% and 2.37%, respectively.

According to the 4-hour trading cycle depicted below, after the market became the long trend on March 10th with a rise of over 40%, the price has remained in a narrow consolidation range between $26,578 and $28,472 for the last three days, significantly lowering volatility. From the perspective of SMAs, a long trend was displayed, while the MA7 support was at the same level as the MA25 support. If the long stops pushing up the price later, the short is likely to be back in control.

Overall, the market is favorable to the long trend. Therefore, it is recommended to hold long positions at present, and enter into further orders when the price has a pullback but is above the low point.

During yesterday's trading session, all three major U.S. stock indexes rose. The Dow Jones index, with a relatively weak strength, modestly rose 0.98%. The S&P 500 index climbed 1.31%. The Nasdaq index was strongest, sharply rising 1.58%. Meanwhile, two of the leading cryptos, BTC and ETH, rose 0.76% and 2.37%, respectively.

As to political and economic fields, the Federal Open Market Committee (FOMC) held a two-day meeting regarding interest rates starting Tuesday. In view of the risks of the U.S. and European banks, Bill Ackman, a big name in hedge funds, and William Dudley, a former Fed official, both suggested a suspension of rate hikes. Tesla CEO Musk was more aggressive, calling on the Fed to cut interest rates by 0.5%.

According to the CME's FedWatch tool, traders place an 85% chance or above on the Fed raising rates by 25 basis points in contrast to a nearly 15% chance on not raising rates.

On Tuesday, U.S. Treasury Secretary Alan Yellen told the American Bankers Association (ABA) summit in Washington, D.C. that it is necessary to take deposit guarantee measures, such as measures for Silicon Valley Bank (SVB) and Signature Bank, if similar institutions experience a run and risk contagion.

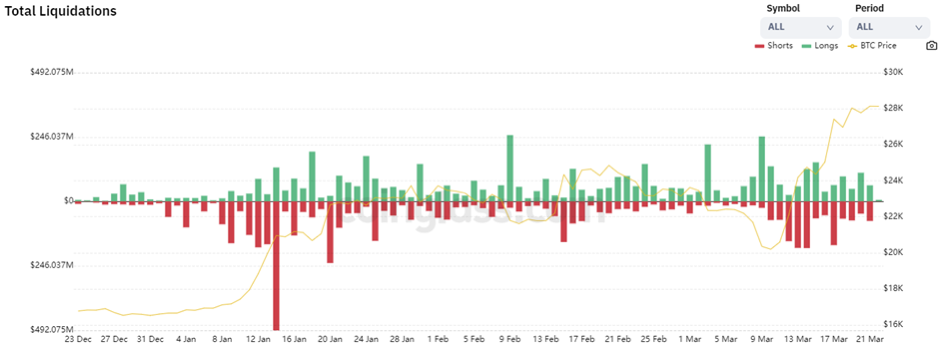

Over the past 24 hours, there has been a total of $61.92 million in long liquidations and $74.62 million in short liquidations, resulting in a net short liquidation of $12.7 million. In general, the change in the total amount of liquidations remained between $100 million and $200 million with a modest change, and investors returned to a rational investment.

The Fear & Greed index has slightly risen to 68, over the significant threshold of 50, and hit a new high since November 2021 in a row. This suggests that the market has become optimistic.

The Bitcoin Ahr999 index has remained 0.81, which is above the support level of 0.45 but below that of 1.2. This shows that the short-term trend becomes strong, but the long-term trend is still a bear market. Therefore, It is not recommended to buy the dip in batches. However, purchasing small amounts through dollar-cost averaging (DCA) may be a viable strategy.

According to the above analysis, the market has become optimistic with a stable price trend. Therefore, we recommend periodically buying with a fixed amount and selling them gradually as the market rises.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.