How to Evaluate Cryptocurrency? Understanding Its Value Before Investment

2024/02/05 20:07:40

Cryptocurrencies have rapidly evolved into a mature asset category, especially in Australia, where they are increasingly recognized as more than just a tool for speculation. This is evidenced by the significant investments and active pursuit of crypto ETFs by many of the world's leading investment banks. Like all investments, cryptocurrencies demand thorough due diligence. This article will provide you with a detailed, step-by-step guide to evaluate your investments, ensuring they are both well-informed and strategically sound.

Why is Evaluating a Cryptocurrency Necessary?

Evaluating a cryptocurrency is crucial for Australian investors, enthusiasts, and financial analysts. This evaluation not only helps in understanding the inherent value and potential of a digital currency but also in making informed decisions in a highly volatile market. We will explore the reasons why cryptocurrency evaluation is crucial and delve into specific aspects that should be considered during the process.

Understanding the Value of Cryptocurrencies

Cryptocurrencies differ from traditional currencies like the Australian dollar, U.S dollar or Euro, as they lack a central governing authority, like a government, to oversee their valuation. This absence of a centralized regulatory entity means there are no definitive factors influencing the shifts in cryptocurrency's value. The value of cryptocurrency primarily hinges on the collective perception of its worth in the market. If a significant number of people deem it valuable, its value rises. This unregulated nature leads to volatility, with demand driving the fluctuations. These shifts can be pronounced, and influenced by additional elements such as the cryptocurrency's availability, its practical uses, and the level of competition in the market.

Besides, investors can also focus on the fundamental aspects that contribute to the value of cryptocurrencies like technology, market demand, utility, and the community's strength that collectively determine a cryptocurrency's worth. By understanding these factors, traders can gauge the intrinsic value and long-term potential of a digital currency.

The value of the cryptocurrency market is known for its fluctuations, at times reaching unprecedented peaks and in other instances experiencing notable drops. Grasping the valuation principles of cryptocurrency sheds light on these shifts.

The Importance of Cryptocurrency Evaluation Before Investing

In Australia, investing in cryptocurrencies demands a thorough evaluation due to their volatile and unpredictable nature. Understanding the market trends, technology, regulatory environment, and potential risks associated with each cryptocurrency is crucial. An in-depth evaluation helps investors make informed decisions, discerning between promising digital currencies and those that might not yield desired returns. It involves assessing the coin's utility, underlying blockchain technology, team expertise, community support, and market position. Additionally, keeping abreast of global or Australian regulatory changes and technological advancements can significantly impact your investment's future. Proper cryptocurrency evaluation minimizes risks and maximizes potential gains, ensuring a strategic approach to this dynamic and emerging investment landscape.

Understanding the Relation Between Investment Decisions and Crypto Analysis in Australia

Crypto analysis, encompassing both fundamental and technical aspects, provides a comprehensive view of the Australian market's current state and potential future trends. Fundamental analysis involves evaluating the intrinsic value of a cryptocurrency by examining factors like technology, team, market demand, and regulatory environment. Meanwhile, technical analysis focuses on statistical trends gathered from market activity, including price movements and trading volume. By integrating these methods, Australian investors can make more informed decisions, balancing potential risks with possible rewards. This approach helps in identifying promising investment opportunities and mitigating the inherent unpredictability of the crypto market, ultimately leading to more strategic and potentially profitable investment decisions.

» Further Reading: Crypto Trading for Beginners: How to Trade Cryptocurrency in 2024

What is Cryptocurrency?

Cryptocurrency represents a revolutionary form of digital or virtual currency that uses cryptography for secure financial transactions. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology. Cryptocurrency stands distinct from digital currency. While digital currency, backed by financial institutions, can be converted into cash at banks or ATMs, cryptocurrency operates differently. Transactions made with cryptocurrencies are logged on the blockchain, a digital ledger that securely records electronic data to demonstrate ownership, rather than being authenticated by a financial institution as with digital currency.

While Bitcoin has been around since 2009, the broader applications of cryptocurrencies and blockchain technology in finance are still evolving such as the approval for Bitcoin spot ETFs in 2024. It's anticipated that they could be used for trading various financial assets like bonds and stocks in the future. Several cryptocurrencies exist alongside Bitcoin. Ethereum, created in 2015, is a blockchain platform with its cryptocurrency, Ethereum, and is second in popularity to Bitcoin. Litecoin, similar to Bitcoin but with quicker development in innovations like faster payments, is another notable cryptocurrency. People can also trade those cryptocurrencies on centralized exchanges like FameEX. If you want to know more about cryptocurrency, you can refer to this guide here for more.

What Are the Key Techniques to Analyze Cryptocurrencies?

Analyzing cryptocurrencies is a multifaceted process involving various techniques that help investors and enthusiasts understand and predict market trends, project viability, and investment potential. This section explores the key methodologies and tools essential for effective cryptocurrency analysis.

1. Basics Information of Crypto Analysis

With effective cryptocurrency analysis, one key aspect to evaluate is the quality of a project's website. A credible crypto project typically showcases a well-designed, user-friendly website that is easy to explore and understand. This platform should clearly articulate the team's vision and offerings, providing visitors with insights into their objectives and plans. Be wary of projects that lack a dedicated website or present one that is poorly constructed and unfinished, as this often signals a lack of professionalism and seriousness. Essential elements to look for on a cryptocurrency project's website include:

・Regular updates about the project's latest developments and activities in the crypto industry.

・High-quality content that is free from grammatical and typographical errors.

・Detailed information about the team members and founders, showcasing their expertise and roles.

・Information on significant partnerships within the industry, highlighting the project's network and collaborations.

・A clear vision for the token's function and role within the project's ecosystem.

・Accessible to the project's white paper, which should be available for download and detail the project’s objectives and strategies.

・Evidence of engagement from the project's community, such as social media shares. Links to the project's various social media accounts, indicating active engagement across different platforms instead of fraud.

Above are just a few of the basic evaluation criteria for projects, serving as a first step for newbies to assess these projects.

2. Reading a Cryptocurrency White Paper: An Essential Step for Evaluation

While some white papers are highly technical, a thorough review is essential to grasp the project's intricacies and assess its feasibility. Such an evaluation is crucial in predicting the potential adoption and success of the cryptocurrency. A white paper is a critical document for any cryptocurrency initiative, providing a comprehensive overview of the project. It encompasses the project's objectives, functionality, strategies, vision, and economic model. Key elements typically found in a white paper include:

・The specific issue the project aims to address.

