Trade LTC: Your Complete Litecoin Trading Guide to Buying and Selling Litecoin

2023/11/21 17:21:45

The Basics of Litecoin Trading

What is Litecoin Trading?

Litecoin trading refers to the buying and selling of the cryptocurrency Litecoin on various platforms or exchanges. Traders can trade Litecoin against other cryptocurrencies such as Bitcoin or fiat currencies like the US dollar. By participating in Litecoin trading, traders aim to profit from the price fluctuations of Litecoin by buying low and selling high. This allows them to take advantage of the market movements and potentially earn substantial profits. Litecoin trading offers opportunities for both short-term speculation and long-term investment strategies. Whether a trader prefers to take advantage of short-term price movements or hold onto Litecoin for the long term, there are options available to suit their trading style and goals.

Why is Litecoin Important to Traders?

Litecoin holds great importance for traders due to its unique features and benefits. Being one of the oldest cryptocurrencies, Litecoin has an established track record and a strong market presence. It offers faster transaction times, lower transaction fees, and can handle a larger volume of transactions compared to Bitcoin. These characteristics make Litecoin an attractive choice for traders looking for quick and affordable transactions. Litecoin has strong community backing and is widely accepted, which makes it highly liquid in the markets. Traders can easily find buyers and sellers, ensuring smooth trading experiences. Additionally, the volatility of Litecoin's price creates opportunities for potential profits through short-term trading strategies such as day trading or swing trading.

Litecoin: The Silver To Bitcoin's Gold

Litecoin, often referred to as the "Silver to Bitcoin's Gold," is a popular cryptocurrency that has gained significant attention in the digital currency market. Just like silver holds value and is considered a precious metal, Litecoin is seen as a valuable alternative to Bitcoin. While Bitcoin is often seen as the pioneer and the most dominant cryptocurrency, Litecoin offers several distinct features that set it apart. One of the key differences is the faster transaction confirmation time, thanks to its unique algorithm. This has made Litecoin a preferred choice for those seeking quicker and more efficient transactions. Additionally, Litecoin has a larger maximum supply compared to Bitcoin, which means there will be more Litecoins in circulation. This increased supply and lower price per coin make Litecoin more accessible to a wider range of investors.

Getting Started with Litecoin Trading

Whether you are a seasoned trader looking to diversify your portfolio or a beginner interested in the world of cryptocurrency, Litecoin trading can be a profitable endeavor. This step-by-step Litecoin trading guide will walk you through the essential steps of buying Litecoin, ensuring you have a solid foundation to start your trading journey.

1. Choosing a Regulated Trading Platform or Trusted Crypto Exchange

When venturing into Litecoin trading, it is crucial to choose a reputable and regulated trading platform. Look for platforms that offer a user-friendly interface, competitive fees, and robust security measures. A regulated platform ensures that your funds are protected and provides a transparent trading environment.

Additionally, conducting thorough research on different platforms is essential. Take the time to compare fees, security features, and available trading tools. Reading reviews from other traders can provide valuable insights into the platform's reliability and customer support.

Lastly, consider factors such as liquidity and trading volume. Opting for a platform with ample liquidity ensures that you can easily buy and sell Litecoin, enhancing your trading experience such as using mobile apps.

2. Understanding Litecoin Price Movement Before Buying LTC

Before entering the Litecoin market, it is essential to understand how price movements work. Conduct thorough research, analyze market trends, and utilize technical analysis tools to make informed trading decisions. By understanding the factors influencing price movements, you can optimize your buying and selling strategies.

3. Setting Up Your Trading Account

To start trading Litecoin, you need to set up a trading account on your chosen platform. This typically involves providing basic personal information linked to an email or phone number. Once your account is ready, you can deposit funds and begin trading. At FameEX, users do not need to complete KYC for depositing or trading, making the process easier for everyone. However, you might need to complete the verification process only when you want to withdraw funds.

4. How to Safely Store Your Litecoin After Purchase?

After purchasing Litecoin, it is crucial to prioritize the security and storage of your digital assets. Consider utilizing a hardware wallet or a secure digital wallet to store your Litecoin offline. These wallets provide an extra layer of protection against potential hacking or theft.

By following these steps, you can confidently embark on your Litecoin trading journey. Remember to continuously educate yourself, stay updated with market news, and develop your trading strategies to maximize your chances of success.

What are the Advantages of Trading Litecoin With FameEX?

Trading Litecoin with FameEX presents numerous advantages. The platform offers a real-time price chart that can be easily customized using various technical indicators for comprehensive market analysis. It allows you to check the Litecoin to Tether (LTC/USDT) exchange rate with constant updates due to volatile market changes.

One of the key benefits of FameEX is its scalability. The platform can accommodate both high and modest trading needs. It also offers the benefits of cost-effectiveness; FameEX's Litecoin trading bots help users save on trading fees.

Additionally, FameEX offers competitive fees and low spreads, allowing traders to maximize their profits. With transparent and fair pricing, you can trade Litecoin without worrying about excessive costs eating into your gains. Moreover, FameEX offers a wide range of trading options, including leveraged trading, allowing you to amplify your potential profits. This flexibility enables you to take advantage of market movements and optimize your trading strategy.

Above all, FameEX provides traders with the essential knowledge and assurance to make informed trading decisions. The Litecoin bot trades with precision, maximizing potential profits. This platform permits Australian users to execute their trading actions with ease, making the process both efficient and user-friendly.

What are The Key Trading Strategies for Litecoin?

Understanding the Market Trends for Effective Litecoin Trading

In order to trade Litecoin effectively, it is crucial to have an understanding of the market trends. This involves analyzing past and present data, market volatility, and identifying profitable trading opportunities. Let's delve deeper into these aspects:

Analyzing Market Volatility and Identifying Profitable Trading Opportunities

Cryptocurrency markets, including Litecoin, are renowned for their extreme volatility. This should not be a general deterrent though, but rather treated as a valuable tool for identifying potential trading opportunities. When analyzing market volatility, the key is understanding what triggers these dramatic swings.

Market news, economic indicators, and global events often lead to volatility. For instance, regulatory announcements or major technological advancements can boost or dent investor sentiment, leading to market shake-ups. So, it's crucial to always be informed about the happenings in the crypto space.

Moreover, tools like volatility indexes and volatility charts can be used to measure and visualize the extent of price fluctuations over a certain period. This can help in determining the potential risk and reward of a trade, thus forming a fundamental part of your Litecoin trading strategy.

Remember, volatility increases risk, but it also increases opportunity. It's the peaks and troughs that provide trading opportunities; you just need the skills to leverage them. So, make sure to include volatility analysis in your key trading strategies for Litecoin.

Developing a Strong Trading Plan for Buying and Selling Litecoin

Creating a robust Trading Plan for Litecoin is crucial, and cannot be underestimated. It serves as a command center, directing your course of action. Research and analysis form the backbone of this plan, and they should be updated continuously, keeping pace with the changes in the Litecoin market.

Exploring different strategies to see what aligns best with your risk tolerance and trading goals is an important first step. For instance, Day Trading may fit those who can monitor the movements closely, while Swing Trading may be more suitable for others who can’t dedicate as much time.

Moreover, it's imperative that your plan include a clear exit strategy to safeguard against significant losses. Stop-loss orders and take-profit points can be effective instruments to minimize possible losses and secure your gains.

Remember, a well-determined Trading Plan for Litecoin can function as a protective hedge, maintaining your sanity even during volatile market conditions.

The Importance of Diversifying Your Litecoin Trading Strategy

In the intriguing domain of Litecoin trading, diversification can be your reliable ally. Rather than placing all your investment in one currency or trend, it's suggested to spread it across multiple areas - this, essentially, is what diversification means.

Why is diversification crucial? Firstly, it reduces risk. Imagine if you have invested all your funds in one trend and it fails abruptly. You'll potentially lose everything. But with diversification, your risk is spread across various investments. If one fails, others may succeed, possibly minimizing your overall loss.

Secondly, diversification can potentially increase your opportunities for return. By investing in various trends, you open up prospect to benefit from multiple successful ventures. Also, it helps in maintaining a balanced and healthy portfolio.

Always remember, every investment carries some degree of risk. Diversifying your Litecoin trading strategy is a proactive approach and it provides a cushion against possible market volatility. However, make sure the diversification is purposeful. Random investment in numerous trends without understanding their potentials isn’t diversification - it's chaos.

Invest smartly, diversify cautiously and keep thriving in the Litecoin trading world.

How to Manage Risk When Trading Litecoin?

When it comes to trading Litecoin, it's crucial to have a solid understanding of risk management strategies. This ensures that you can make informed decisions and minimize potential losses. Here, we will explore some key points on how to manage risk when trading Litecoin.