・An outline of the consensus mechanism employed in the project.

・Distinctive features that differentiate the token from its competitors.

・An explanation of the token's purpose and functionality. Information about the process of token creation, destruction, and transaction mechanisms. Critical questions such as the mechanics of the token system, total supply, and distribution plan.

・Insight into the team's vision, along with their proposed methods and strategies for realizing it. A detailed roadmap, illustrating the project's anticipated evolution and progress.

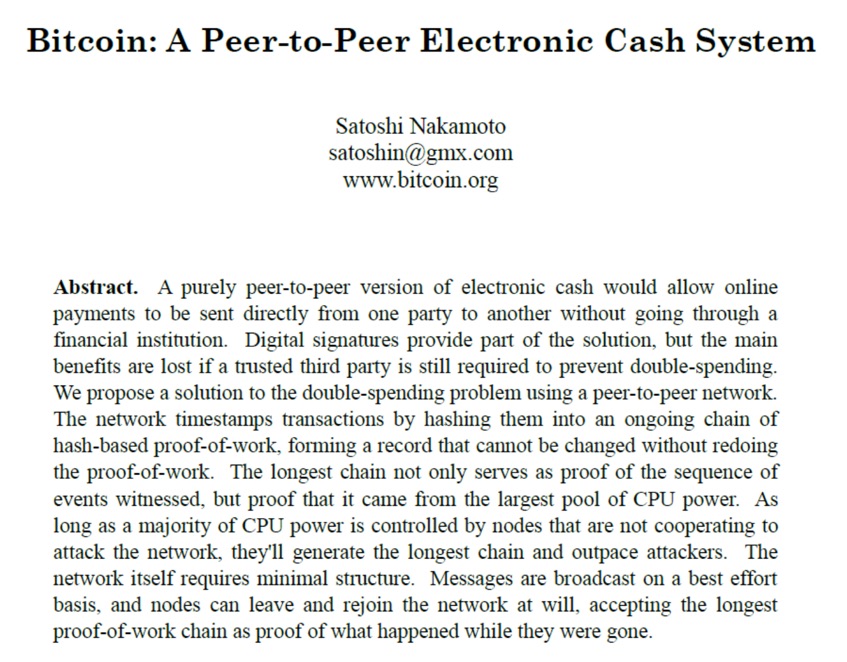

The most famous white paper, known as 'Bitcoin: A Peer-to-Peer Electronic Cash System,' has been influential since its initial release on October 31, 2008. This groundbreaking document was authored by the enigmatic Satoshi Nakamoto, an individual or group whose identity remains unknown to this day. The white paper envisioned a decentralized online payment system that operates independently, ensures robust security, and features a finite supply of currency units.

Such an evaluation is crucial in predicting the potential adoption and success of the cryptocurrency.

3. Traversing the Crypto Space: Technical Analysis Fundamentals

Technical analysis is a vital tool for predicting future market behavior based on past market data. Fundamental analysis, coupled with technical analysis, is an essential method for evaluating an asset's true value, particularly in cryptocurrencies. This comprehensive approach involves scrutinizing various qualitative, quantitative, and economic aspects to determine the intrinsic worth of a cryptocurrency. The aim is to ascertain whether the cryptocurrency is overvalued, undervalued, or fairly priced in the market by analyzing its foundational health and performance metrics.

Fundamental analysis extends beyond just examining a company's financial statements and market share, as typically done with stocks. It includes an in-depth evaluation of the underlying technology, security features, development team, community support, and market trends. Moreover, a crucial component of this fundamental analysis is the examination of the cryptocurrency's whitepaper and roadmap to understand its future potential and sustainability.

Technical analysis is also integrated into this process, where historical price data and market trends are analyzed to predict future price movements. This involves studying price charts, identifying patterns, and utilizing various indicators to gauge market sentiment and investor behavior. By combining both fundamental and technical analysis, investors can make more informed decisions, balancing the real value of the cryptocurrency with its speculative market price.

Source: Technical Analysis from TradingVIew

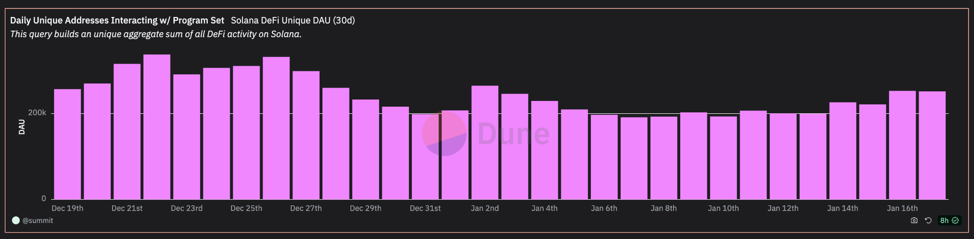

4. Digging Deeper into Tokenomics: The Backbone of Crypto Projects

Tokenomics refers to the economic policies and attributes of a cryptocurrency that affect its supply and demand. Tokenomics pertains to the financial framework of a project and the role of its token within that ecosystem. If a token functions merely as a payment method, its worth tends to be volatile with market trends.

On the other hand, when a token serves as the driving force behind a decentralized application (DApp), its economic structure becomes intricate, leading to potentially greater stability in its value. Grasping the tokenomics of a venture is crucial prior to investment, as it offers a glimpse into the token's prospective worth.

Traders can focus on understanding the tokenomics of a cryptocurrency, which involves studying its total supply, circulation, and functional role within the project's ecosystem. They evaluate factors that could impact the token's enduring value, including its rarity and its significance in facilitating transactions and governance within the project.