The High Risk of Losing Money Rapidly Due to Leverage in Litecoin Trading

Leverage can be a powerful tool in trading, but it also comes with a high risk. It's important to understand that leverage amplifies both profits and losses. Therefore, it's essential to use leverage cautiously and have a clear risk management plan in place. You should consider whether you can afford to take the high risk of losing your money.

Assessing Whether You Can Afford the High Risk of Trading Litecoin

Trading Litecoin, like any investment, carries a certain level of risk. Before getting involved, it's essential to assess your financial situation and determine whether you can afford to take on the risks associated with trading. This includes considering factors such as your risk tolerance, capital availability, and investment goals.

Risk Management Techniques for Successful Trading

Here are some techniques to help you minimize risks and execute trades effectively when buying and selling Litecoin, it is important to consider the following best practices:

- Set Stop-Loss Orders: A stop-loss order is a predetermined price at which you will exit a trade to limit your losses. By setting stop-loss orders, you can protect yourself from significant losses if the market moves against you.

- Use Proper Position Sizing: Proper position sizing involves determining the appropriate amount of capital to allocate to each trade. This ensures that even if a trade results in a loss, it doesn't significantly impact your overall account balance.

- Diversify Your Portfolio: Diversification is key to reducing risk in trading. By spreading your investments across different assets or cryptocurrencies, you can minimize the impact of a single trade or market event.

- Stay Informed: Stay updated with the latest news, market trends, and analysis. This helps you make informed trading decisions and avoid unexpected market movements that could lead to losses.

- Keep Emotions in Check: Emotions can cloud judgment and lead to impulsive trading decisions. Develop a trading plan and stick to it, regardless of market fluctuations. Discipline and patience are crucial for successful trading.

- Use Technical Analysis: Technical analysis involves studying past price movements and patterns to predict future price of litecoin. By analyzing charts, indicators, and trends, you can make more informed trading decisions.

- Practice Risk-Reward Ratio: Before entering a trade, always assess the potential reward compared to the risk you are taking. Aim for a favorable risk-reward ratio, where the potential reward outweighs the potential loss.

Remember, successful trading is not about eliminating risks completely but managing them effectively. By implementing these risk management techniques, you can enhance your trading strategy and increase your chances of profitable trades.

Benefitting from FameEX’s Risk-Management Tools in Litecoin Trading

Maximize your Litecoin trading success with FameEX's advanced risk management tools is easy. Understanding the volatility of Litecoin markets, FameEX offers several essential strategies for traders to manage their risks. The following are key highlights:

Grid Trading AI Tool

FameEX also offers a Quant AI tool for grid trading, which automates your trading strategy by executing 'Buy Low and Sell High' tactics. The FameEX Grid Trading quant tool stands out as a premier risk management solution for traders. Its automated capabilities enable it to execute digital asset transactions precisely when it's most beneficial, operating continuously without requiring human oversight. This innovative AI trading bot brings new levels of flexibility to trading, allowing traders to operate on their schedule while promoting a systematic, disciplined approach to trading automation. It capitalizes on the predictable fluctuations in a cryptocurrency's price, enabling profit generation from even minor changes in value. Especially effective in markets where prices fluctuate within a narrow range, this tool helps traders stay calm and collected, avoiding impulsive decisions often triggered by the fear of missing out (FOMO).

Perpetual Futures to Hedge Your Funds

The use of perpetual futures on the FameEX platform presents a strategic advantage for Litecoin traders seeking robust risk management solutions. Perpetual futures, with their unique feature of no expiry date, offer a continuous and flexible approach to hedging. This flexibility is vital in the volatile crypto market, allowing traders to protect their investments against sudden price swings in Litecoin. Through FameEX, traders gain access to advanced tools that enable precise control over their positions, such as setting leverage levels or stop-loss orders and employing strategies like short selling to counterbalance market fluctuations. These features are instrumental in mitigating risks, ensuring that traders can capitalize on market movements while effectively managing potential losses.

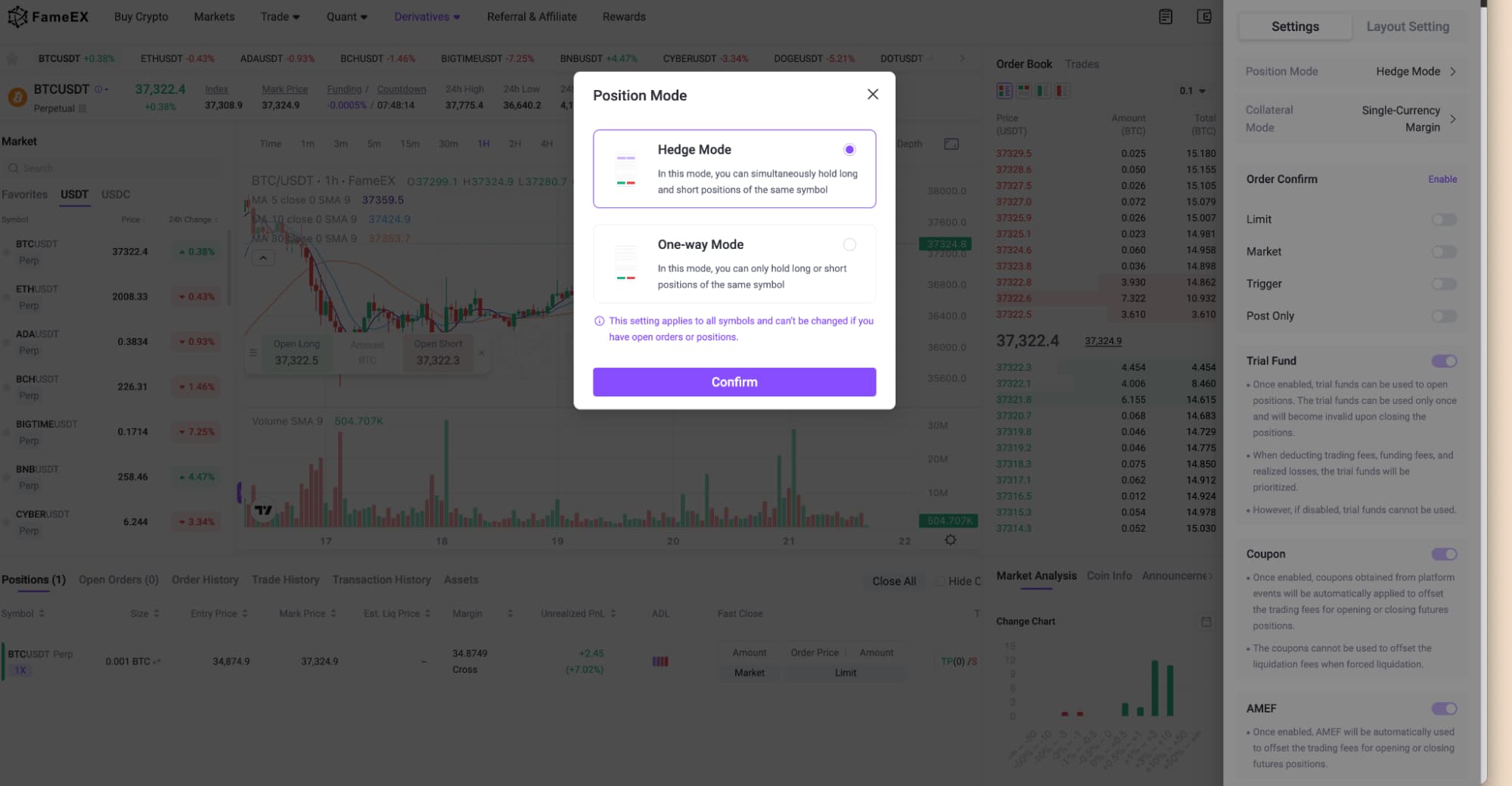

FameEX's risk management tool in futures stands out with its innovative Position Mode, offering traders an effective way to manage their investments. The tool provides two distinct modes: One-way Mode and Hedge Mode. In One-way Mode, traders can either hold long or short positions for the same symbol, enabling a straightforward approach where profits and losses counterbalance each other. This mode is enhanced by the "Reduce-Only" order type, which strategically allows traders to decrease their positions without inadvertently opening new ones in the opposite direction. On the other hand, Hedge Mode offers the flexibility to simultaneously hold both long and short positions for the same symbol. This unique feature empowers traders to hedge their position risks across different market movements within the same symbol, offering a multifaceted approach to risk management.