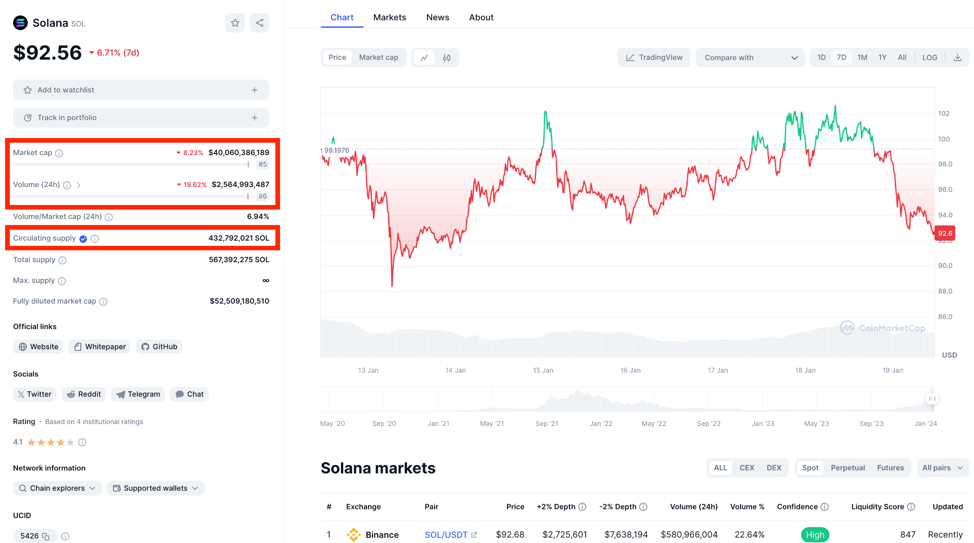

5. Assessing the Trading Volume, Market Capitalization and Volatility: The Core Metrics

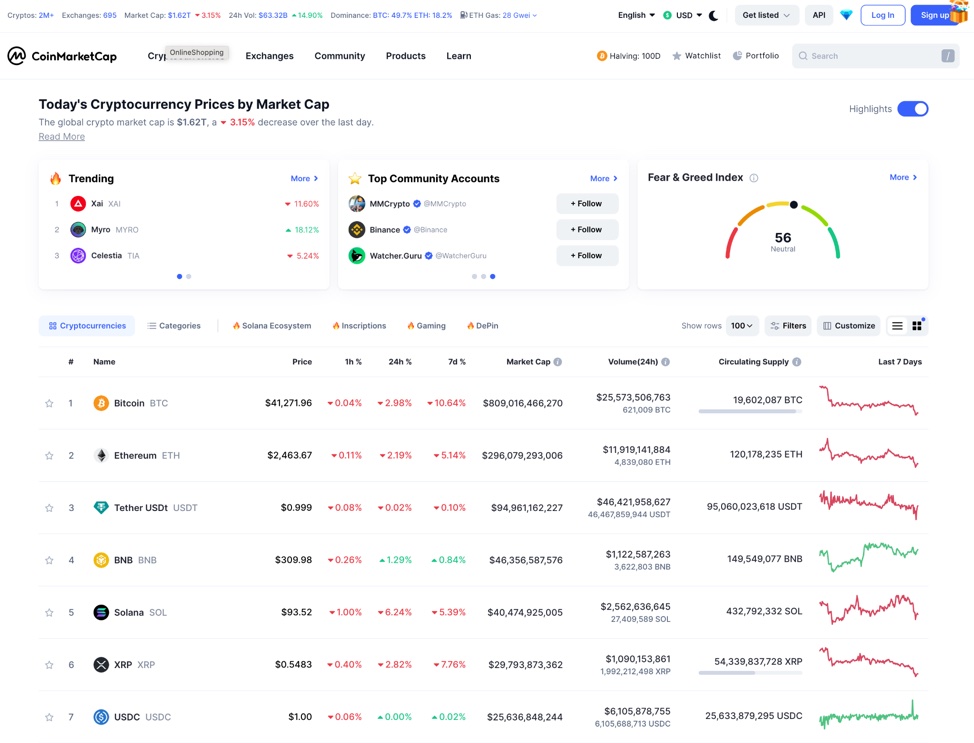

To gather these core metrics, it's recommended to use a cryptocurrency platform like CoinMarketCap or CoinGecko. Distinguishing between a beginner and an experienced investor often comes down to their understanding of three key market metrics:

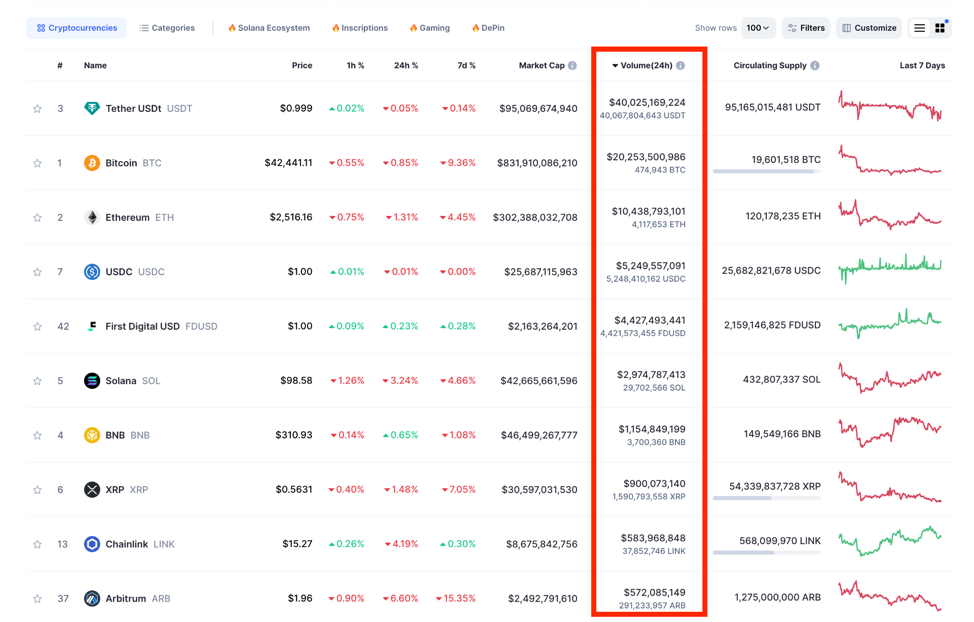

・Trading Volume: This metric reflects the amount of a cryptocurrency traded over a certain period. High trading volume indicates active buying and selling, which usually translates to better liquidity and more stable prices. For instance, Tether (USDT) has a daily trading volume of over $40 billion at the time of this writing. However, a low trading volume can imply a lack of investor confidence, potentially leading to erratic price movements and poor liquidity.

Source: CoinMarketCap

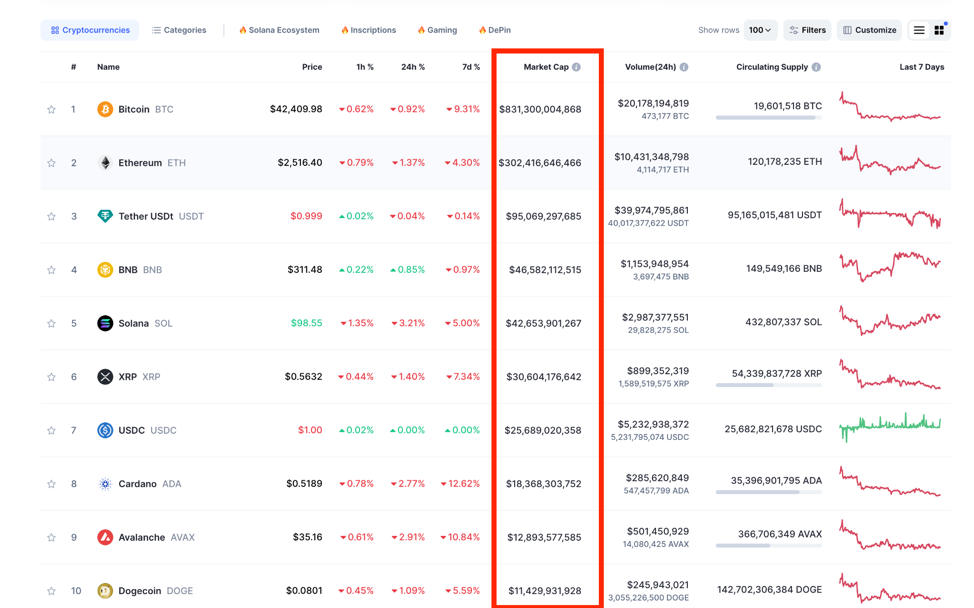

・Market Capitalization: This is determined by multiplying a cryptocurrency's current price by its total circulating supply. Investing in cryptocurrencies with a high market cap above $1 billion is often seen as safer. However, it's not always reliable as even high market cap cryptocurrencies can carry significant risks. Some new and emerging projects with strong potential and partnerships may have lower market caps but could be promising if given more time or visibility. Typically, cryptocurrencies ranked in the top 100 are considered more secure investments compared to those lower down.

Source: CoinMarketCap

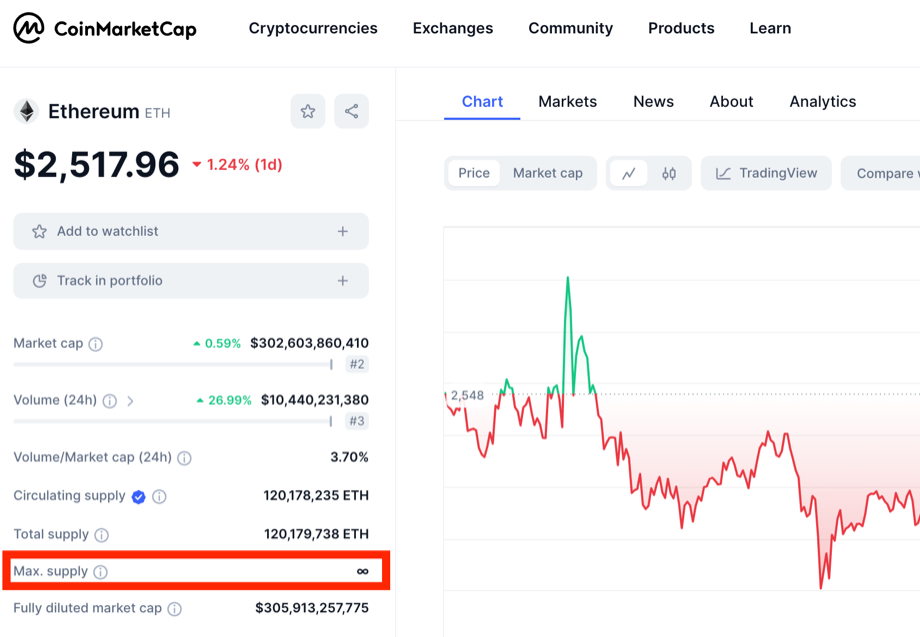

・Supply Metrics: Many cryptocurrencies have a maximum supply limit, which is the total number they will ever issue. While some, like Ethereum (ETH), have no capped supply, most have a defined limit, even if it's in the billions. The circulating supply represents the coins currently available for trade or held in wallets. Understanding the distinctions between maximum, circulating, and total supply is crucial for informed investment decisions, as it can give insights into a coin's potential scarcity and influence on its value.

Source: CoinMarketCap

All three key factors explain how these metrics provide essential insights into the market presence, investor interest, and price stability of a cryptocurrency. Understanding these metrics is crucial for evaluating the market strength and investment risk associated with a particular cryptocurrency.

How to Evaluate the Potential and Value of a Cryptocurrency?

Evaluating the potential and value of a cryptocurrency is a critical step for Australian investors and enthusiasts to make informed decisions. This section delves into various aspects that contribute to the overall assessment of a cryptocurrency's worth and future prospects in the Australian market.

Decoding Token Value: What Does the Price of a Cryptocurrency Indicate?

The price of a cryptocurrency in Australia is influenced by market demand, investor sentiment, and fundamentals of the underlying project. The price is often a reflection of how much demand exists in the market for that particular token, influenced by investor interest and confidence. High demand can lead to price increases, whereas low demand might cause a decrease. Also, the stability of a cryptocurrency's price is another important factor. Frequent and drastic fluctuations can indicate a risky investment.