After all, by diversifying investments across a variety of assets, FameEX emphasizes the importance of minimizing risk exposure. Stay informed with the latest Litecoin market trends and news with our comprehensive insights, giving traders an edge in the dynamic world of cryptocurrency. Our in-depth analysis of technical aspects equips traders with tools to analyze past Litecoin price movements, aiding in more accurate future projections. Additionally, FameEX encourages a meticulous approach to risk-reward assessment, focusing on opportunities with greater potential rewards. This strategic blend of risk management tools and techniques, curated by FameEX, not only mitigates trading risks but also enhances the profitable opportunities in Litecoin trading.

Conclusion

In conclusion, understanding the process of buying and selling Litecoin (LTC) is essential for traders looking to venture into the cryptocurrency market. By following the steps outlined in this guide, such as creating an account on a reputable trading platform like FameEX, depositing funds, and executing buy and sell orders, traders can engage in Litecoin trading effectively.

A key aspect to consider when trading LTC is the constant fluctuations in the LTC/USDT price. Therefore, it is crucial to stay updated on market trends and utilize tools like the order book on FameEX to view current buy and sell orders for LTC/USDT. Additionally, conducting thorough research, setting stop-loss orders, diversifying your portfolio, and staying informed about market news and events are best practices that can enhance successful and profitable Litecoin trading.

FAQ About Litecoin Trading

Q: Is Litecoin good for day trading?

A: Yes, Litecoin is considered a popular cryptocurrency for day trading. It offers ample trade volume and price swings, providing opportunities for day traders to profit from. Additionally, Litecoin has gained recognition as "Bitcoin's little brother," further adding to its popularity among traders.

Q: Is Litecoin a good long-term investment?

A: The long-term outlook for Litecoin remains uncertain. However, it has consistently ranked among the top five cryptocurrencies in terms of market capitalization. This high market capitalization ensures liquidity and profit potential for investors and traders. Ultimately, the decision to invest in Litecoin or any other cryptocurrency should be made after conducting thorough research and considering personal risk tolerance.

Q: Where can I trade Litecoin?

A: There are multiple platforms where you can trade Litecoin, and one prominent option is FameEX. FameEX is a reputable cryptocurrency exchange that provides a secure and user-friendly trading environment. With a strong track record, FameEX offers a variety of trading pairs, including Litecoin. Traders can benefit from FameEX's reliable order execution and competitive fees.

Q: What are the tips for successful and profitable Litecoin trading?

A: To ensure success and profitability when trading Litecoin, it is essential to follow some valuable tips. These include staying updated on market news and trends, adapting strategies as the market evolves, diversifying trades across different cryptocurrencies and markets, and maintaining discipline in trading decisions. By implementing these tips and approaches, traders can maximize their chances of making informed trading decisions and achieving their objectives in the Litecoin market.

Q: What are the most effective Litecoin trading strategies?

A: The most effective Litecoin trading strategies involve understanding the cryptocurrency market, analyzing price movements, and applying sound trading principles.

Q: How does Litecoin work on an exchange?

A: On a cryptocurrency exchange, Litecoin can be bought, sold, or traded against other digital assets based on its current price in the market.

Q: What are the alternatives to Litecoin?

A: Bitcoin and other cryptocurrencies are alternatives to Litecoin for trading and investment purposes.

Q: What factors should I consider before buying Litecoin?

A: Before buying Litecoin, consider whether you understand the volatility of the cryptocurrency market, Litecoin's price movements, and the risks involved in trading.

Q: What are the trading hours for Litecoin?

A: Litecoin can be traded 24/7 on cryptocurrency exchanges, unlike traditional financial markets that have specific trading hours.

Q: How can I go short on Litecoin?

A: Going short on Litecoin involves speculating on the price decreases of the cryptocurrency, with the aim of profiting from the downward movements.

Q: What should I do if the price of Litecoin increases?

A: If the price of Litecoin increases, you can consider taking profits by closing your position, or continue holding Litecoin with the expectation of further price gains.

Q: How do I buy Litecoin?

A: You can buy Litecoin on a cryptocurrency exchange by placing an order to purchase the desired amount of Litecoin at the current price.

Q: Is buying and holding Litecoin a viable strategy?

A: Buying and holding Litecoin can be a viable long-term strategy if you believe in the potential of the cryptocurrency and are willing to endure price fluctuations.

Q: What is the significance of speculating on the price movements instead of buying and holding Litecoin?

A: Speculating on the price movements allows traders to capitalize on short-term fluctuations in Litecoin's value without taking ownership of the cryptocurrency.

The information on this website is for general information only. It should not be taken as constituting professional advice from FameEX.