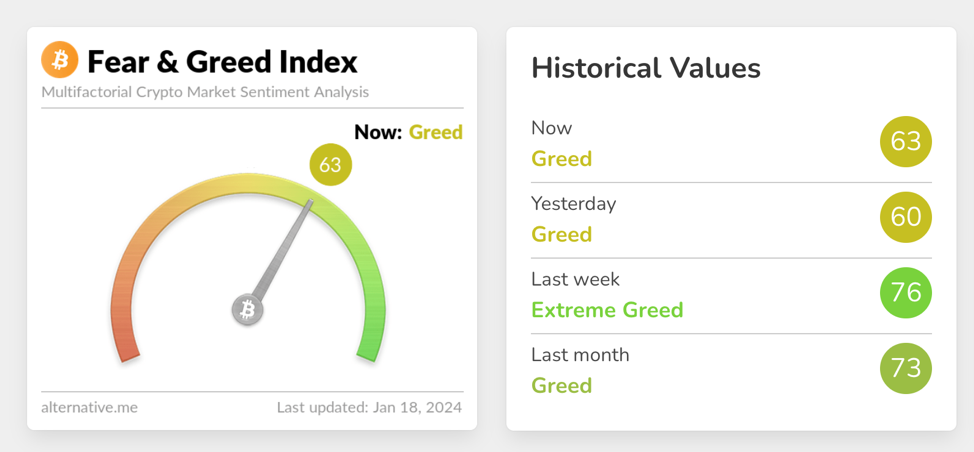

Investor sentiment, driven by news, market trends, and overall economic conditions, also plays a crucial role. Positive news can boost confidence, leading to price increases, while negative news can result in decreases. The Bitcoin Fear and Greed Index operates on the principle that two primary emotions, fear and greed, significantly impact market dynamics. When fear predominates, market participants, concerned about losing capital and market stability, might sell assets or engage in short-selling to capitalize on the prevailing sentiment. This fear is often triggered by factors like macroeconomic issues, specific asset declines, or negative publicity impacting crypto tokens. In contrast, greed drives participants to accumulate assets, spurred by the fear of missing out (FOMO) on potential gains during upward market trends. This index measures whether markets or assets are trading above or below their true value due to these emotions, presented on a spectrum from extreme fear to extreme greed.

Bitcoin Fear & Greed Index, Source: Alternative

Lastly, the fundamentals of the project, such as its utility, technological innovation, team credibility, and real-world application, underpin the long-term value of the cryptocurrency. A robust and innovative project is more likely to attract investors and retain value over time. Understanding these factors will help in obtaining more insights behind a cryptocurrency's price.

Fundamentals of Evaluating a Cryptocurrency's Market Cap in Australia

When evaluating a cryptocurrency's market cap, Australian investors should consider the relationship between market cap and liquidity in the Australian market and the long-term investment potential in the context of Australian technological innovation and market adoption.These aspects collectively provide a more comprehensive understanding of a cryptocurrency's market cap and its overall position in the market in the long run.

Market caps categorize companies and cryptocurrencies based on their total value, akin to large-cap, mid-cap, and small-cap classifications in the business and Web3 worlds. This classification helps distinguish between cryptocurrencies of varying risk and growth potential. Essentially, the market cap serves as an indicator of a cryptocurrency's popularity and significance within the crypto ecosystem at a given time.

Different Ways to Evaluate the Potential of a Crypto Project

In addition to the factors already considered, there are several key aspects that still need to be evaluated. It's crucial to assess the technical innovation of the project. This includes understanding the unique features and technological advancements it brings to the table. Next, examining the team's background is vital. A strong team often comprises individuals with a track record of success in other crypto projects, lending credibility and expertise. The information about the founders and key team members can usually be found in the project's white paper and on their website.

Another important aspect is the level of community engagement. Active participation in social media channels like X (previously Twitter), Telegram, Reddit, and Discord is a good indicator of community interest and support. Pay attention to the number of followers, the quality of interactions in the comment sections, and how the team engages with the community. Beware of projects where community queries are ignored or met with dismissive responses.

The project's practical applications should also be considered. A crypto project that solves real-world problems or offers tangible benefits is more likely to be sustained in the long term. Don’t forget to check for partnerships with other reputable entities, as these can enhance the project's credibility and potential for success. Ensure these partnerships are authentic and relevant to the project's goals.

Analyze the project's long-term sustainability and growth potential. This includes looking at the roadmap, future plans, and how the project aims to evolve and adapt to the ever-changing crypto landscape in Australia. Remember, thorough research and a critical approach are essential when evaluating any crypto project. By examining these different aspects, newbies can gain a comprehensive understanding of what makes a crypto project promising and worth investing in.

What Are the Red Flags to Watch Out for When Evaluating Crypto?

Identify potential red flags specific to the Australian crypto market that could indicate high risk or a lack of viability in a project. Be aware of common scams and warning signs prevalent in Australia. We highlight the key warning signs that investors and enthusiasts should be aware of to make informed and cautious decisions in the crypto market.

Signal Alerts: Identifying Red Flags in Cryptocurrency Projects

It is essential to be vigilant and recognize the common red flags that signal potential scams or untrustworthy projects in the crypto industry. These warning signs can range from the subtle to the blatantly obvious. Key indicators include opaque operations where project details or the team's identities are not transparent, unrealistic promises of extraordinarily high returns with little to no risk, and signs of market manipulation. Key warning signs include:

・Rug Pull Scams: In these scams, a cryptocurrency project, NFT, or coin is hyped to attract investment. Once the funding goal is met, the scammers disappear with the money, leaving investors with worthless assets. The infamous Squid coin scam is a prime example, where the token's value plummeted to zero, and investors couldn't sell their tokens. That’s why FameEX always evaluates all listing projects seriously and only lists high-quality projects in order to safeguard users' funds.

・Phishing Scams: A classic tactic where scammers use emails with malicious links to fake websites, aiming to steal sensitive information like cryptocurrency wallet keys.

・Man-in-the-Middle Attacks: When logging into cryptocurrency accounts over public networks, scammers can intercept sensitive information, such as wallet keys and passwords. Using a VPN is a crucial safeguard against these attacks.

・Social Media Giveaway Scams: These involve fake social media posts, sometimes using celebrity images, promising Bitcoin giveaways but leading victims to fraudulent sites.

・AI Scams: The rise of AI has led to new forms of deception, such as using chatbots to promote fake investment opportunities or manipulating proof of work to exaggerate a project's legitimacy and following.

By staying alert to these common warning signs, you can navigate the cryptocurrency landscape more safely and avoid falling prey to these increasingly sophisticated scams.

Above, several common risk signals in cryptocurrency projects have been identified. Additional red flags include opaque operations, unrealistic promises, and signs of market manipulation. It's important to recognize these warning signs, which also encompass inconsistencies in whitepapers, a lack of clear communication from the project team, and unrealistic growth projections.

Evaluating the Risks

When evaluating the risks associated with a cryptocurrency project, two more key areas to focus on are the regulatory environment and market volatility. The regulatory landscape for cryptocurrencies can vary significantly between countries and can change rapidly, making compliance a complex and dynamic challenge. This specific legal framework and ongoing legislative changes in the regions where the project operates are crucial to assessing the regulatory risk. On the other hand, market volatility is inherent in the cryptocurrency world. The prices of digital currencies can fluctuate wildly based on various factors such as investor sentiment, technological advancements, market trends, and macroeconomic factors. This volatility can impact the project's stability and its attractiveness to investors. Therefore, a comprehensive risk evaluation should consider both the potential regulatory hurdles and the unpredictability of market conditions to paint a realistic picture of the project's risk profile.

Importance of Assessing the Team Behind the Project

Evaluating the project team is essential, as the success of a project largely depends on the capabilities and cohesion of its members. The team behind a cryptocurrency project is a critical factor in its potential success or failure. When assessing the team, it's important to consider their collective experience, background, and proficiency in the cryptocurrency sector, and how well they work together. These factors are key indicators of the team's strength and potential to drive the project to success.

Tools and Resources for Cryptocurrency Evaluation

For investors, enthusiasts, and analysts in the cryptocurrency world, having the right tools and resources is pivotal for effective evaluation and decision-making. We will outline the essential tools and resources that can aid in the analysis and assessment of cryptocurrencies, providing a comprehensive toolkit for anyone looking to navigate the crypto market more effectively.

For market data and various project information, including market cap, total supply, price volatility, white papers, and social media presence, you can find all these details on the platforms below to show that they have a reputable and popular standing.

CoinMarketCap

CoinMarketCap is widely regarded as a reliable source for precise market information. This website monitors the prices of numerous cryptocurrencies, ordering them by their market capitalization. Additionally, CoinMarketCap features a range of tools including calendars for Initial Coin Offerings (ICOs) and events, a section for complimentary airdrops, and a platform for cryptocurrency education.

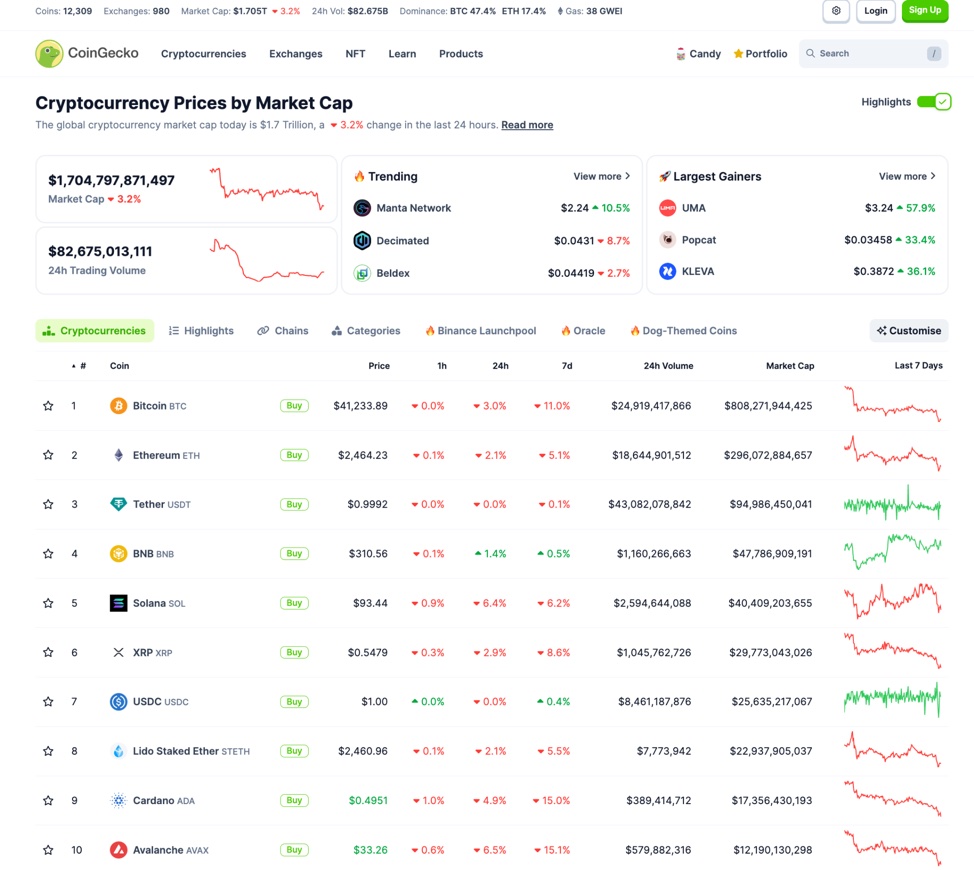

CoinGecko

Coingecko offers live market information for a vast array of cryptocurrencies. It allows users to sort these coins by various categories and also provides additional functionalities such as portfolio management and an educational platform dedicated to cryptocurrency.

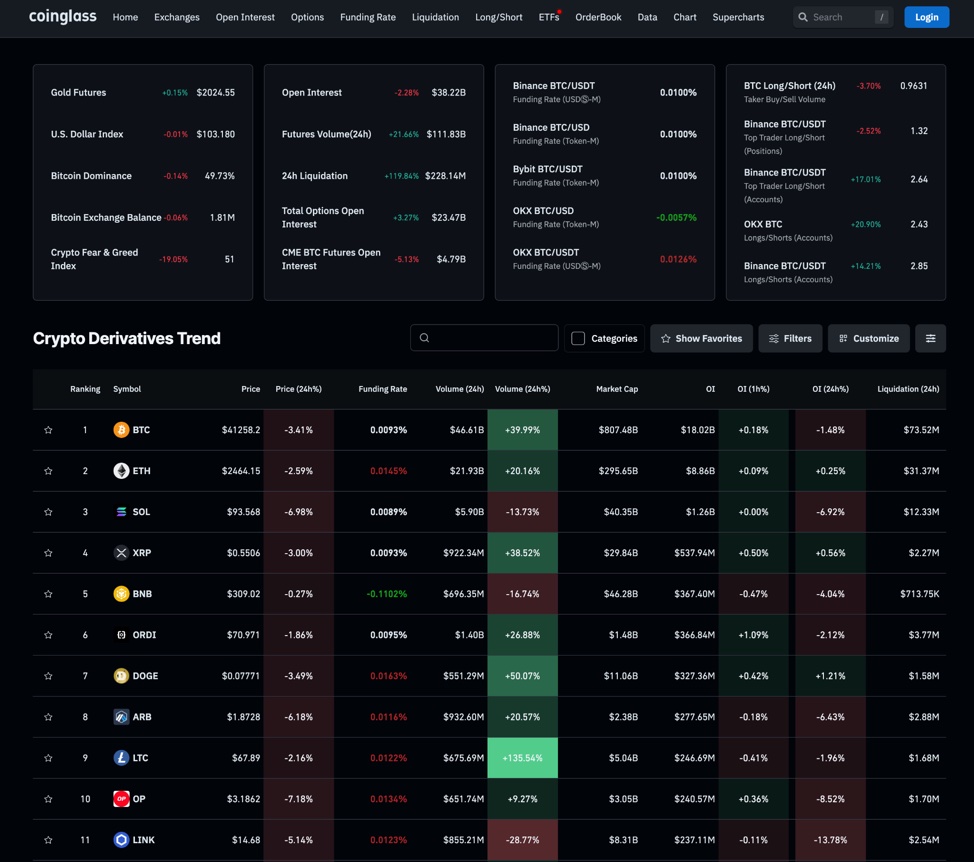

CoinGlass

CoinGlass, a specialized platform for cryptocurrency derivative data analysis, delivers precise, up-to-the-minute market information to its global user base. This enables them to make well-informed investment choices, reduce risks, and optimize their returns in the crypto market. Offering a wealth of market insights, including price movements, trading volumes, and more, CoinGlass employs a variety of analytical methods. Users have the flexibility to tailor indicators and strategies to their specific requirements. Designed for ease of use, the platform facilitates straightforward data exploration, analysis, and strategy development. CoinGlass is committed to increasing transparency in the cryptocurrency derivatives sector by delivering exceptionally accurate data to users worldwide.

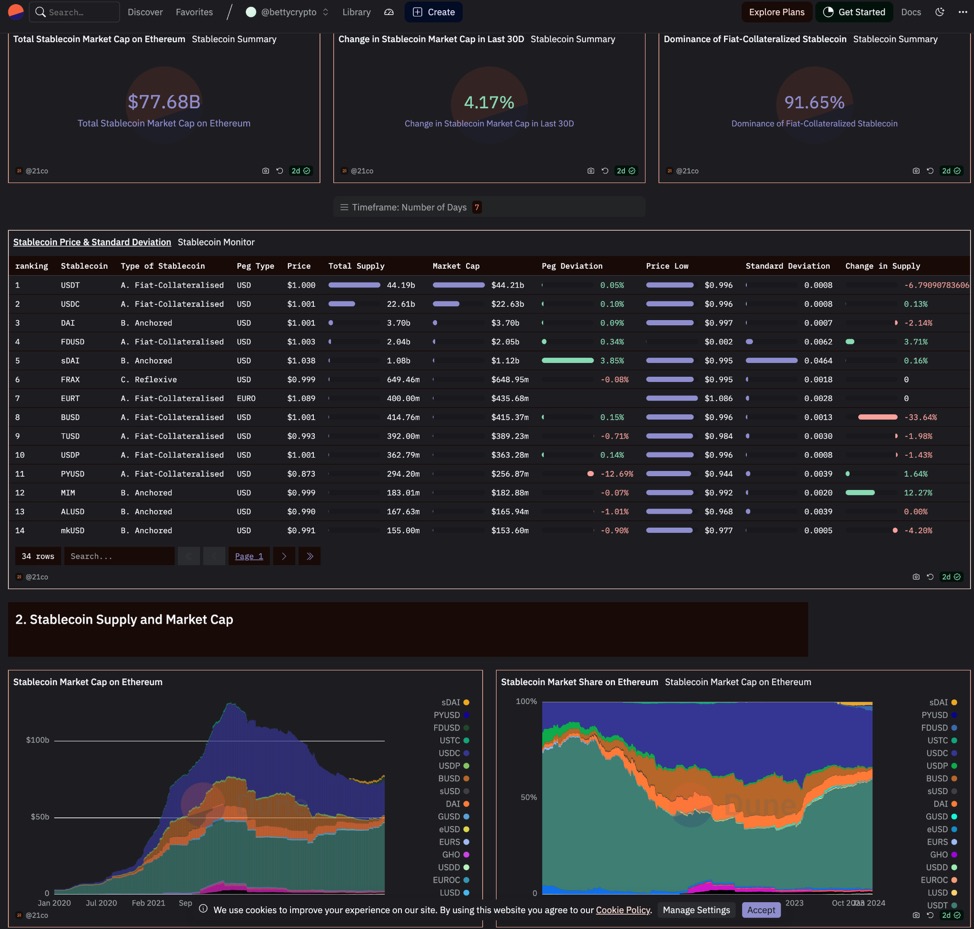

Dune Analytics

Dune Analytics is a widely-used DeFi platform that facilitates querying across Ethereum, Optimism, and BNB chains. This open-access platform enables users to create and view diverse crypto dashboards for monitoring blockchain data. Utilizing SQL queries, analysts can delve into data from any smart contract established on these supported blockchains.

How to Use Crypto Evaluation to Make an Informed Investment?

Making an informed investment in the cryptocurrency market requires more than just a basic understanding of blockchain and digital assets. It involves a strategic approach to evaluation, analysis, and decision-making. We will demonstrate dedicated steps to guide our potential investors on how to use crypto evaluation effectively to make well-informed investment choices.

Beginner’s Guide to Investing in Cryptocurrencies: Assess, Evaluate, Invest!

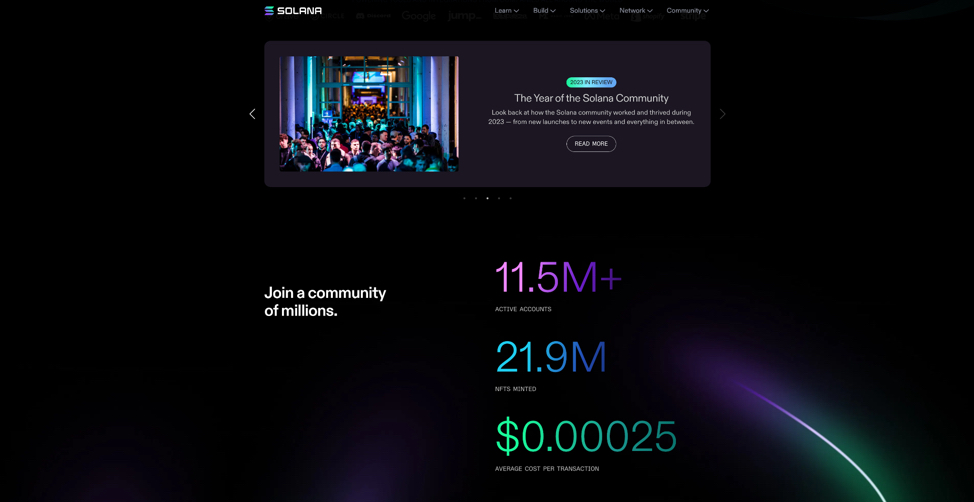

Investing in cryptocurrencies can be a thrilling but complex endeavor, especially for beginners. For Australian beginners, start by assessing your financial situation and risk tolerance. Opt for the most secure and reliable Australian platforms when purchasing cryptocurrencies, and concentrate on closely monitoring both Australian and international economic events that could significantly influence safe and prudent investment decisions in the cryptocurrency market. Let's apply the steps for investing in cryptocurrencies specifically to Solana (SOL):

Step 1: Assess All Information

Traders can start by gathering comprehensive information on the Solana website. This involves delving into its unique features and white paper to understand the intricacies of its Proof of History (PoH) and Proof of Stake (PoS) consensus mechanisms, exploring their social media, and studying the founding team and development history. These steps are essential to ensure the credibility of this project.

Step 2: Evaluate the Project

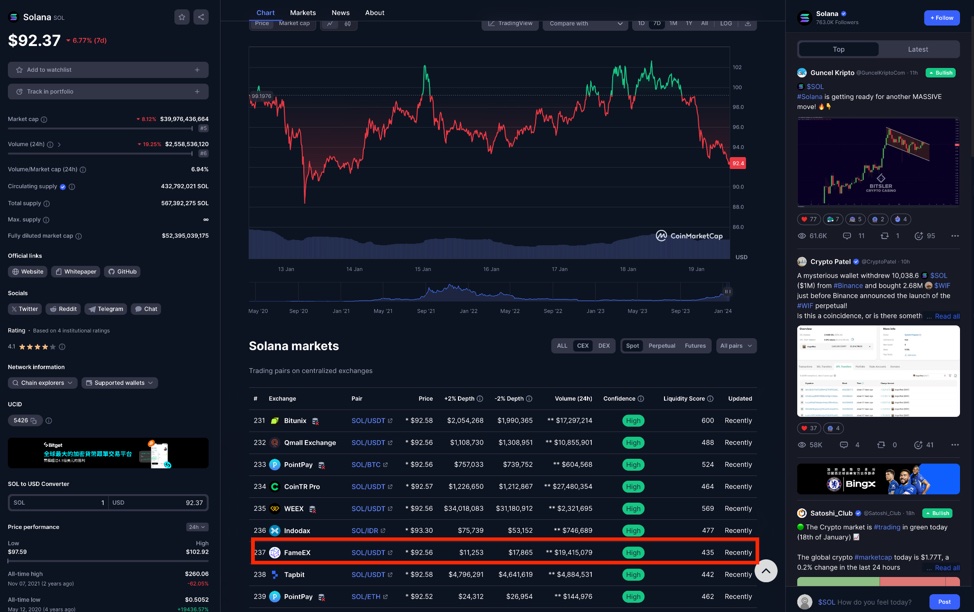

A thorough market analysis of Solana is imperative. This should include examining its price history, market capitalization, and trading volume. Additionally, it's important to analyze how Solana responds to significant market events, such as the notable FTX collapse, which previously triggered a substantial drop.

Source: CoinMarketCap

Daily Unique Addresses Interacting, source: Dune Analytic

For those with keen interest, a technical analysis of Solana's price charts and trading patterns, including moving averages and support and resistance levels, can offer deeper insights into its potential future price movements.

According to the news on Cointelegraph, the value of SOL might witness a "bull flag" pattern surge with its price on Jan 18, 2024, closely approaching the top edge of what seems to be a bull flag formation. This pattern is a positive continuation indicator where prices move within a downward-sloping channel after a significant upward trend, suggesting a potential breakout. If SOL breaks above the upper trendline of this pattern, it could target a rise to $194, an 80% increase from its current levels, potentially by March 2024.

This is merely an example for beginners to assess the value in technical analysis. However, these should only be considered as advice; the final decision still remains with the trader.

SOL/USD daily price chart. Source: TradingView

Step 3: Invest in Crypto

This phase is pivotal in shaping the investment strategy. It involves selecting the right platform for Solana and choosing an appropriate centralized exchange (CEX), such as FameEX, or a decentralized exchange (DEX) storage solution. If you opt to buy from exchanges, you can identify credible ones on CoinMarketCap. Then, try setting up an account and deposit funds for trading.

» Further Reading: Buy Solana (SOL) with Credit Card or Debit Card Instantly

Source: CoinMarketCap

After you buy the SOL as an investment, then the actual monitoring of Solana involves executing the investment strategy and regularly reviewing the investment in light of Solana-specific news and overall cryptocurrency market trends. Continuous education and staying informed about the latest developments in Solana and the broader cryptocurrency market are essential for maintaining and adjusting investment strategies in response to the highly volatile and unpredictable nature of cryptocurrencies. Remember, investing in cryptocurrencies involves significant risk, including the potential loss of your investment, so never invest more than you can afford to lose. Stay updated with industry news and continue learning to refine your strategy over time.

Conclusion

Whether you're a beginner or an experienced investor in Australia, the key is to continually educate yourself about the Australian market trends and approach each investment with a balanced view of its potential and risks. Stay informed about the Australian crypto landscape to make the most of the opportunities in this exciting market. By applying the insights and strategies outlined in this guide, you can navigate the cryptocurrency landscape with more confidence and a better understanding, positioning yourself to make the most of the opportunities this exciting and futuristic market has to offer.

FAQ About How to Evaluate A Cryptocurrency

Q: How Do You Know If Crypto Is Good?

A: A good cryptocurrency typically has a stable market trend, strong project fundamentals, credible team, active community, practical real-world applications, and adheres to regulatory standards.

Q: How Do You Evaluate a Token in Australia?

A: To evaluate a token, examine its tokenomics, use case, project viability, information in the white paper, community and developer activity, and any strategic partnerships or collaborations in Australia.

Q: How Can I Evaluate the Potential Growth of a Cryptocurrency?

A: Evaluate a cryptocurrency's potential growth by analyzing its historical performance, technological innovation, market adoption rate, position in the competitive landscape, future roadmap, and global economic factors.

The information on this website is for general information only. It should not be taken as constituting professional advice from FameEX.